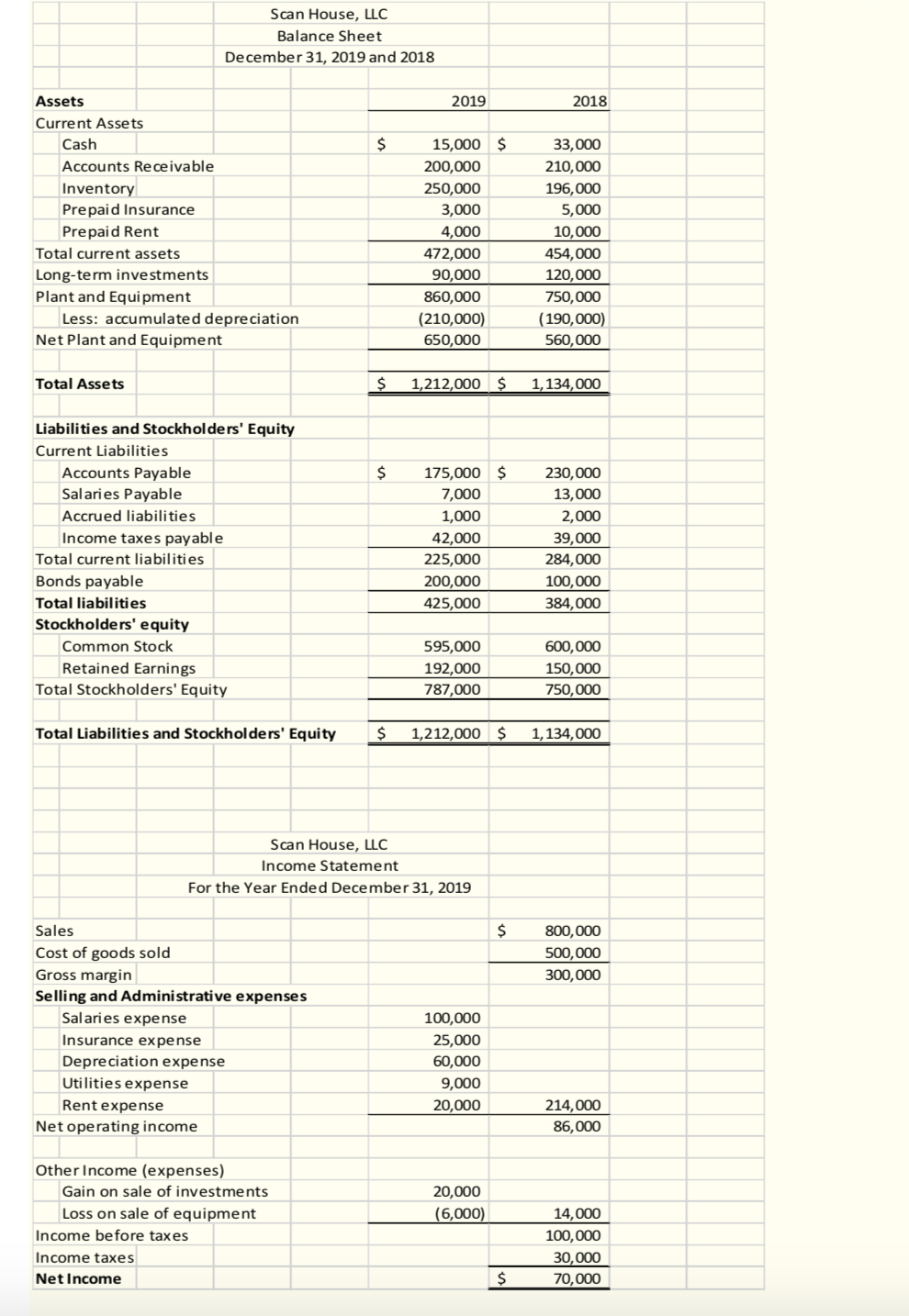

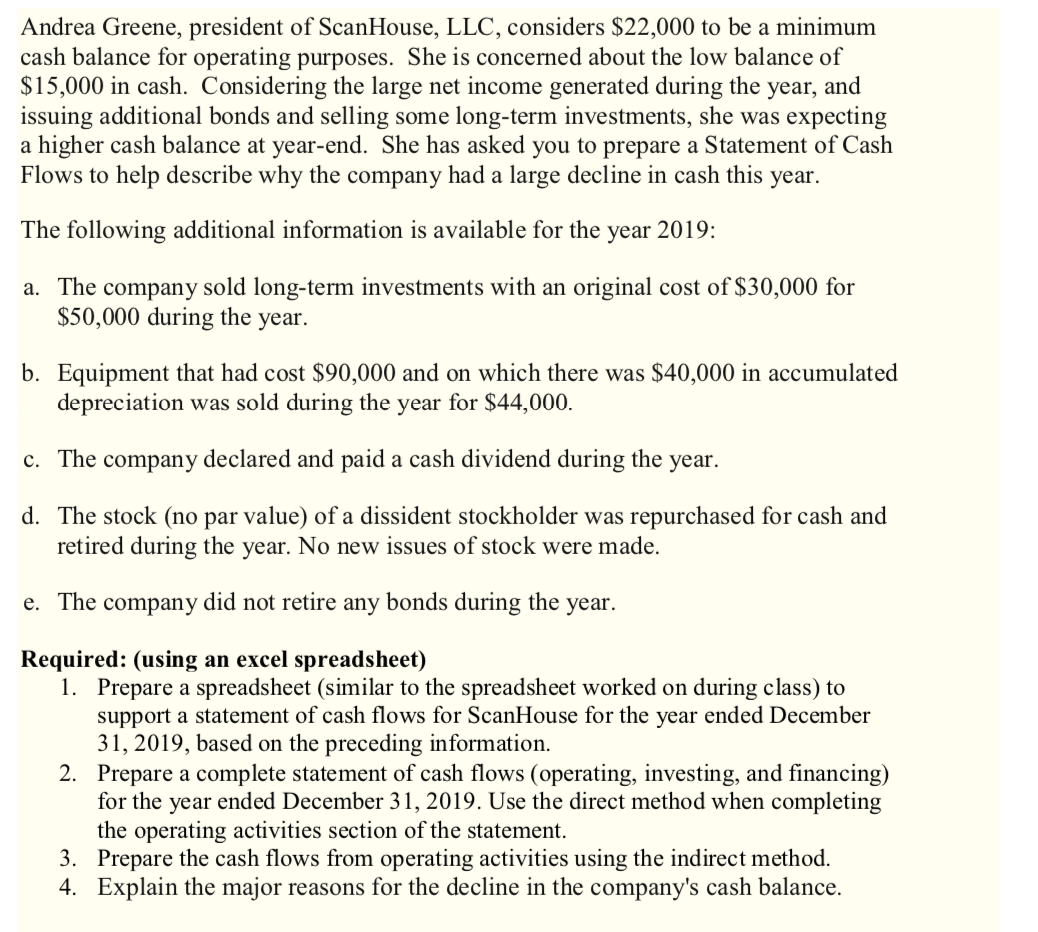

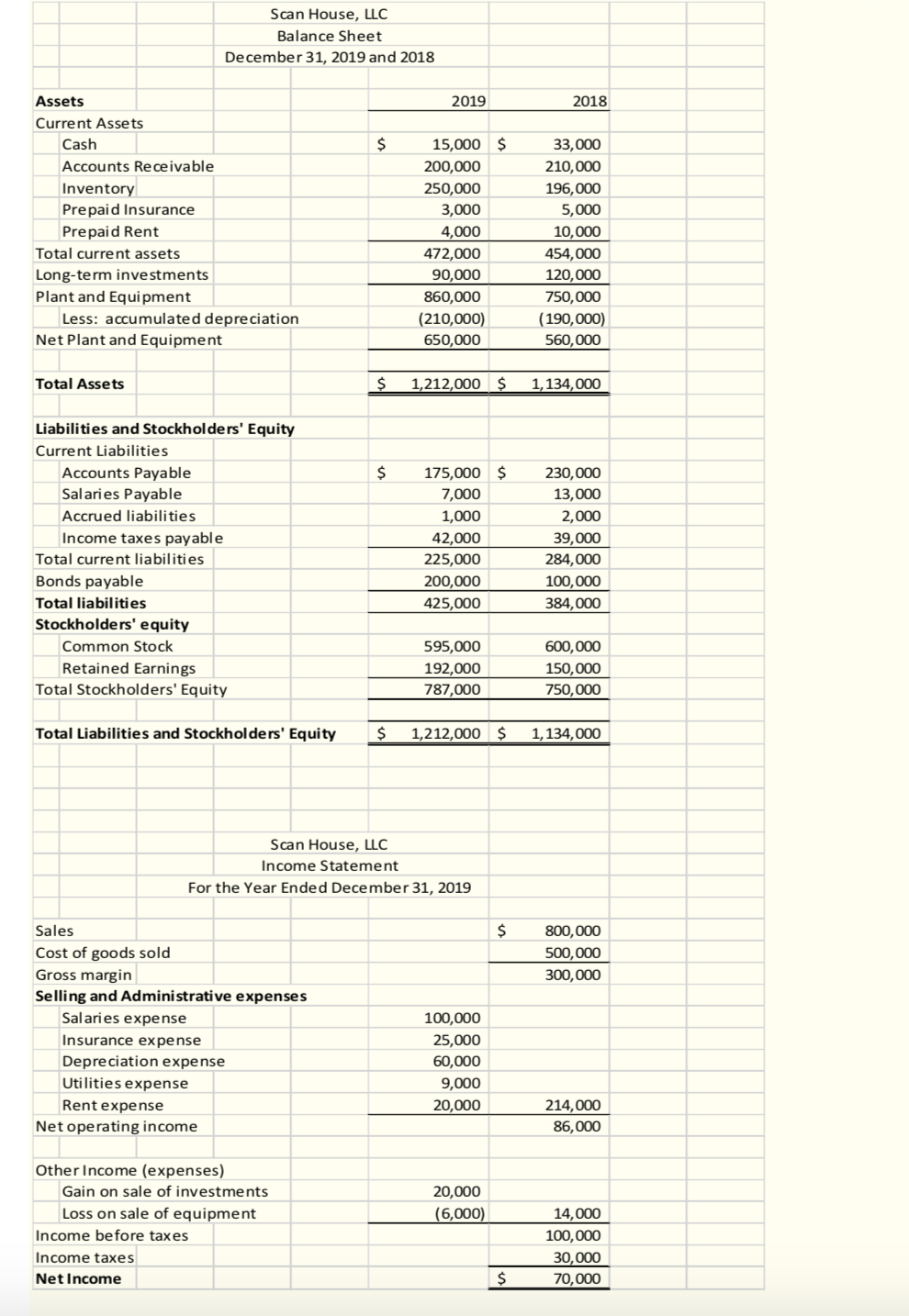

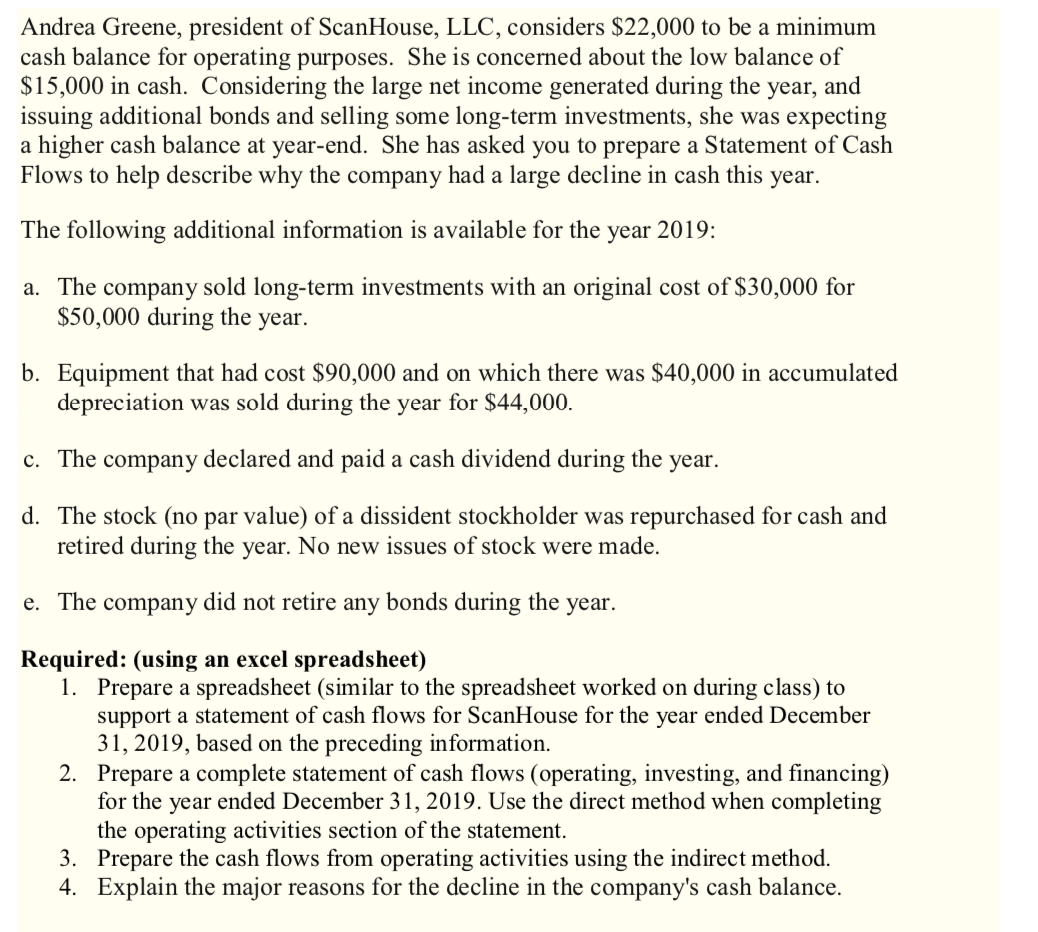

Scan House, LLC Balance Sheet December 31, 2019 and 2018 2019 2018 Assets Current Assets Cash Accounts Receivable Inventory Prepaid Insurance Prepaid Rent Total current assets Long-term investments Plant and Equipment Less: accumulated depreciation Net Plant and Equipment 15,000 $ 200,000 250,000 3,000 4,000 472,000 90,000 860,000 (210,000) 650,000 33,000 210,000 196,000 5,000 10,000 454,000 120,000 750,000 (190,000) 560,000 Total Assets $ 1,212,000 $ 1,134,000 $ $ Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Salaries Payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders' equity Common Stock Retained Earnings Total Stockholders' Equity 175,000 7,000 1,000 42,000 225.000 200,000 425,000 230,000 13,000 2,000 39,000 284,000 100,000 384,000 595,000 192,000 787,000 600,000 150,000 750,000 Total Liabilities and Stockholders' Equity $ 1,212,000 $ 1,134,000 Scan House, LLC Income Statement For the Year Ended December 31, 2019 800,000 500,000 300,000 Sales Cost of goods sold Gross margin Selling and Administrative expenses Salaries expense Insurance expense Depreciation expense Utilities expense Rent expense Net operating income 100,000 25,000 60,000 9,000 20,000 214,000 86,000 20,000 (6,000) Other Income (expenses) Gain on sale of investments Loss on sale of equipment Income before taxes Income taxes Net Income 14,000 100,000 30,000 70,000 $ Andrea Greene, president of Scan House, LLC, considers $22,000 to be a minimum cash balance for operating purposes. She is concerned about the low balance of $15,000 in cash. Considering the large net income generated during the year, and issuing additional bonds and selling some long-term investments, she was expecting a higher cash balance at year-end. She has asked you to prepare a Statement of Cash Flows to help describe why the company had a large decline in cash this year. The following additional information is available for the year 2019: a. The company sold long-term investments with an original cost of $30,000 for $50,000 during the year. b. Equipment that had cost $90,000 and on which there was $40,000 in accumulated depreciation was sold during the year for $44,000. c. The company declared and paid a cash dividend during the year. d. The stock (no par value) of a dissident stockholder was repurchased for cash and retired during the year. No new issues of stock were made. e. The company did not retire any bonds during the year. Required: (using an excel spreadsheet) 1. Prepare a spreadsheet (similar to the spreadsheet worked on during class) to support a statement of cash flows for ScanHouse for the year ended December 31, 2019, based on the preceding information. Prepare a complete statement of cash flows (operating, investing, and financing) for the year ended December 31, 2019. Use the direct method when completing the operating activities section of the statement. 3. Prepare the cash flows from operating activities using the indirect method. 4. Explain the major reasons for the decline in the company's cash balance. 2. Scan House, LLC Balance Sheet December 31, 2019 and 2018 2019 2018 Assets Current Assets Cash Accounts Receivable Inventory Prepaid Insurance Prepaid Rent Total current assets Long-term investments Plant and Equipment Less: accumulated depreciation Net Plant and Equipment 15,000 $ 200,000 250,000 3,000 4,000 472,000 90,000 860,000 (210,000) 650,000 33,000 210,000 196,000 5,000 10,000 454,000 120,000 750,000 (190,000) 560,000 Total Assets $ 1,212,000 $ 1,134,000 $ $ Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Salaries Payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders' equity Common Stock Retained Earnings Total Stockholders' Equity 175,000 7,000 1,000 42,000 225.000 200,000 425,000 230,000 13,000 2,000 39,000 284,000 100,000 384,000 595,000 192,000 787,000 600,000 150,000 750,000 Total Liabilities and Stockholders' Equity $ 1,212,000 $ 1,134,000 Scan House, LLC Income Statement For the Year Ended December 31, 2019 800,000 500,000 300,000 Sales Cost of goods sold Gross margin Selling and Administrative expenses Salaries expense Insurance expense Depreciation expense Utilities expense Rent expense Net operating income 100,000 25,000 60,000 9,000 20,000 214,000 86,000 20,000 (6,000) Other Income (expenses) Gain on sale of investments Loss on sale of equipment Income before taxes Income taxes Net Income 14,000 100,000 30,000 70,000 $ Andrea Greene, president of Scan House, LLC, considers $22,000 to be a minimum cash balance for operating purposes. She is concerned about the low balance of $15,000 in cash. Considering the large net income generated during the year, and issuing additional bonds and selling some long-term investments, she was expecting a higher cash balance at year-end. She has asked you to prepare a Statement of Cash Flows to help describe why the company had a large decline in cash this year. The following additional information is available for the year 2019: a. The company sold long-term investments with an original cost of $30,000 for $50,000 during the year. b. Equipment that had cost $90,000 and on which there was $40,000 in accumulated depreciation was sold during the year for $44,000. c. The company declared and paid a cash dividend during the year. d. The stock (no par value) of a dissident stockholder was repurchased for cash and retired during the year. No new issues of stock were made. e. The company did not retire any bonds during the year. Required: (using an excel spreadsheet) 1. Prepare a spreadsheet (similar to the spreadsheet worked on during class) to support a statement of cash flows for ScanHouse for the year ended December 31, 2019, based on the preceding information. Prepare a complete statement of cash flows (operating, investing, and financing) for the year ended December 31, 2019. Use the direct method when completing the operating activities section of the statement. 3. Prepare the cash flows from operating activities using the indirect method. 4. Explain the major reasons for the decline in the company's cash balance. 2