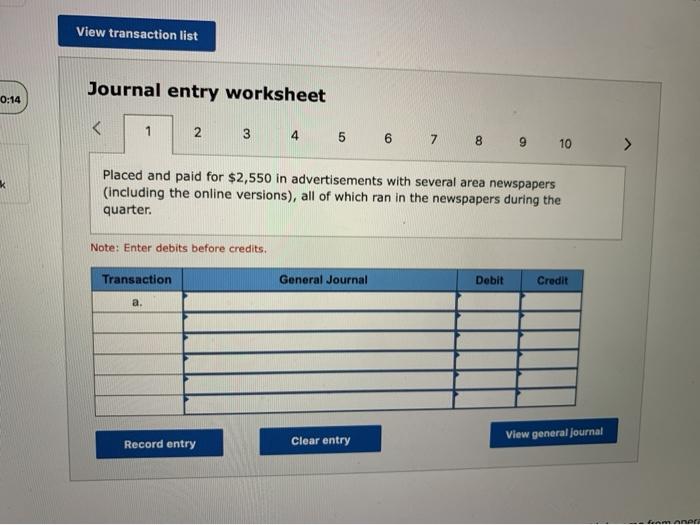

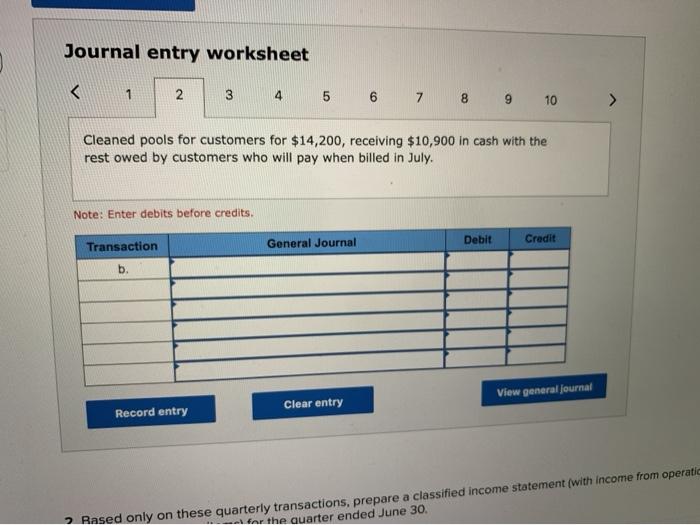

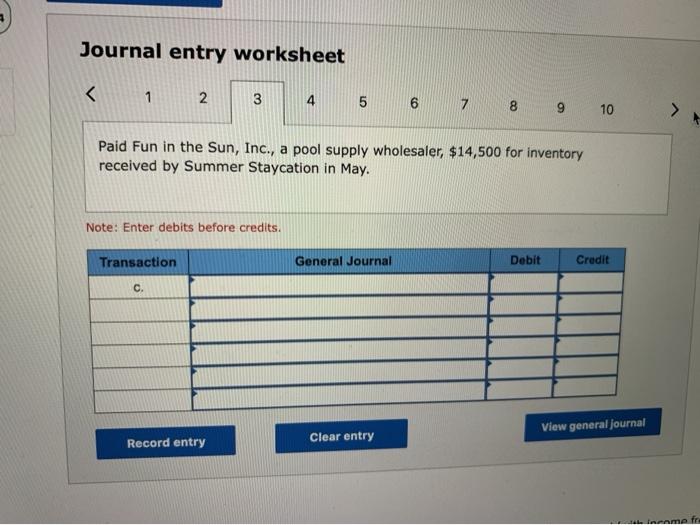

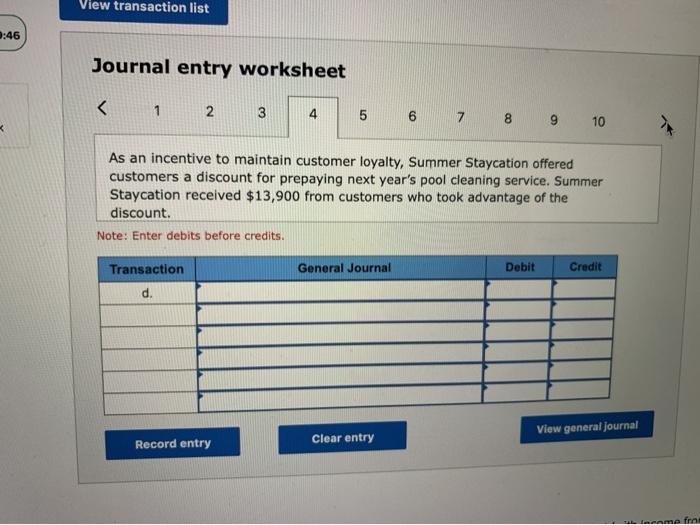

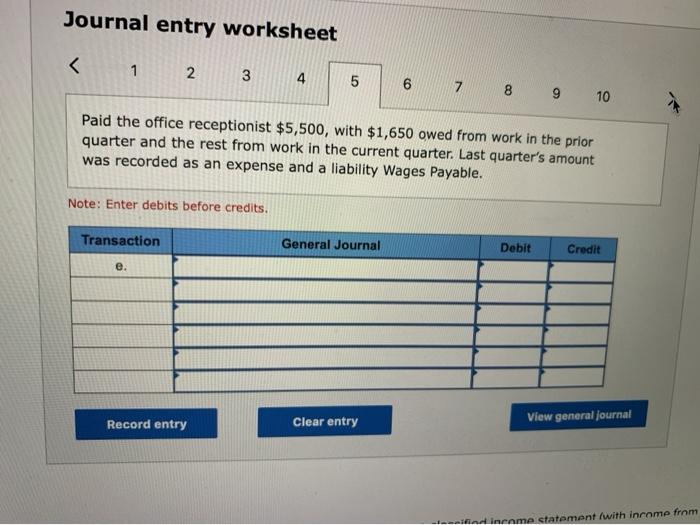

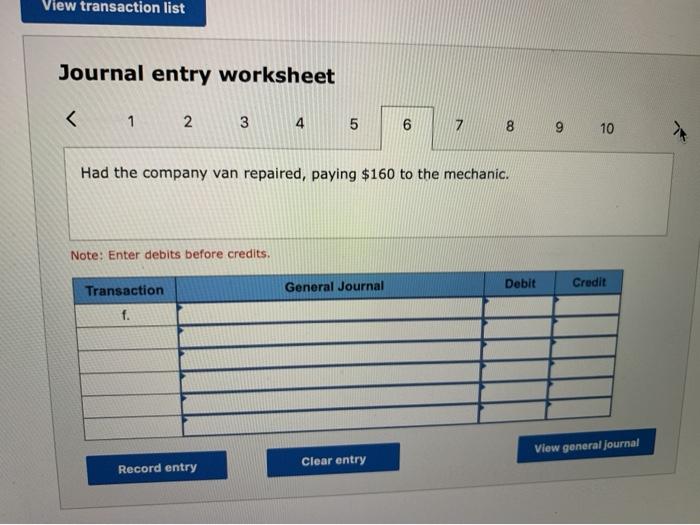

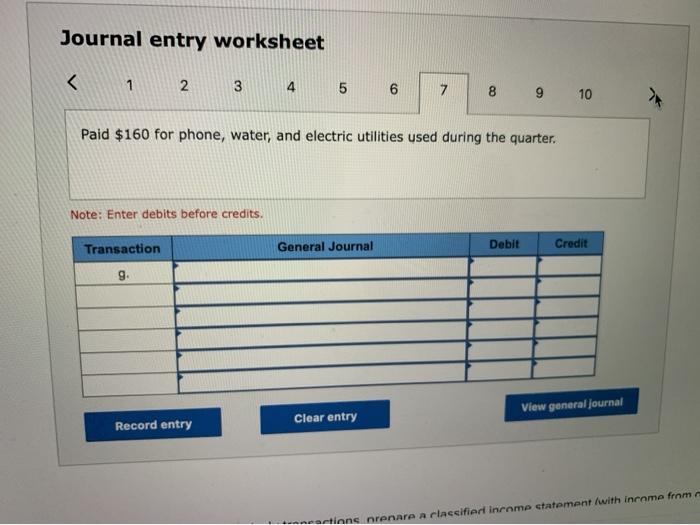

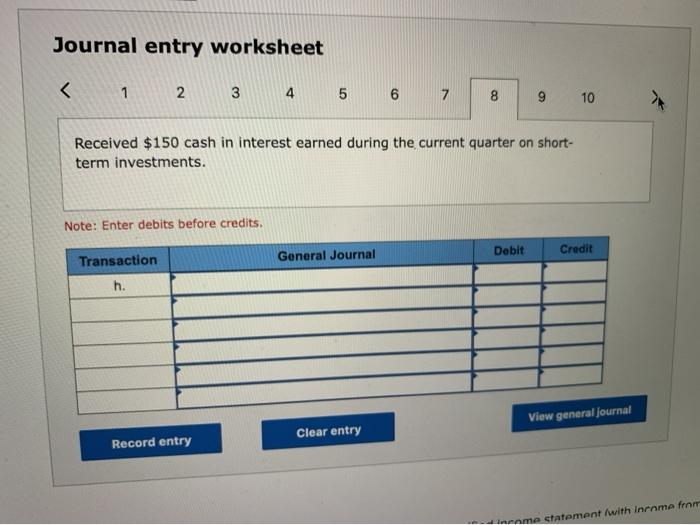

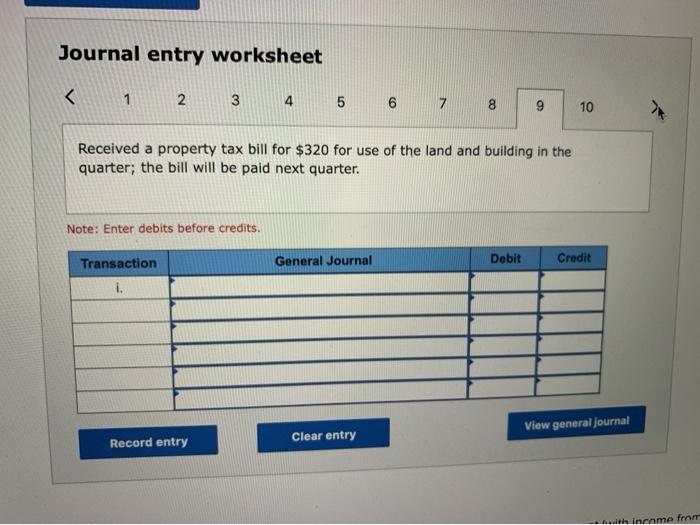

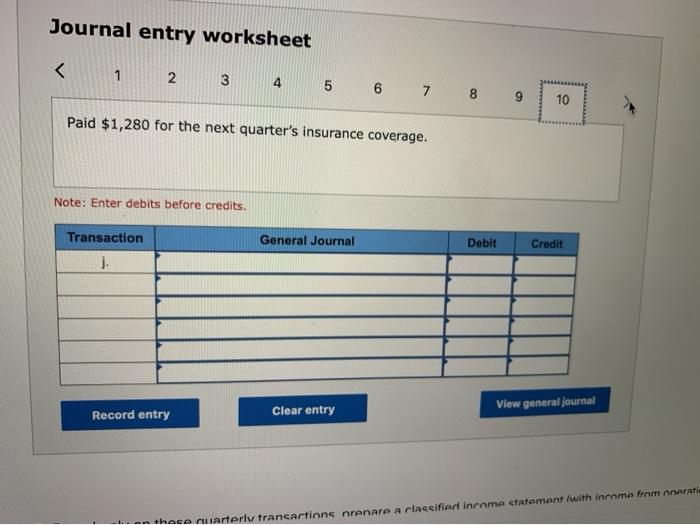

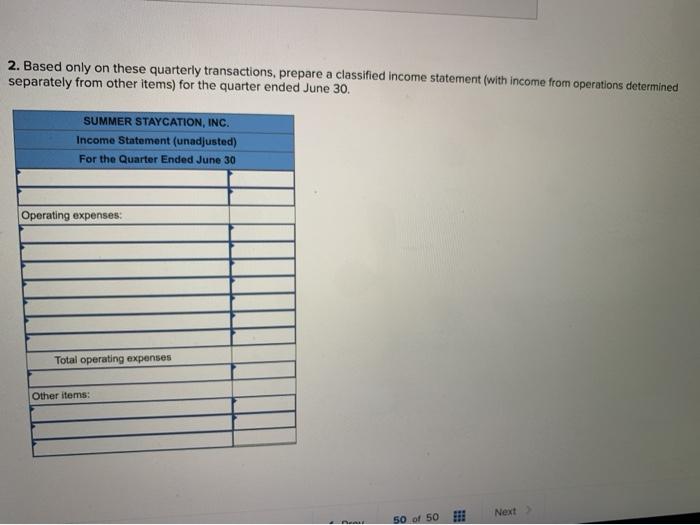

Saved Help Summer Staycation, Inc. had the following transactions related to operating the business in its first year's busiest quarter ended June 30: a. Placed and paid for $2,550 in advertisements with several area newspapers (including the online versions), all of which ran in the newspapers during the quarter. b. Cleaned pools for customers for $14,200, receiving $10,900 in cash with the rest owed by customers who will pay when billed in July c. Paid Fun in the Sun Inc., a pool supply wholesaler, $14,500 for inventory received by Summer Staycation in May. d. As an incentive to maintain customer loyalty, Summer Staycation offered customers a discount for prepaying next year's pool cleaning service. Summer Staycation received $13,900 from customers who took advantage of the discount. e. Pald the office receptionist $5,500, with $1,650 owed from work in the prior quarter and the rest from work in the current quarter. Last quarter's amount was recorded as an expense and a liability, Wages Payable. f. Had the company van repaired, paying $160 to the mechanic g. Paid $160 for phone, water, and electric utilities used during the quarter. h. Received $150 cash in interest earned during the current quarter on short-term investments. 1. Received a property tax bill for $320 for use of the land and building in the quarter the bill will be paid next quarter J. Paid $1,280 for the next quarter's insurance coverage. Required: 1. Prepare journal entries for above transactions. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 10 1 3 2 7 4 5 8 6 Placed and paid for $2,550 in advertisements with several area newspapers (including the online versions), all of which ran in the newspapers during the quarter. Note: Enter debits before credits View transaction list Journal entry worksheet 0:14 1 2 3 3 4 5 6 7 8 9 10 Placed and paid for $2,550 in advertisements with several area newspapers (including the online versions), all of which ran in the newspapers during the quarter Note: Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general journal Journal entry worksheet 1 2 3 4 5 6 7 8 9 10 Cleaned pools for customers for $14,200, receiving $10,900 in cash with the rest owed by customers who will pay when billed in July. Note: Enter debits before credits. Debit General Journal Transaction Credit b View general Journal Clear entry Record entry Rased only on these quarterly transactions, prepare a classified income statement (with income from operatic - or the quarter ended June 30. Journal entry worksheet 1 2. 3 4 5 6 78 9 10 Paid Fun in the Sun, Inc., a pool supply wholesaler, $14,500 for inventory received by Summer Staycation in May. Note: Enter debits before credits. Transaction General Journal Debit Credit C. View general journal Record entry Clear entry Inname fr View transaction list 2:46 Journal entry worksheet