Answered step by step

Verified Expert Solution

Question

1 Approved Answer

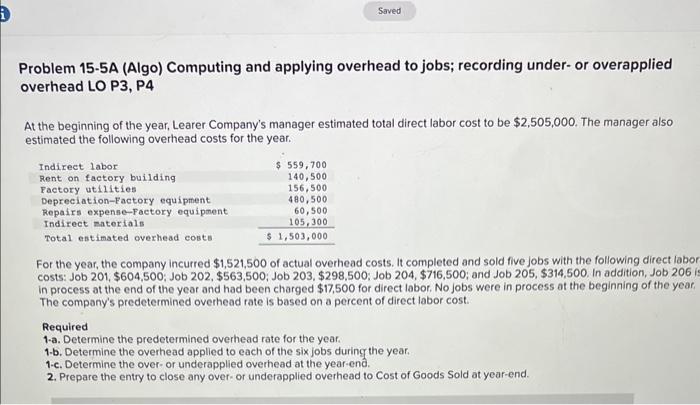

Saved Problem 15-5A (Algo) Computing and applying overhead to jobs; recording under- or overapplied overhead LO P3, P4 At the beginning of the year,

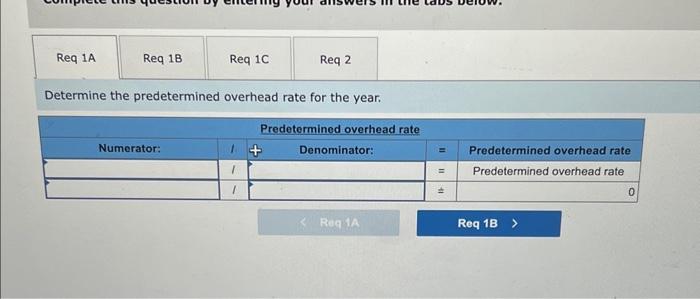

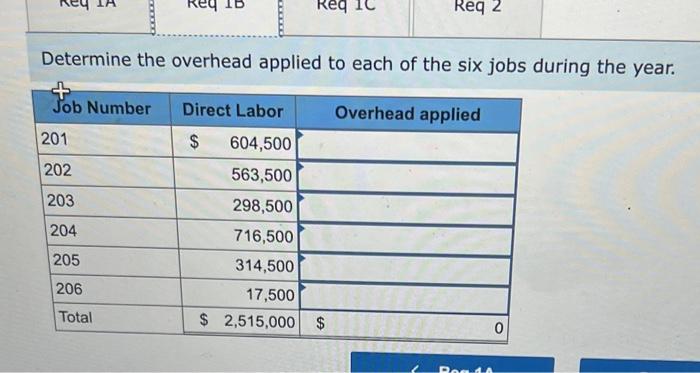

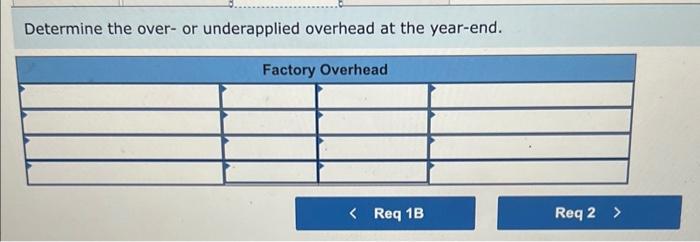

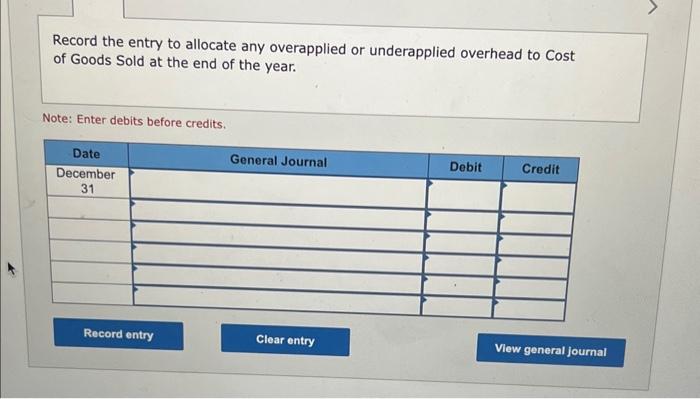

Saved Problem 15-5A (Algo) Computing and applying overhead to jobs; recording under- or overapplied overhead LO P3, P4 At the beginning of the year, Learer Company's manager estimated total direct labor cost to be $2,505,000. The manager also estimated the following overhead costs for the year. Indirect labor Rent on factory building Factory utilities Depreciation-Factory equipment Repairs expense-Factory equipment Indirect materials Total estimated overhead costs $ 559,700 140,500 156,500 480,500 60,500 105,300 $ 1,503,000 For the year, the company incurred $1,521,500 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, $604,500; Job 202, $563,500; Job 203, $298,500; Job 204, $716,500; and Job 205, $314,500. In addition, Job 206 is in process at the end of the year and had been charged $17,500 for direct labor. No jobs were in process at the beginning of the year. The company's predetermined overhead rate is based on a percent of direct labor cost. Required 1-a. Determine the predetermined overhead rate for the year. 1-b. Determine the overhead applied to each of the six jobs during the year. 1-c. Determine the over- or underapplied overhead at the year-end. 2. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. Req 1A Req 1B Req 1C Req 2 Determine the predetermined overhead rate for the year. Predetermined overhead rate Numerator: 1+ Denominator: = Predetermined overhead rate 1 = Predetermined overhead rate 1 0 Req 1A Req 1B > Req Req 2 Determine the overhead applied to each of the six jobs during the year. + Job Number Direct Labor Overhead applied 201 $ 604,500 202 563,500 203 298,500 204 716,500 205 314,500 206 Total 17,500 $ 2,515,000 $ Res d 0 Determine the over- or underapplied overhead at the year-end. Factory Overhead < Req 1B Req 2 > Record the entry to allocate any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year. Note: Enter debits before credits. Date December 31 General Journal Debit Credit View general journal Record entry Clear entry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started