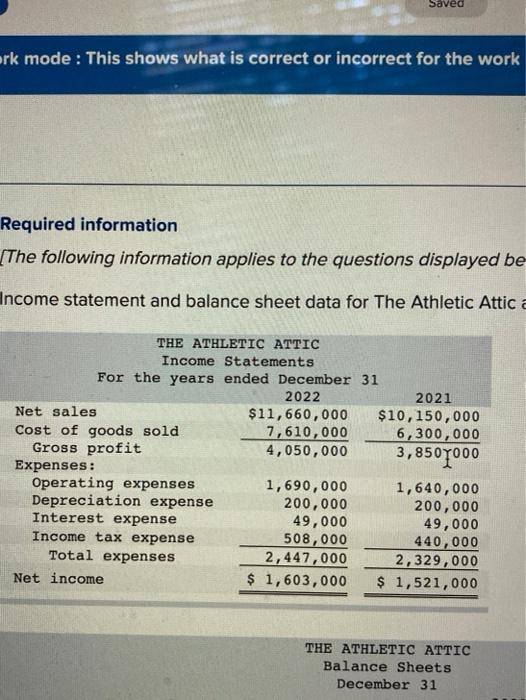

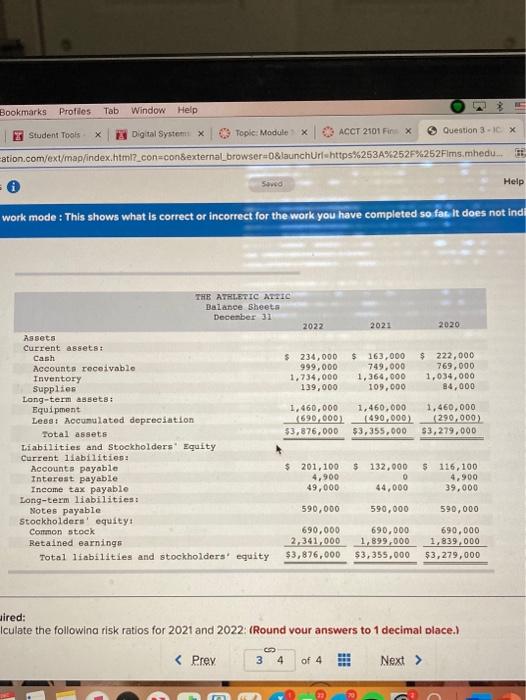

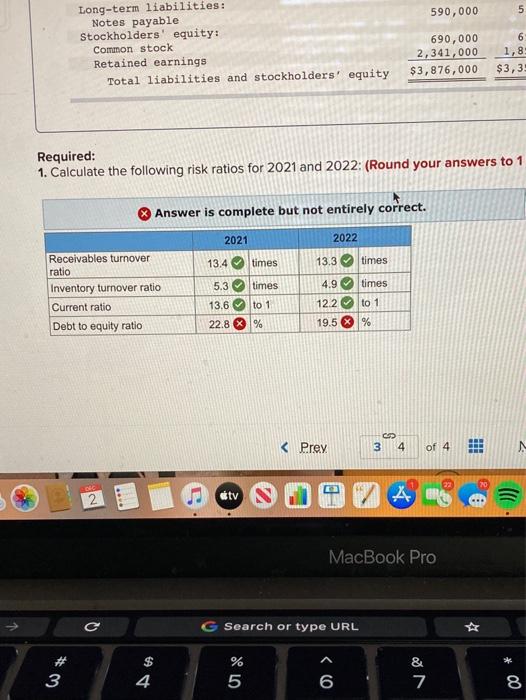

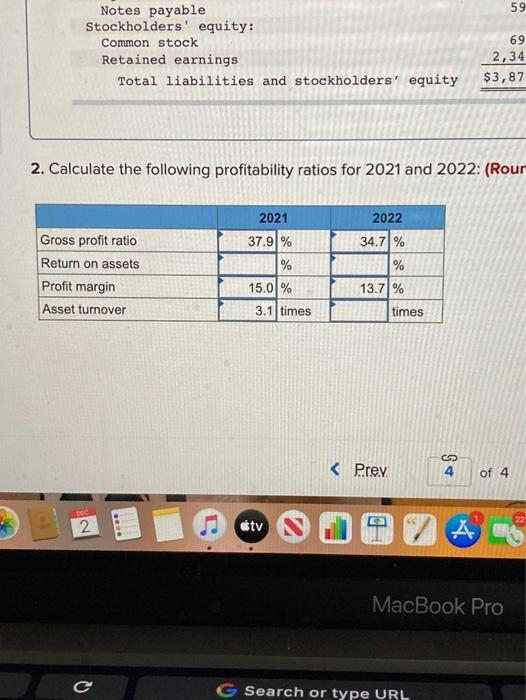

Saved rk mode : This shows what is correct or incorrect for the work Required information [The following information applies to the questions displayed be Income statement and balance sheet data for The Athletic Attica THE ATHLETIC ATTIC Income Statements For the years ended December 31 2022 2021 Net sales $11,660,000 $10, 150,000 Cost of goods sold 7,610,000 6,300,000 Gross profit 4,050,000 3,850,000 Expenses: Operating expenses 1,690,000 1,640,000 Depreciation expense 200,000 200,000 Interest expense 49,000 49,000 Income tax expense 508,000 440,000 Total expenses 2,447,000 2,329,000 Net income $ 1,603,000 $ 1,521,000 THE ATHLETIC ATTIC Balance Sheets December 31 Bookmarks Profiles Tab Window Help X > Question 3-CX Student Tools Digital System Topic: Module x ACCT 2101 Fix -ation.com/ext/map/index.html?_con=conexternal browser0&launchurl=https%253A%252F%252Fims.mhedu... 1 Sowed Help work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indi THE ATHLETIC ATTIC Balance Sheets December 31 2022 2021 2020 $ 234,000 $ 163,000 999,000 749,000 1,734,000 1,364,000 139,000 109,000 $ 222,000 769,000 1,034,000 84,000 1,460,000 690.000) 53,876,000 1,460,000 (490,000) $3,355,000 1,460,000 (290,000) $3,279,000 Assets Current assets Cash Accounts receivable Inventory Supplies Long-term assets: Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity! Common stock Retained earnings Total liabilities and stockholders' equity $ 201,100 4,900 49,000 $ 132,000 0 44,000 $ 126, 100 4,900 39,000 590,000 590,000 590,000 690,000 2,341,000 $3,876,000 690,000 1,899,000 $3,355,000 690,000 1,839,000 $3,279,000 aired: Iculate the following risk ratios for 2021 and 2022: (Round vour answers to 1 decimal place.) 4 590,000 5 Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity 690,000 2,341,000 $3,876,000 6 1,8 $3,3 Required: 1. Calculate the following risk ratios for 2021 and 2022: (Round your answers to 1 Answer is complete but not entirely correct. 2021 2022 13.3 times 13.4 times 5.3 times 13,6 to 1 4.9 Receivables turnover ratio Inventory turnover ratio Current ratio Debt to equity ratio times 122 to 1 % 22.8 X 1% 19.5 S