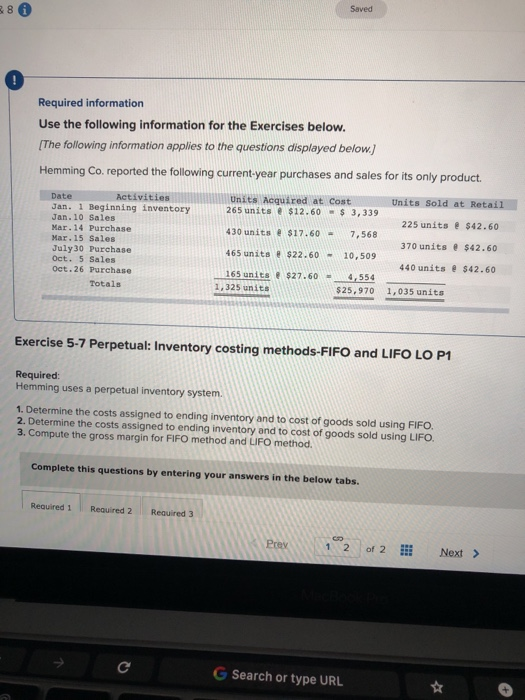

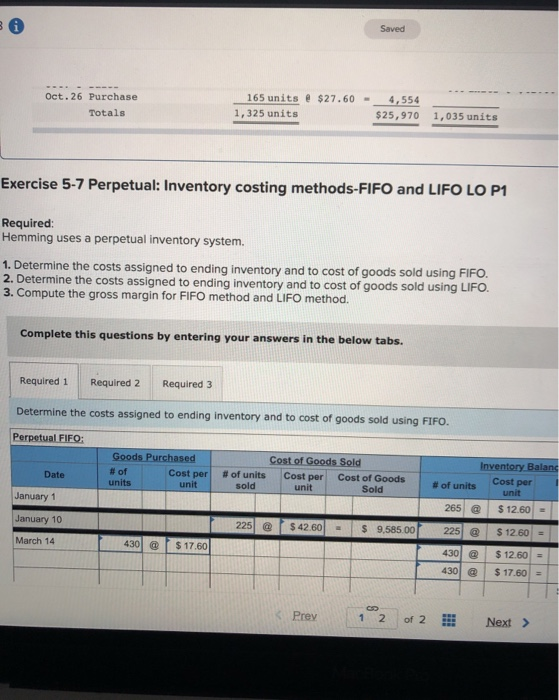

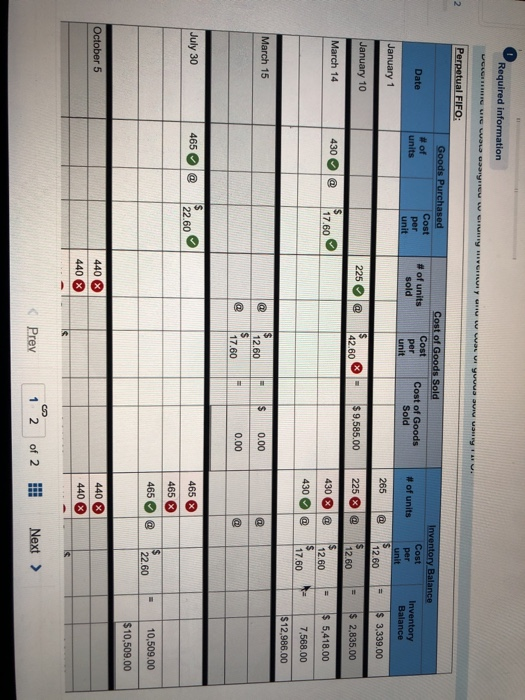

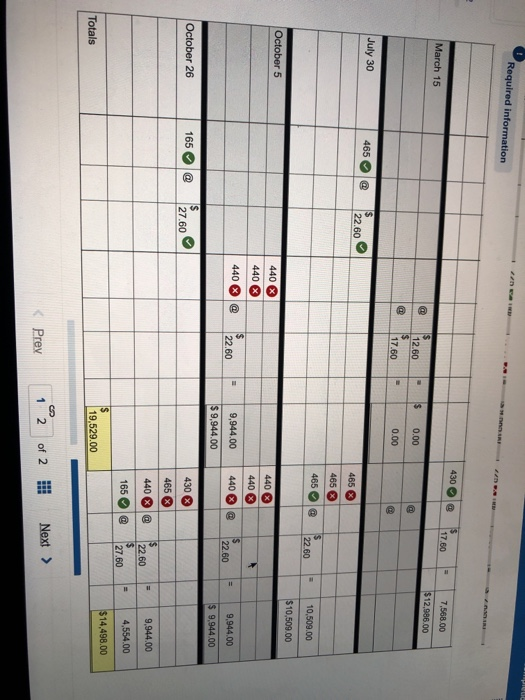

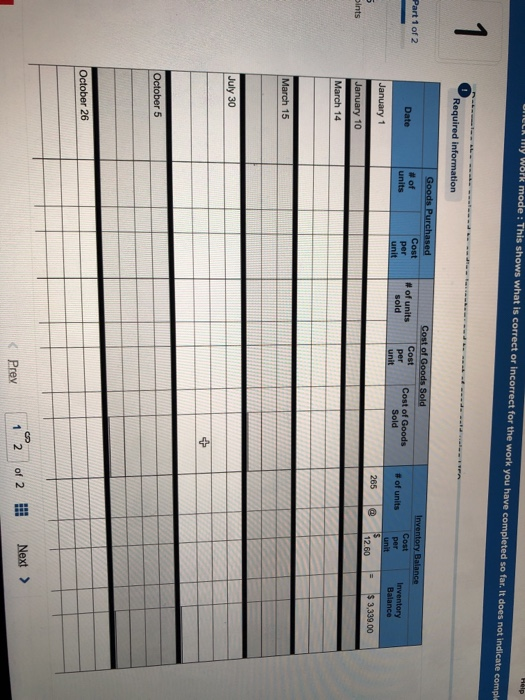

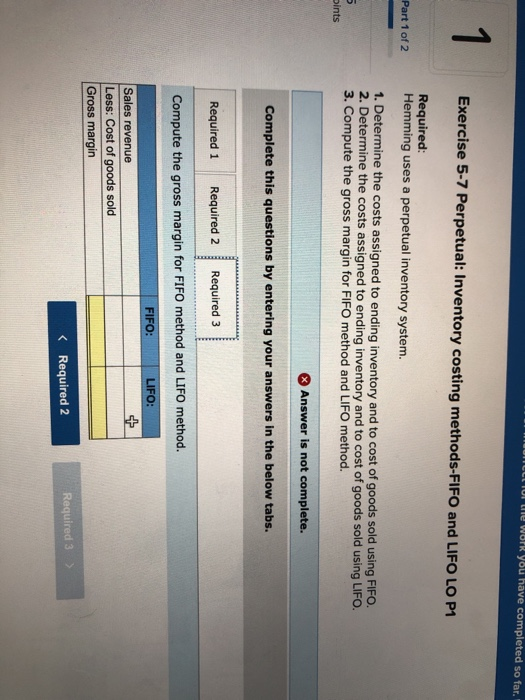

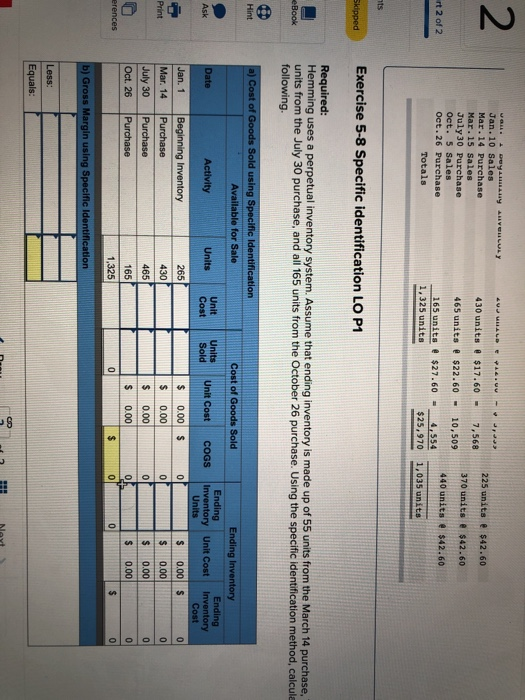

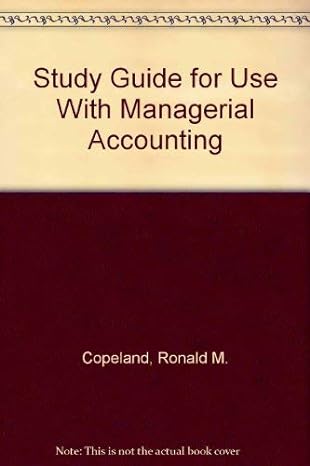

Saved Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below.) Hemming Co. reported the following current-year purchases and sales for its only product. Date Activities Jan. 1 Beginning inventory Jan. 10 Sales Mar. 14 Purchase Mar.15 Sales July 30 Purchase Oct. 5 Sales Oct.26 Purchase Totals Units Acquired at Cost Units Sold at Retail 265 units @ $12.60 - $ 3,339 225 units $42.60 430 units @ $17.60 7,568 370 units $42.60 465 units $22.60 - 10,509 440 units @ $42.60 165 units $27.60 = 4,554 1,325 unita $25,970 1,035 units Exercise 5-7 Perpetual: Inventory costing methods-FIFO and LIFO LO P1 Required: Hemming uses a perpetual inventory system. 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross margin for FIFO method and LIFO method. Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Required 3 Prev 1 2 Next > G Search or type URL BA Saved Oct.26 Purchase Totals 165 units @ $27.60 - 1,325 units 4,554 $25,970 1,035 units Exercise 5-7 Perpetual: Inventory costing methods-FIFO and LIFO LO P1 Required: Hemming uses a perpetual inventory system. 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross margin for FIFO method and LIFO method. Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Required 3 Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Perpetual FIFO: Goods Purchased # of Cost per units unit Cost of Goods Sold # of units Cost per Cost of Goods sold unit Sold Date Inventory Balans # of units Cost per January 1 unit 265 @ $ 12.60 January 10 225 @ $ 42.60 $ 9.585.00 225 @ $ 12.60 March 14 430 $17.60 4301 @ $ 12.60 = $17.60 430 Prey 1 2 of 2 Next > Required information WE HET LIC LL you w My HR www yuva Viru. 2 Perpetual FIFO Date Goods Purchased # of Cost units per unit Cost of Goods Sold # of units Cost Cost of Goods sold per unit Sold # of units Inventory Balance Cost Inventory per unit Balance s 12.60 $ 3,339.00 January 1 265 @ January 10 225 @ $ 42.60 x $9,585.00 225 H1 $ 2,835.00 March 14 430 @ 17.60 430 xl@ $ 12.60 s 12.60 $ 17.60 = $ 5,418.00 430 @ 7,568.00 $12.986.00 March 15 @ $ 12.60 $ 0.00 @ G) 0.00 17.60 @ - July 30 465 @ 22.60 465 465 465 @ 22.60 10,509.00 $ 10,509.00 October 5 440 X 440 X x x 440 440 Is Prev 1 2 of 2 Next > BBB Required information an 430 March 15 17.60 7.568.00 $12.986.00 12.60 $ 0.00 @ 17.60 0.00 20 July 30 465 @ $ 22.60 465 % 465 465 @ $ 22.60 10,509.00 $ 10,509.00 October 5 440 X 440 X 440 X X X 440 % 440 s 22.60 440 $ 22.60 = 9,944.00 $ 9,944.00 9,944.00 $ 9,944.00 October 26 165 @ 27.60 430 4653 440 @ = 9,944.00 $ 22.60 $ 27.60 165 4,554.00 @ > $14.498.00 Totals 19,529.00 GO 1 Prey 2 Next > of 2 UNCLE My work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate compla Help 1 Required information Part 1 of 2 Goods Purchased #of Cost units per Date Cost of Goods Sold # of units Cost Cost of Goods sold per unit Sold Inventory Balance Cost per Inventory unit Balance unit # of units January 1 265 12.60 $ 3,339.00 Sints January 10 March 14 March 15 July 30 October 5 October 26 Prey 1 2 Next > of 2 IUI We Work you have completed so far." 1 Exercise 5-7 Perpetual: Inventory costing methods-FIFO and LIFO LO P1 Part 1 of 2 Required: Hemming uses a perpetual inventory system. 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross margin for FIFO method and LIFO method. 5 pints Answer is not complete. Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Required 3 Compute the gross margin for FIFO method and LIFO method. FIFO: LIFO: Sales revenue Less: Cost of goods sold Gross margin 2 40 LAL&. - 225 units @ $42.60 430 units @ $17.60 - 7,568 won. Duyauny AVELLULY Jan. 10 Sales Mar. 14 Purchase Mar.15 Sales July 30 Purchase Oct. 5 Sales Oct. 26 Purchase Totals 465 units @ $22.60 - 370 units e $42.60 10,509 rt 2 of 2 440 units @ $42.60 165 units @ $27.60 - 1,325 units 4,554 $25,970 1,035 units ts Skipped Exercise 5-8 Specific identification LO P1 Required: Hemming uses a perpetual inventory system. Assume that ending inventory is made up of 55 units from the March 14 purchase, units from the July 30 purchase, and all 165 units from the October 26 purchase. Using the specific identification method, calcule following eBook Hint a) Cost of Goods Sold using Specific Identification Available for Sale Cost of Goods Sold Ask Date Activity Units Unit Cost Units Sold Unit Cost COGS Ending Inventory Ending Ending Inventory Unit Cost Inventory Units Cost $ 0.00 S $ 0.00 0.00 265 $ $ Print Beginning Inventory Purchase Purchase Jan. 1 Mar. 14 July 30 Oct. 26 430 0.00 $ 0.00 0.00 465 $ OOOOO uus OOOOO Purchase s 0.00 0.00 erences 165 1,325 0 $ 0 $ b) Gross Margin using Specific identification Less: Equals: -S