Question

Saved Topic 4 Assignment 23 0.66 points _(ebook ) Print References Problem 8-8 Calculating Motor Vehicle Operating Costs [LO8-2] You have gathered the following

Saved\ Topic 4 Assignment\ 23\ 0.66\ points\

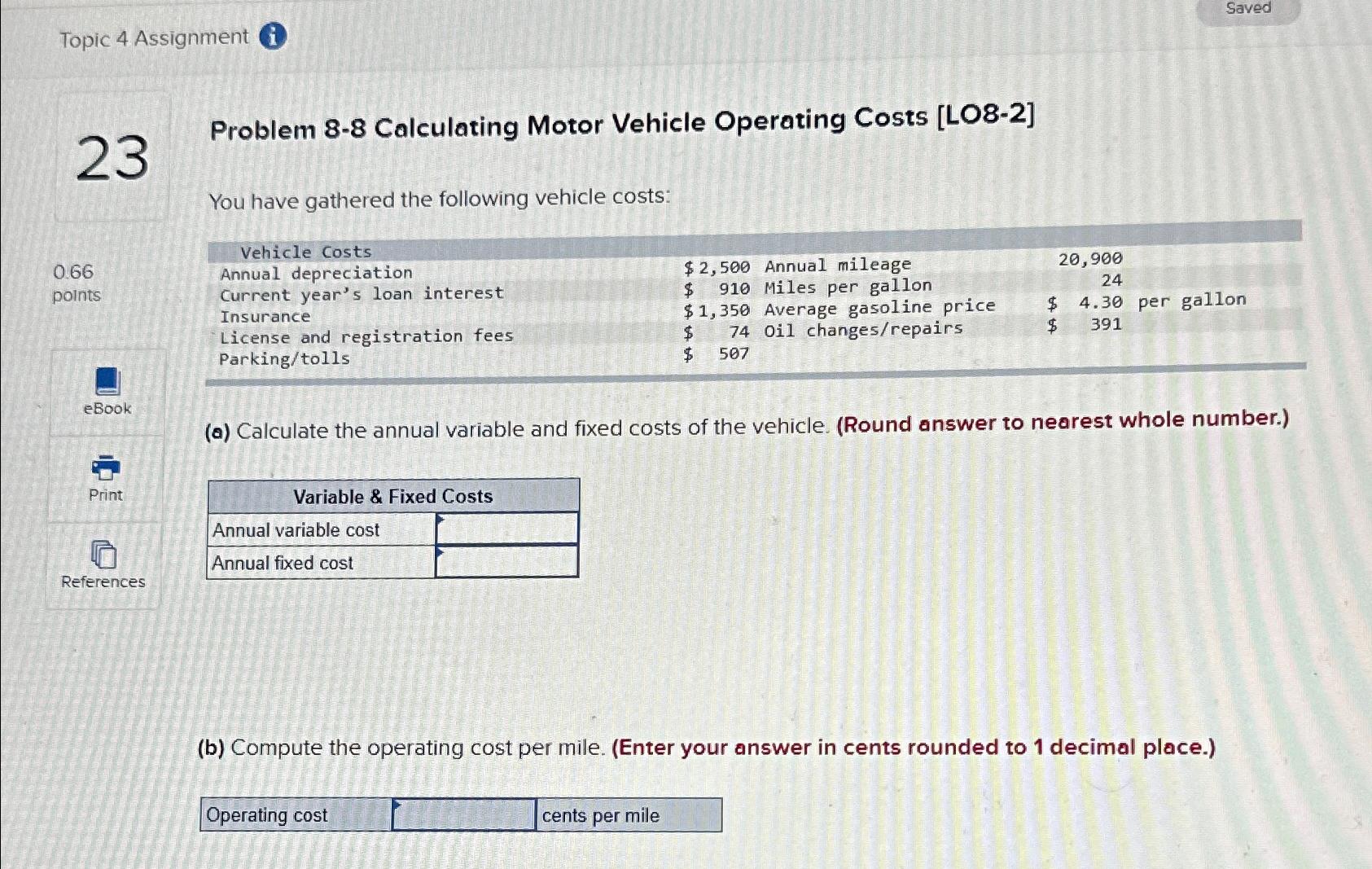

_(ebook )\ Print\ References\ Problem 8-8 Calculating Motor Vehicle Operating Costs [LO8-2]\ You have gathered the following vehicle costs:\ \\\\table[[Vehicle Costs,,,,,],[Annual depreciation,

$2,500,Annual mileage,,0,900,],[Current year's loan interest,

$910,Miles per gallon,,24,],[Insurance,

$1,350,Average gasoline price,

$,4.30,per gallon],[License and registration fees,

$74,Oil changes/repairs,

$,391,],[Parking/tolls,507,,,,]]\ (a) Calculate the annual variable and fixed costs of the vehicle. (Round answer to nearest whole number.)\ \\\\table[[Variable & Fixed Costs],[Annual variable cost,],[Annual fixed cost,]]\ (b) Compute the operating cost per mile. (Enter your answer in cents rounded to 1 decimal place.)\ Operating cost\ cents per mile

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started