Answered step by step

Verified Expert Solution

Question

1 Approved Answer

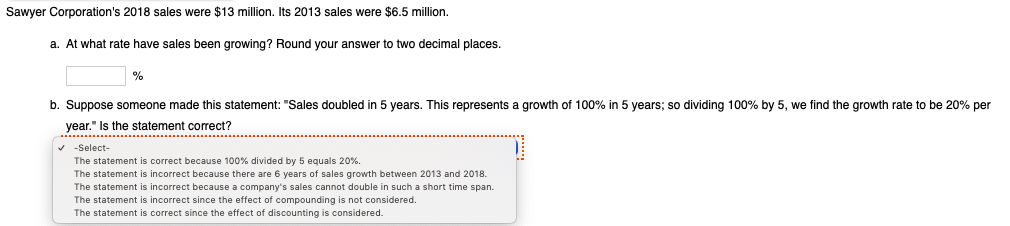

Sawyer Corporation's 2018 sales were $13 million. Its 2013 sales were $6.5 million. a. At what rate have sales been growing? Round your answer to

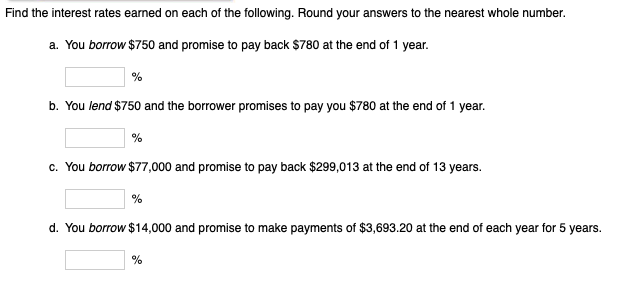

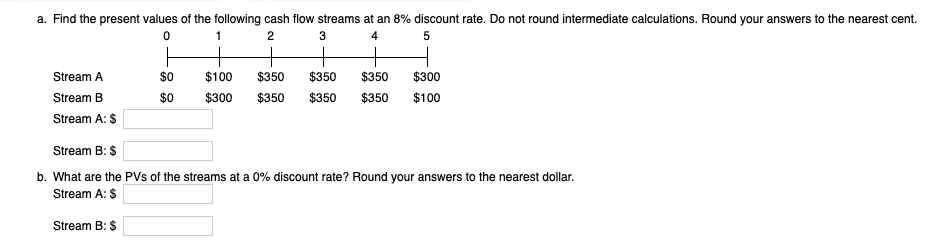

Sawyer Corporation's 2018 sales were $13 million. Its 2013 sales were $6.5 million. a. At what rate have sales been growing? Round your answer to two decimal places. % b. Suppose someone made this statement: "Sales doubled in 5 years. This represents a growth of 100% in 5 years; so dividing 100% by 5, we find the growth rate to be 20% per year." Is the statement correct? -Select- The statement correct because 100% divided by 5 equals 20%. The statement is incorrect because there are 6 years of sales growth between 2013 and 2018. The statement is incorrect because a company's sales cannot double in such a short time span. The statement is incorrect since the effect of compounding is not considered. The statement is correct since the effect of discounting is considered Find the interest rates earned on each of the following. Round your answers to the nearest whole number. a. You borrow $750 and promise to pay back $780 at the end of 1 year. % b. You lend $750 and the borrower promises to pay you $780 at the end of 1 year. % C. You borrow $77,000 and promise to pay back $299,013 at the end of 13 years. % d. You borrow $14,000 and promise to make payments of $3,693.20 at the end of each year for 5 years. % a. Find the present values of the following cash flow streams at an 8% discount rate. Do not round intermediate calculations. Round your answers to the nearest cent. 0 1 2 3 4 5 $0 $350 $350 Stream A Stream B Stream A: $ $100 $300 $350 $350 $300 $100 $0 $350 $350 Stream B: $ b. What are the PVs of the streams at a 0% discount rate? Round your answers to the nearest dollar. Stream A: $ Stream B:S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started