Answered step by step

Verified Expert Solution

Question

1 Approved Answer

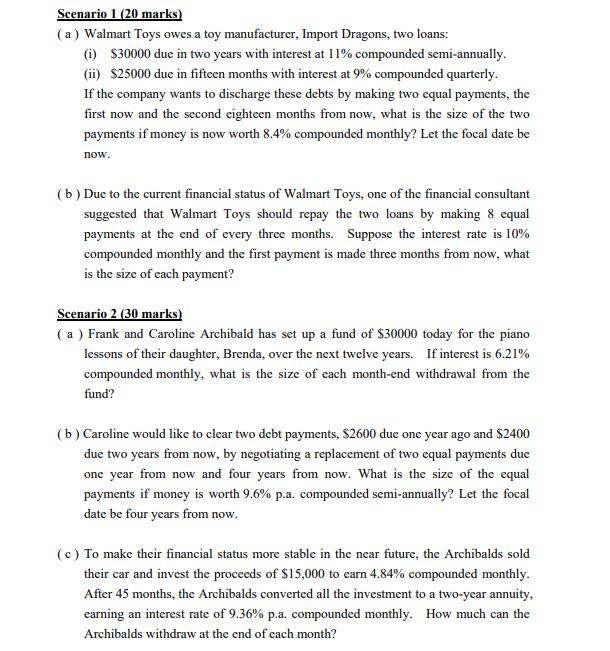

Scenario 1 (20 marks) (a) Walmart Toys owes a toy manufacturer, Import Dragons, two loans: (i) $30000 due in two years with interest at

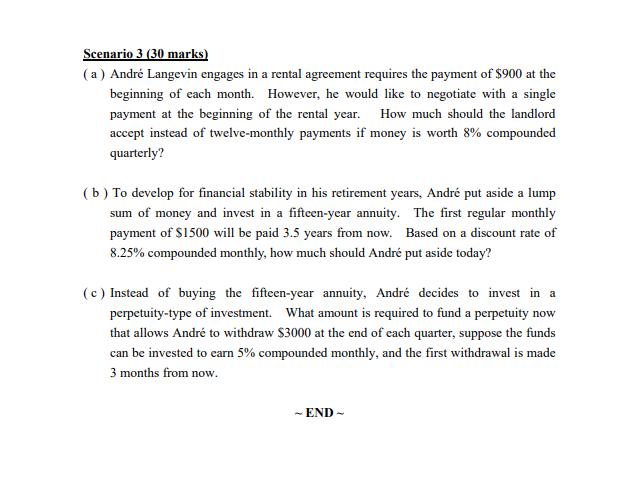

Scenario 1 (20 marks) (a) Walmart Toys owes a toy manufacturer, Import Dragons, two loans: (i) $30000 due in two years with interest at 11% compounded semi-annually. (ii) $25000 due in fifteen months with interest at 9% compounded quarterly. If the company wants to discharge these debts by making two equal payments, the first now and the second eighteen months from now, what is the size of the two payments if money is now worth 8.4% compounded monthly? Let the focal date be now. (b) Due to the current financial status of Walmart Toys, one of the financial consultant suggested that Walmart Toys should repay the two loans by making 8 equal payments at the end of every three months. Suppose the interest rate is 10% compounded monthly and the first payment is made three months from now, what is the size of each payment? Scenario 2 (30 marks) (a) Frank and Caroline Archibald has set up a fund of $30000 today for the piano lessons of their daughter, Brenda, over the next twelve years. If interest is 6.21% compounded monthly, what is the size of each month-end withdrawal from the fund? (b) Caroline would like to clear two debt payments, $2600 due one year ago and $2400 due two years from now, by negotiating a replacement of two equal payments due one year from now and four years from now. What is the size of the equal payments if money is worth 9.6% p.a. compounded semi-annually? Let the focal date be four years from now. (c) To make their financial status more stable in the near future, the Archibalds sold their car and invest the proceeds of $15,000 to earn 4.84% compounded monthly. After 45 months, the Archibalds converted all the investment to a two-year annuity, earning an interest rate of 9.36% p.a. compounded monthly. How much can the Archibalds withdraw at the end of each month? Scenario 3 (30 marks) (a) Andr Langevin engages in a rental agreement requires the payment of $900 at the beginning of each month. However, he would like to negotiate with a single payment at the beginning of the rental year. How much should the landlord accept instead of twelve-monthly payments if money is worth 8% compounded quarterly? (b) To develop for financial stability in his retirement years, Andr put aside a lump sum of money and invest in a fifteen-year annuity. The first regular monthly payment of $1500 will be paid 3.5 years from now. Based on a discount rate of 8.25% compounded monthly, how much should Andr put aside today? (c) Instead of buying the fifteen-year annuity, Andr decides to invest in a perpetuity-type of investment. What amount is required to fund a perpetuity now that allows Andr to withdraw $3000 at the end of each quarter, suppose the funds can be invested to earn 5% compounded monthly, and the first withdrawal is made 3 months from now. ~ END -

Step by Step Solution

★★★★★

3.63 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Scenario 1 20 marks a i Walmart Toys owe a toy manufacturer Import Dragons two loans the first is 30000 due in two years with interest at 11 compounded semiannually and the second is 25000 due in fift...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started