says it's incorrect

says it's incorrect

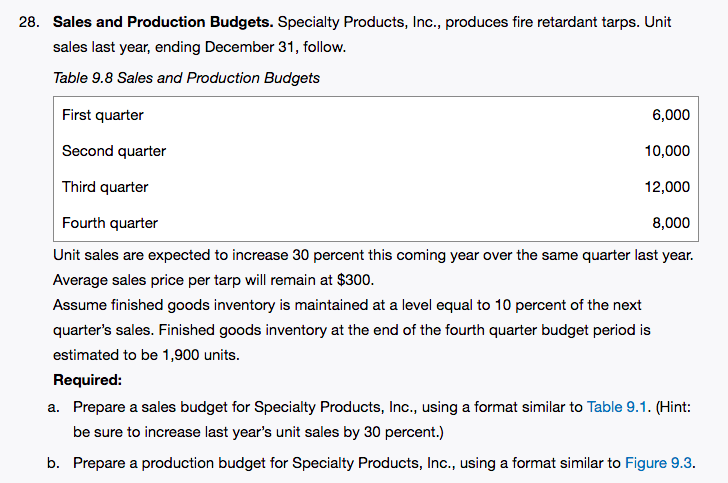

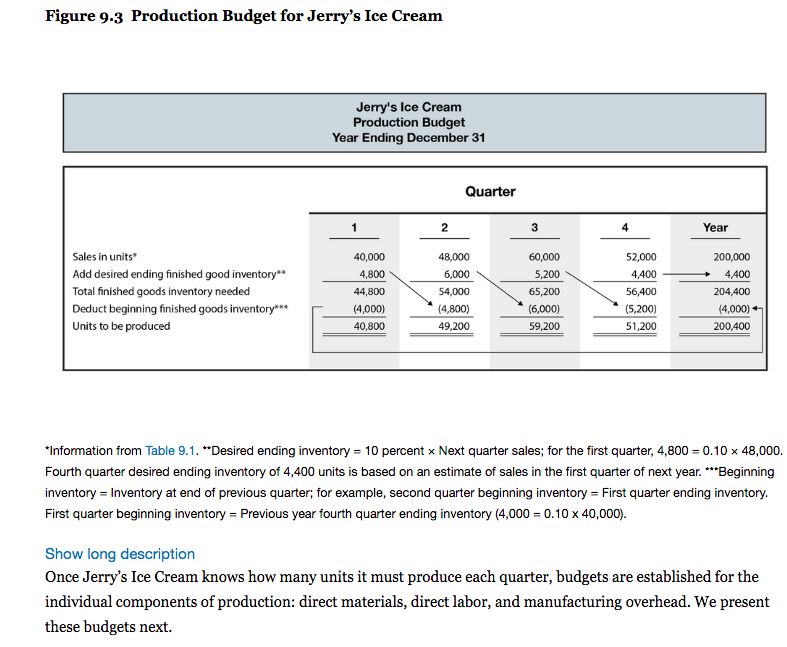

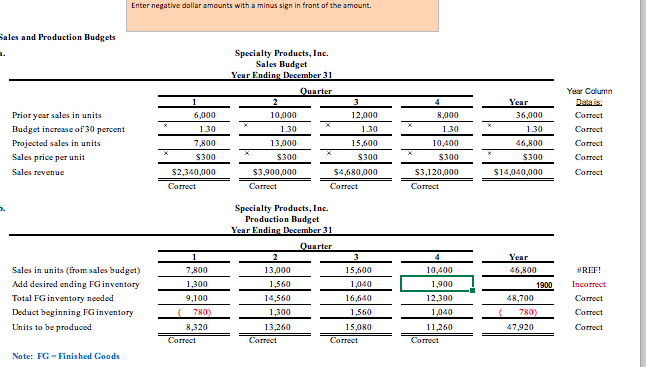

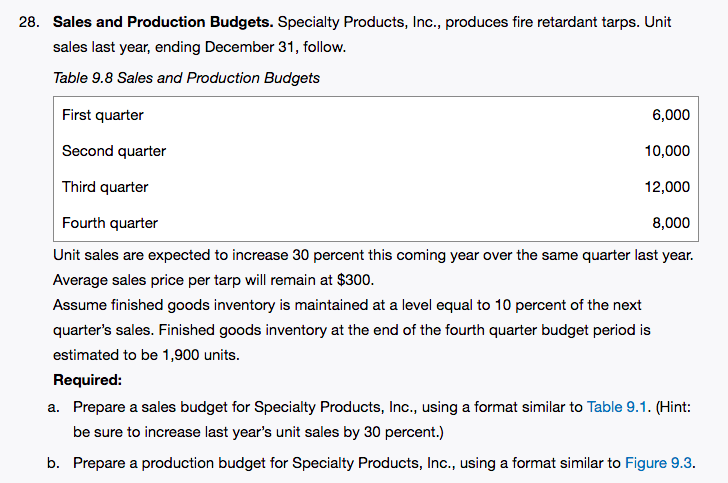

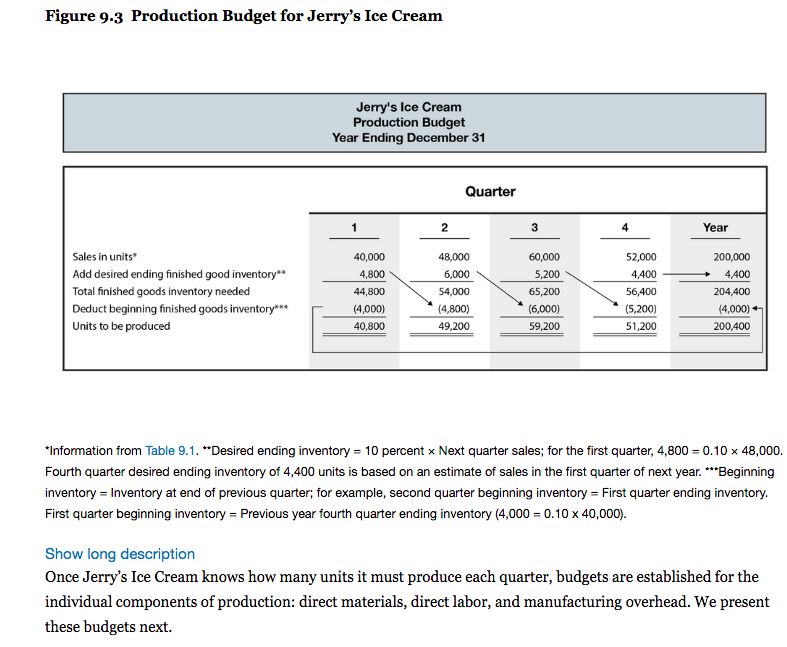

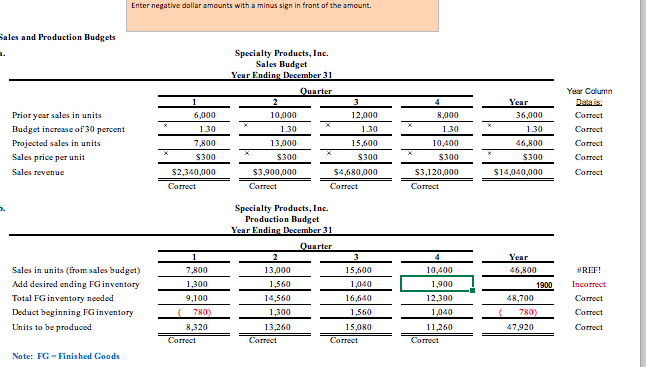

28. Sales and Production Budgets. Specialty Products, Inc., produces fire retardant tarps. Unit sales last year, ending December 31, follow. Table 9.8 Sales and Production Budgets First quarter 6,000 Second quarter 10,000 Third quarter 12,000 Fourth quarter 8,000 Unit sales are expected to increase 30 percent this coming year over the same quarter last year. Average sales price per tarp will remain at $300. Assume finished goods inventory is maintained at a level equal to 10 percent of the next quarter's sales. Finished goods inventory at the end of the fourth quarter budget period is estimated to be 1,900 units. Required: a. Prepare a sales budget for Specialty Products, Inc., using a format similar to Table 9.1. (Hint: be sure to increase last year's unit sales by 30 percent.) b. Prepare a production budget for Specialty Products, Inc., using a format similar to Figure 9.3. Figure 9.3 Production Budget for Jerry's Ice Cream Jerry's Ice Cream Production Budget Year Ending December 31 Quarter 1 2 3 4 Year Sales in units Add desired ending finished good inventory** Total finished goods inventory needed Deduct beginning finished goods inventory*** Units to be produced 40,000 4,800 44,800 (4,000) 40,800 48,000 6,000 54,000 (4,800) 49,200 60,000 5,200 65,200 (6,000) 59,200 52,000 4,400 56,400 (5,200) 51,200 200,000 4,400 204,400 (4,000) + 200,400 *Information from Table 9.1. **Desired ending inventory = 10 percent * Next quarter sales; for the first quarter, 4,800 = 0.10 x 48,000. Fourth quarter desired ending inventory of 4,400 units is based on an estimate of sales in the first quarter of next year. ***Beginning inventory = Inventory at end of previous quarter, for example, second quarter beginning inventory = First quarter ending inventory. First quarter beginning inventory = Previous year fourth quarter ending inventory (4,000 = 0.10 x 40,000). Show long description Once Jerry's Ice Cream knows how many units it must produce each quarter, budgets are established for the individual components of production: direct materials, direct labor, and manufacturing overhead. We present these budgets next. Enter negative dollar amounts with a minus sign in front of the amount. Sales and Production Budgets Prior year sales in units Budget increase of 30 percent Projected sales in units Sales price per unit Sales revenue 8,000 1.30 6,000 1.30 7,800 $300 Specialty Products, Inc. Sales Budget Year Ending December 31 Quarter 2 10,000 12,000 1.30 1.30 13,000 15,600 S300 $300 $3,900,000 $4,680,000 Correct Correct Year 36,000 1.30 46,800 $300 $14,040,000 Year Column Data is Correct Correct Correct Correct Correct 10,400 $300 $2,340,000 Correct $3,120,000 Correct Sales in units (from sales budget) Add desired ending FG inventory Total FG inventory needed Deduct beginning FG inventory Units to be produced 7,800 1,300 9,100 (780) 8,320 Correct Specialty Products, Inc. Production Budget Year Ending December 31 Quarter 2 13,000 15,600 1,560 1,040 14,560 16,640 1,300 1,560 13.260 15,080 Correct Correct 10,400 1.900 12,300 1,040 11,260 Correct Year 46,800 1900 48,700 780) 47,920 #REF! Incorrect Correct Correct Correct Note: FG-Finished Goods 28. Sales and Production Budgets. Specialty Products, Inc., produces fire retardant tarps. Unit sales last year, ending December 31, follow. Table 9.8 Sales and Production Budgets First quarter 6,000 Second quarter 10,000 Third quarter 12,000 Fourth quarter 8,000 Unit sales are expected to increase 30 percent this coming year over the same quarter last year. Average sales price per tarp will remain at $300. Assume finished goods inventory is maintained at a level equal to 10 percent of the next quarter's sales. Finished goods inventory at the end of the fourth quarter budget period is estimated to be 1,900 units. Required: a. Prepare a sales budget for Specialty Products, Inc., using a format similar to Table 9.1. (Hint: be sure to increase last year's unit sales by 30 percent.) b. Prepare a production budget for Specialty Products, Inc., using a format similar to Figure 9.3. Figure 9.3 Production Budget for Jerry's Ice Cream Jerry's Ice Cream Production Budget Year Ending December 31 Quarter 1 2 3 4 Year Sales in units Add desired ending finished good inventory** Total finished goods inventory needed Deduct beginning finished goods inventory*** Units to be produced 40,000 4,800 44,800 (4,000) 40,800 48,000 6,000 54,000 (4,800) 49,200 60,000 5,200 65,200 (6,000) 59,200 52,000 4,400 56,400 (5,200) 51,200 200,000 4,400 204,400 (4,000) + 200,400 *Information from Table 9.1. **Desired ending inventory = 10 percent * Next quarter sales; for the first quarter, 4,800 = 0.10 x 48,000. Fourth quarter desired ending inventory of 4,400 units is based on an estimate of sales in the first quarter of next year. ***Beginning inventory = Inventory at end of previous quarter, for example, second quarter beginning inventory = First quarter ending inventory. First quarter beginning inventory = Previous year fourth quarter ending inventory (4,000 = 0.10 x 40,000). Show long description Once Jerry's Ice Cream knows how many units it must produce each quarter, budgets are established for the individual components of production: direct materials, direct labor, and manufacturing overhead. We present these budgets next. Enter negative dollar amounts with a minus sign in front of the amount. Sales and Production Budgets Prior year sales in units Budget increase of 30 percent Projected sales in units Sales price per unit Sales revenue 8,000 1.30 6,000 1.30 7,800 $300 Specialty Products, Inc. Sales Budget Year Ending December 31 Quarter 2 10,000 12,000 1.30 1.30 13,000 15,600 S300 $300 $3,900,000 $4,680,000 Correct Correct Year 36,000 1.30 46,800 $300 $14,040,000 Year Column Data is Correct Correct Correct Correct Correct 10,400 $300 $2,340,000 Correct $3,120,000 Correct Sales in units (from sales budget) Add desired ending FG inventory Total FG inventory needed Deduct beginning FG inventory Units to be produced 7,800 1,300 9,100 (780) 8,320 Correct Specialty Products, Inc. Production Budget Year Ending December 31 Quarter 2 13,000 15,600 1,560 1,040 14,560 16,640 1,300 1,560 13.260 15,080 Correct Correct 10,400 1.900 12,300 1,040 11,260 Correct Year 46,800 1900 48,700 780) 47,920 #REF! Incorrect Correct Correct Correct Note: FG-Finished Goods

says it's incorrect

says it's incorrect