Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sawyer's Lubricants produces a specialty oil for machine lubrication. The production facility can operate one shift, two shifts, or three shifts. The shift decision

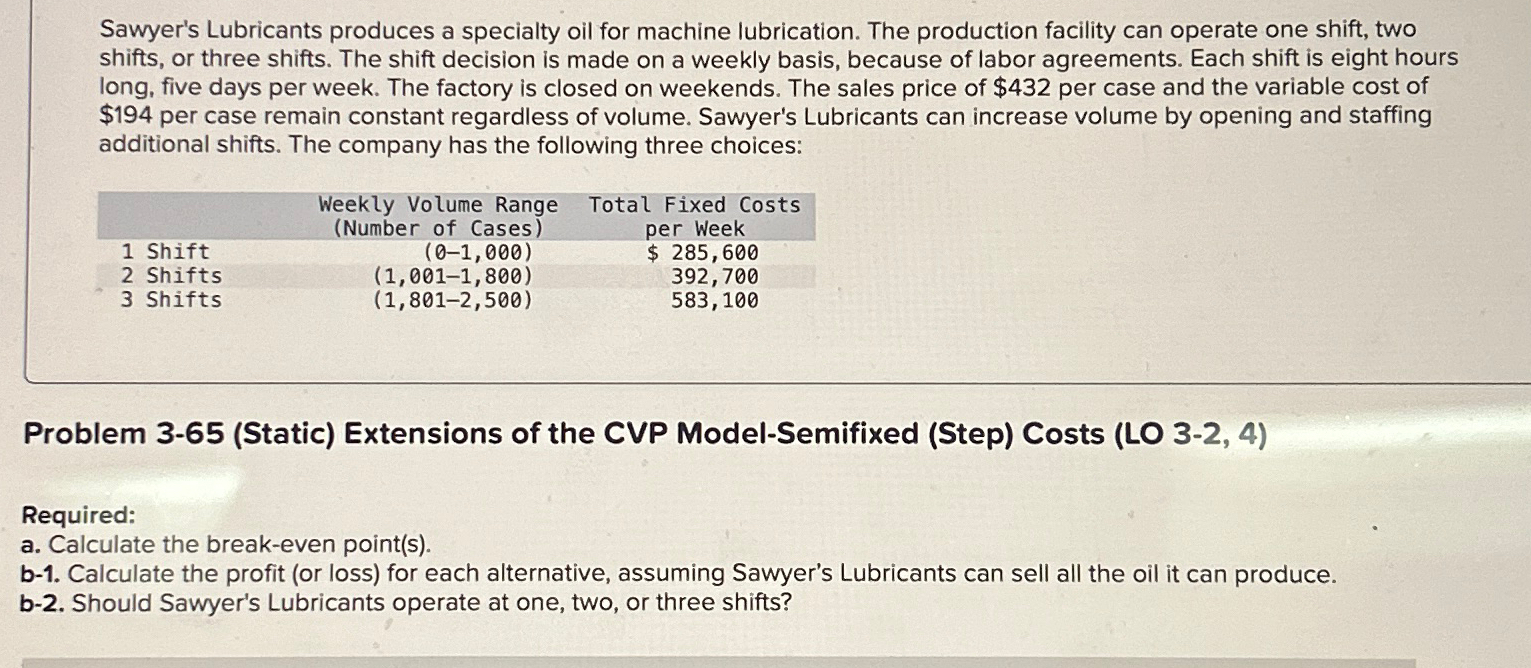

Sawyer's Lubricants produces a specialty oil for machine lubrication. The production facility can operate one shift, two shifts, or three shifts. The shift decision is made on a weekly basis, because of labor agreements. Each shift is eight hours long, five days per week. The factory is closed on weekends. The sales price of $432 per case and the variable cost of $194 per case remain constant regardless of volume. Sawyer's Lubricants can increase volume by opening and staffing additional shifts. The company has the following three choices: Weekly Volume Range Total Fixed Costs (Number of Cases) per Week 1 Shift 2 Shifts 3 Shifts (0-1,000) (1,001-1,800) (1,801-2,500) $ 285,600 392,700 583,100 Problem 3-65 (Static) Extensions of the CVP Model-Semifixed (Step) Costs (LO 3-2, 4) Required: a. Calculate the break-even point(s). b-1. Calculate the profit (or loss) for each alternative, assuming Sawyer's Lubricants can sell all the oil it can produce. b-2. Should Sawyer's Lubricants operate at one, two, or three shifts?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started