Answered step by step

Verified Expert Solution

Question

1 Approved Answer

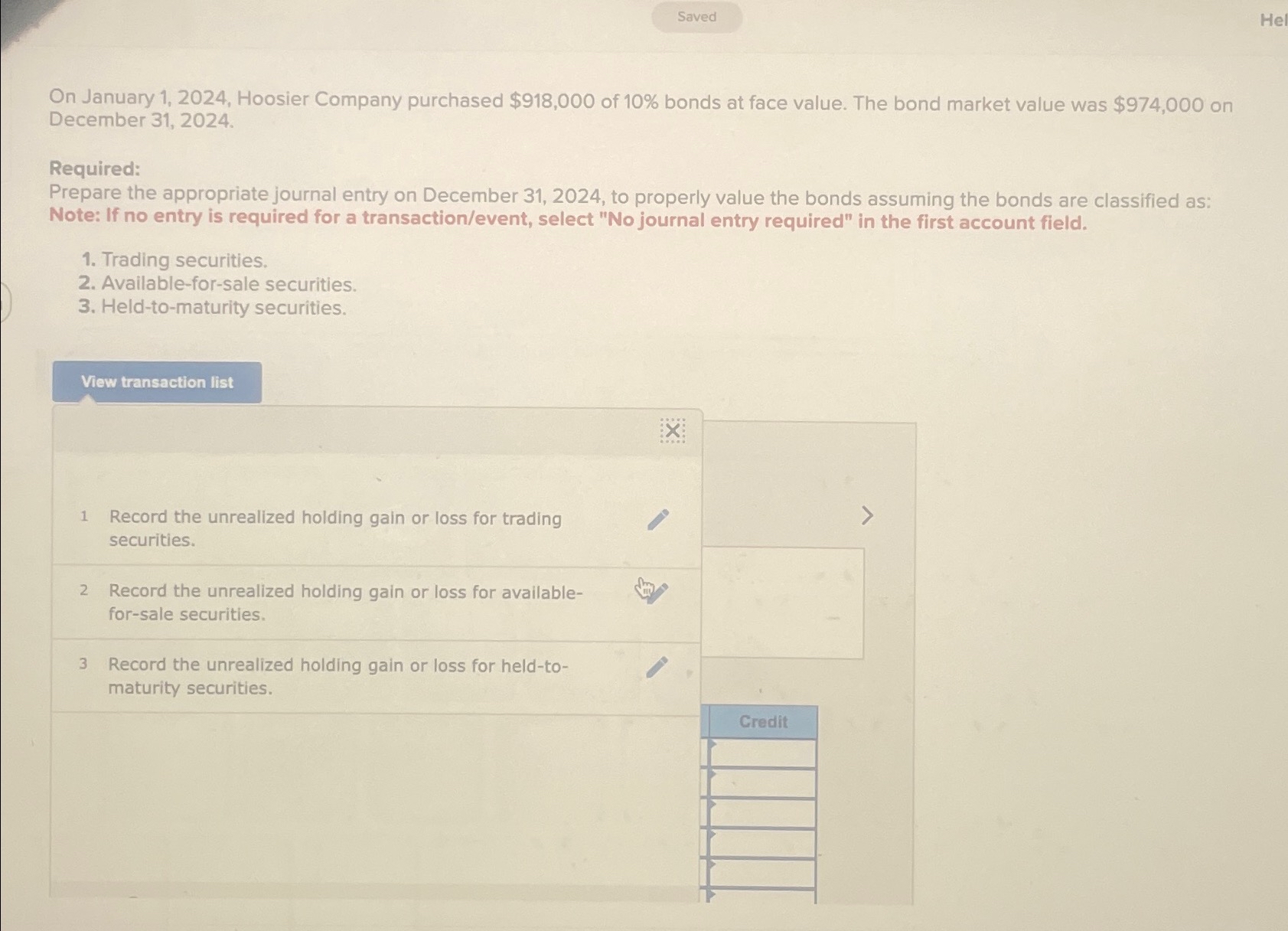

Saved On January 1 , 2 0 2 4 , Hoosier Company purchased $ 9 1 8 , 0 0 0 of 1 0 %

Saved

On January Hoosier Company purchased $ of bonds at face value. The bond market value was $ on December

Required:

Prepare the appropriate journal entry on December to properly value the bonds assuming the bonds are classified as: Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Trading securities

Availableforsale securities

Heldtomaturity securities

Record the unrealized holding gain or loss for trading securities

Record the unrealized holding gain or loss for availableforsale securities

Record the unrealized holding gain or loss for heldtomaturity securities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started