Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Saver Suppose the expected returns of stock A and B are 25% and 35% respectively and the standard deviation of stocks A and B are

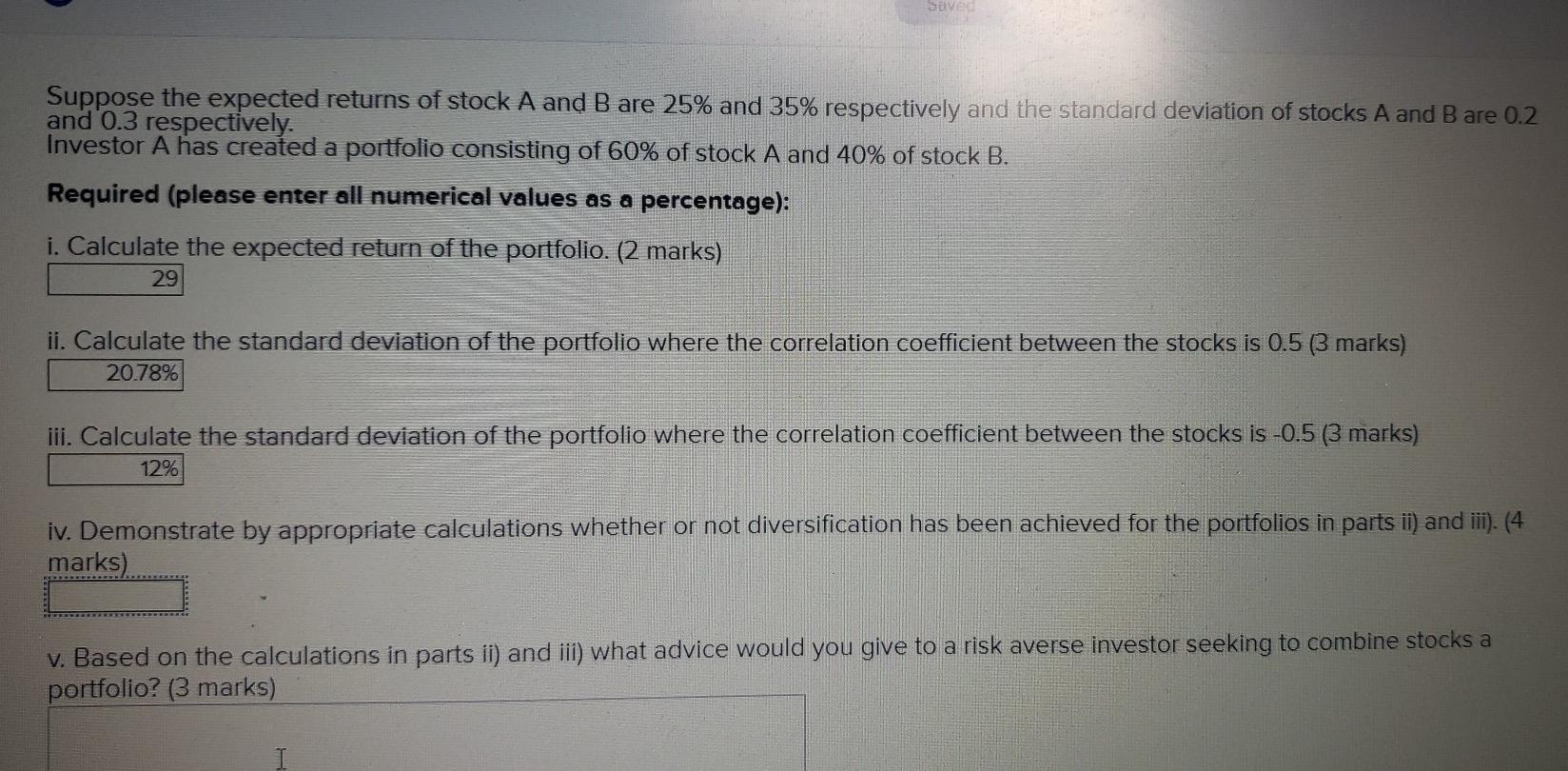

Saver Suppose the expected returns of stock A and B are 25% and 35% respectively and the standard deviation of stocks A and B are 0.2 and 0.3 respectively. Investor A has created a portfolio consisting of 60% of stock A and 40% of stock B. Required (please enter all numerical values as a percentage): i. Calculate the expected return of the portfolio. (2 marks) 29 ii. Calculate the standard deviation of the portfolio where the correlation coefficient between the stocks is 0.5 (3 marks) 20.78% iii. Calculate the standard deviation of the portfolio where the correlation coefficient between the stocks is -0.5 (3 marks) 12% iv. Demonstrate by appropriate calculations whether or not diversification has been achieved for the portfolios in parts ii) and iii). (4 marks) v. Based on the calculations in parts ii) and iii) what advice would you give to a risk averse investor seeking to combine stocks a portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started