Question

Saving For Retirement (40 points) (1) Say that you just recently graduated and are now working. You just turned 22 and are now ready to

Saving For Retirement (40 points)

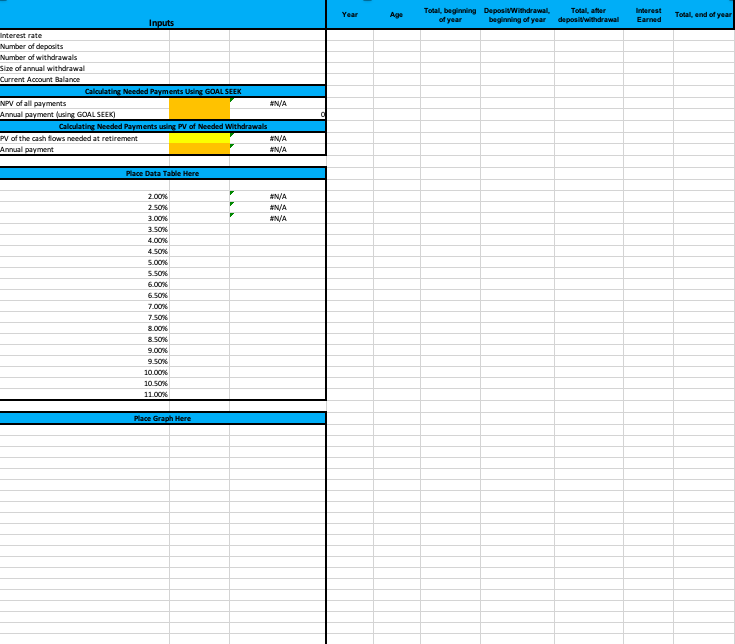

(1) Say that you just recently graduated and are now working. You just turned 22 and are now ready to start saving for retirement. How much do you need to deposit each year in order to withdraw $80,000 a year from age 65 to 95? Make sure to solve for the needed payment using (a) GOAL SEEK and (b) the PV of the needed withdraws. You are comfortable assuming a single annual rate of return of 6% throughout the entire period.

(2) Now say that you have concerns about your 6% rate of return calculation. What if it's too high? What if it's too low? Create a data table showing the sensitivity of the NPV of your retirement savings to fluctuations in your rate of return (choose the range 2% to 11% using 50 basis point increments). Graph this relationship and make sure to title your graph and label your x and y axis.

Checking the sensitivity of your results using different annual rates of return is a good start, but this analysis includes many other assumptions that can have a material affect on the validity of your findings. What are at least two other concerns that you may have with this model and how it relates to you saving for retirement?

WRITE HERE:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started