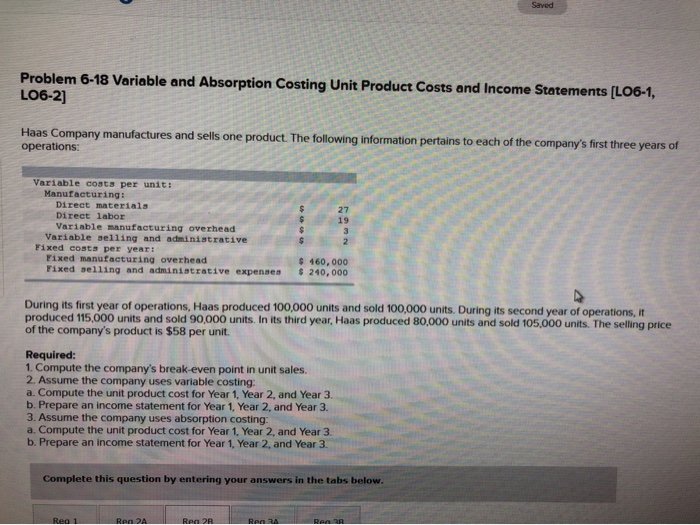

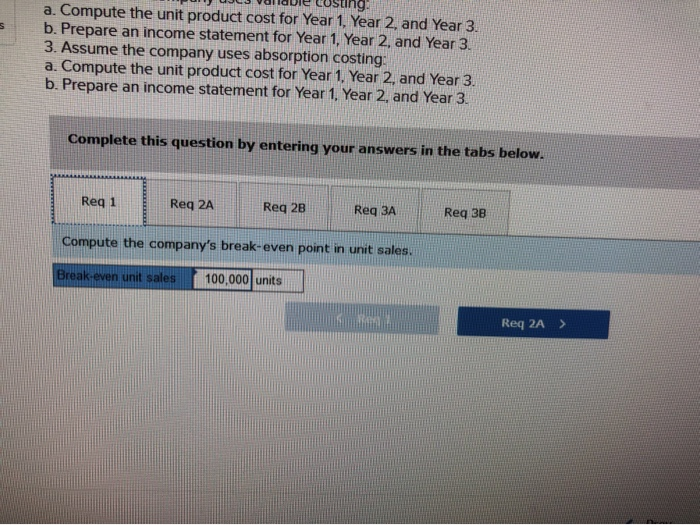

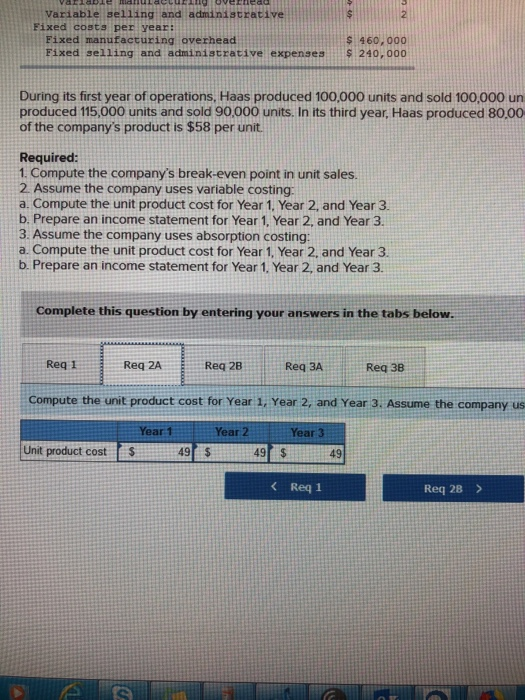

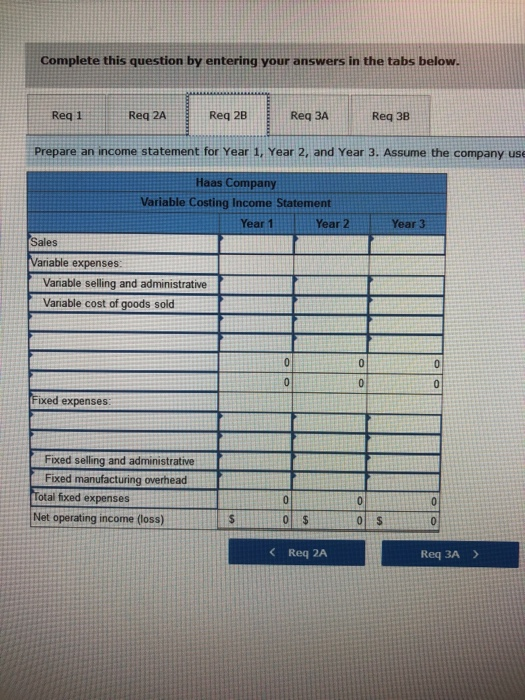

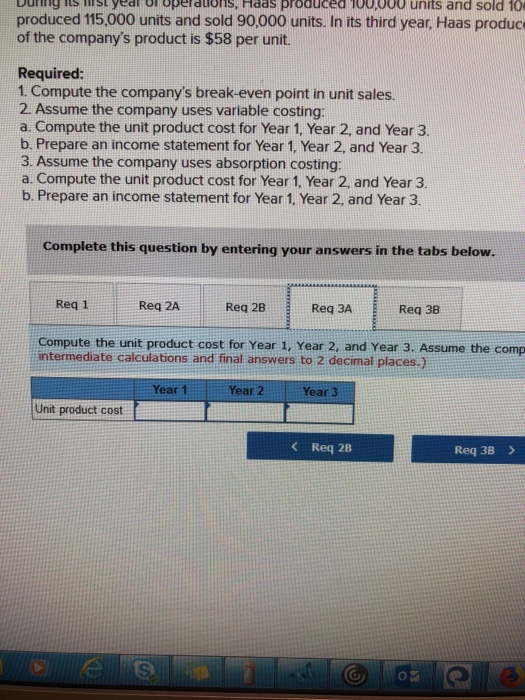

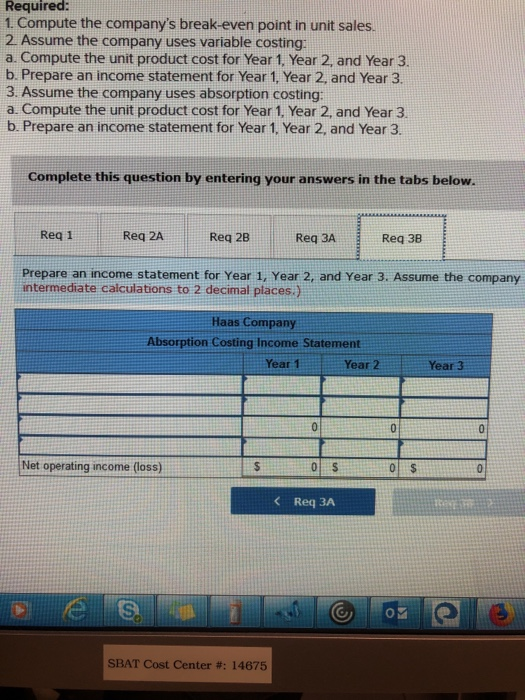

Saved Problem 6-18 Variable and Absorption Costing Unit Product Costs and Income Statements [LO6-1, LO6-2] Haas Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: Variable costs per unit: Manufacturing: Direct materials 27 Direct labor 19 Variable manufacturing overhead Variable selling and administrative Fixed costs per year: 3 2 Fixed manufacturing overhead Fixed selling and administrative expenses 460,000 $ 240,000 During its first year of operations, Haas produced 100,000 units and sold 100,000 units. During its second year of operations, it produced 115.000 units and sold 90,000 units. In its third year, Haas produced 80,000 units and sold 105,000 units. The selling price of the company's product is $58 per unit Required: 1. Compute the company's break-even point in unit sales. 2. Assume the company uses variable costing: a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. 3. Assume the company uses absorption costing: a. Compute the unit product cost for Year 1, Year 2, and Year 3 b. Prepare an income statement for Year 1, Year 2, and Year 3. Complete this question by entering your answers in the tabs below. Rea 34 Rea 1 Rea 24. Rea 28 Rea 38 Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3 3. Assume the company uses absorption costing: Compute the unit product cost for Year 1, Year 2, and Year 3 b. Prepare an income statement for Year 1, Year 2, and Year 3 a. a. Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req 3B Req 3A Compute the company's break-even point in unit sales. 100,000 units Break-even unit sales Req 2A Variable selling and administrative 2 Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses S 460,000 s 240,000 During its first year of operations, Haas produced 100,000 units and sold 100,000 un produced 115,000 units and sold 90.00o0 units. In its third year, Haas produced 80,00 of the company's product is $58 per unit Required: 1 Compute the company's break-even point in unit sales. 2 Assume the company uses variable costing a. Compute the unit product cost for Year 1, Year 2, and Year 3 b. Prepare an income statement for Year 1, Year 2, and Year 3. 3. Assume the company uses absorption costing: a. Compute the unit product cost for Year 1, Year 2, and Year 3 b. Prepare an income statement for Year 1, Year 2, and Year 3. Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req 3A Rea 3B Compute the unit product cost for Year 1, Year 2, and Year 3. Assume the company us Year 1 Year 2 Year 3 Unit product cost S 49 $ 49 $ 49