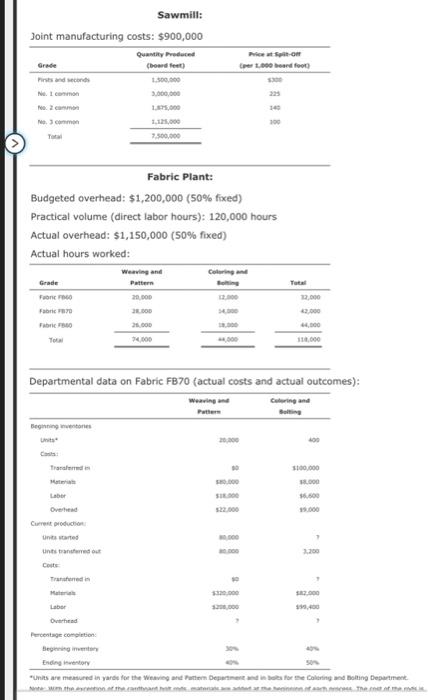

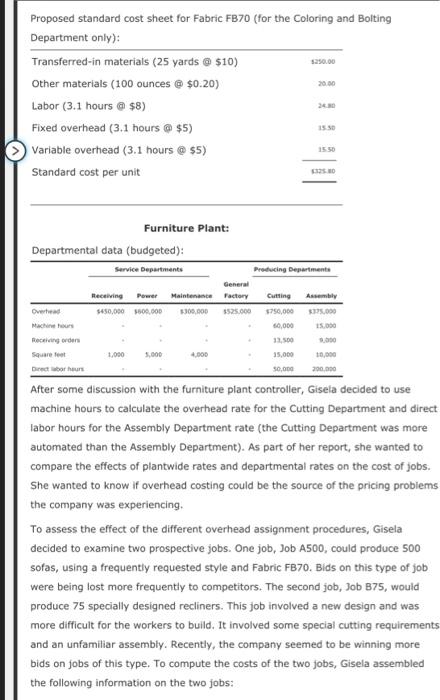

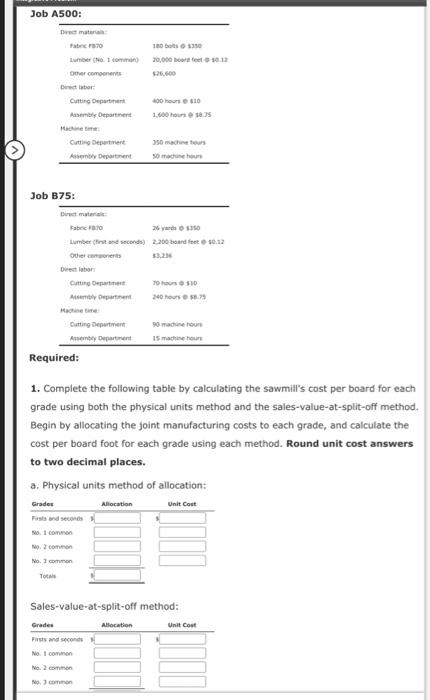

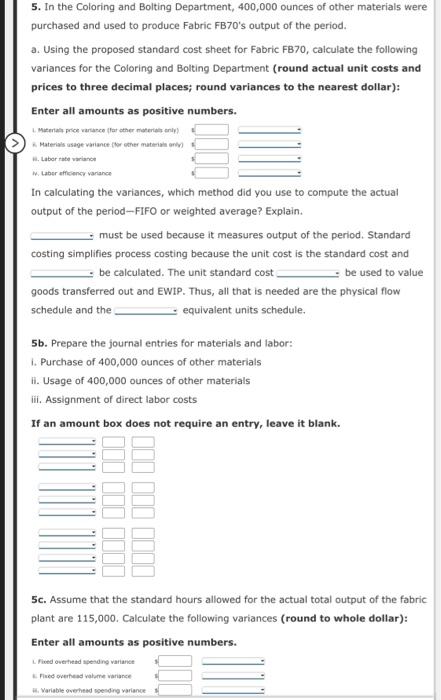

Sawmill: Joint manufacturing costs: $900,000 Fabric Plant: Budgeted overhead: $1,200,000 ( 50% fixed) Practical volume (direct labor hours): 120,000 hours Actual overhead: $1,150,000 ( 50% fixed) Actual hours worked: Departmental data on Fabric FB70 (actual costs and actual outcomes): Proposed standard cost sheet for Fabric FB70 (for the Coloring and Bolting Furniture Plant: Departmental data (budgeted): After some discussion with the furniture plant controller, Gisela decided to use machine hours to calculate the overhead rate for the Cutting Department and direct labor hours for the Assembly Department rate (the Cutting Department was more automated than the Assembly Department). As part of her report, she wanted to compare the effects of plantwide rates and departmental rates on the cost of jobs. She wanted to know if overhead costing could be the source of the pricing problems the company was experiencing. To assess the effect of the different overhead assignment procedures, Gisela decided to examine two prospective jobs. One job, Job A500, could produce 500 sofas, using a frequently requested style and Fabric FB70. Bids on this type of job were being lost more frequently to competitors. The second job, Job B75, would produce 75 specially designed recliners. This job involved a new design and was more difficult for the workers to build. It involved some special cutting requirements and an unfamiliar assembly. Recently, the company seemed to be winning more bids on jobs of this type. To compute the costs of the two jobs, Gisela assembled the following information on the two jobs: Required: 1. Complete the following table by calculating the sawmill's cost per board for each grade using both the physical units method and the sales-value-at-split-off method. Begin by allocating the joint manufacturing costs to each grade, and calculate the cost per board foot for each grade using each method. Round unit cost answers to two decimal places. a. Physical units method of allocation: Sales-value-at-split-off method: 5. In the Coloring and Bolting Department, 400,000 ounces of other materials were purchased and used to produce Fabric FB70's output of the period. a. Using the proposed standard cost sheet for Fabric FB70, calculate the following variances for the Coloring and Bolting Department (round actual unit costs and prices to three decimal places; round variances to the nearest dollar): Enter all amounts as positive numbers. In calculating the variances, which method did you use to compute the actual output of the period-FIFO or weighted average? Explain. must be used because it measures output of the period, Standard costing simplifies process costing because the unit cost is the standard cost and be calculated. The unit standard cost be used to value goods transferred out and EWIP. Thus, all that is needed are the physical flow schedule and the equivalent units schedule. 5b. Prepare the journal entries for materials and labor: i. Purchase of 400,000 ounces of other materials ii. Usage of 400,000 ounces of other materials iii. Assignment of direct labor costs If an amount box does not require an entry, leave it blank. 5c. Assume that the standard hours allowed for the actual total output of the fabric plant are 115,000. Calculate the following variances (round to whole dollar): Enter all amounts as positive numbers. Sawmill: Joint manufacturing costs: $900,000 Fabric Plant: Budgeted overhead: $1,200,000 ( 50% fixed) Practical volume (direct labor hours): 120,000 hours Actual overhead: $1,150,000 ( 50% fixed) Actual hours worked: Departmental data on Fabric FB70 (actual costs and actual outcomes): Proposed standard cost sheet for Fabric FB70 (for the Coloring and Bolting Furniture Plant: Departmental data (budgeted): After some discussion with the furniture plant controller, Gisela decided to use machine hours to calculate the overhead rate for the Cutting Department and direct labor hours for the Assembly Department rate (the Cutting Department was more automated than the Assembly Department). As part of her report, she wanted to compare the effects of plantwide rates and departmental rates on the cost of jobs. She wanted to know if overhead costing could be the source of the pricing problems the company was experiencing. To assess the effect of the different overhead assignment procedures, Gisela decided to examine two prospective jobs. One job, Job A500, could produce 500 sofas, using a frequently requested style and Fabric FB70. Bids on this type of job were being lost more frequently to competitors. The second job, Job B75, would produce 75 specially designed recliners. This job involved a new design and was more difficult for the workers to build. It involved some special cutting requirements and an unfamiliar assembly. Recently, the company seemed to be winning more bids on jobs of this type. To compute the costs of the two jobs, Gisela assembled the following information on the two jobs: Required: 1. Complete the following table by calculating the sawmill's cost per board for each grade using both the physical units method and the sales-value-at-split-off method. Begin by allocating the joint manufacturing costs to each grade, and calculate the cost per board foot for each grade using each method. Round unit cost answers to two decimal places. a. Physical units method of allocation: Sales-value-at-split-off method: 5. In the Coloring and Bolting Department, 400,000 ounces of other materials were purchased and used to produce Fabric FB70's output of the period. a. Using the proposed standard cost sheet for Fabric FB70, calculate the following variances for the Coloring and Bolting Department (round actual unit costs and prices to three decimal places; round variances to the nearest dollar): Enter all amounts as positive numbers. In calculating the variances, which method did you use to compute the actual output of the period-FIFO or weighted average? Explain. must be used because it measures output of the period, Standard costing simplifies process costing because the unit cost is the standard cost and be calculated. The unit standard cost be used to value goods transferred out and EWIP. Thus, all that is needed are the physical flow schedule and the equivalent units schedule. 5b. Prepare the journal entries for materials and labor: i. Purchase of 400,000 ounces of other materials ii. Usage of 400,000 ounces of other materials iii. Assignment of direct labor costs If an amount box does not require an entry, leave it blank. 5c. Assume that the standard hours allowed for the actual total output of the fabric plant are 115,000. Calculate the following variances (round to whole dollar): Enter all amounts as positive numbers