Answered step by step

Verified Expert Solution

Question

1 Approved Answer

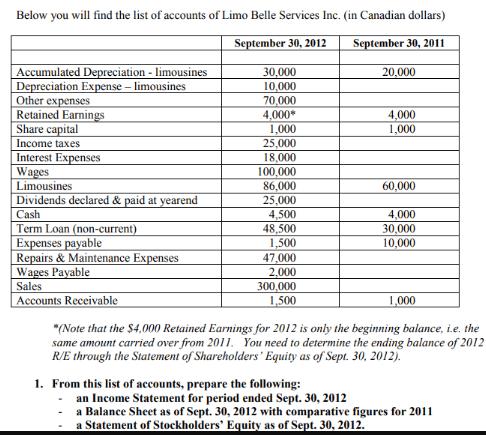

Below you will find the list of accounts of Limo Belle Services Inc. (in Canadian dollars) September 30, 2012 September 30, 2011 Accumulated Depreciation

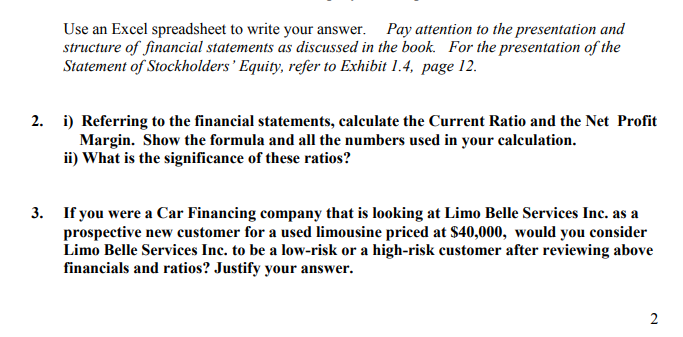

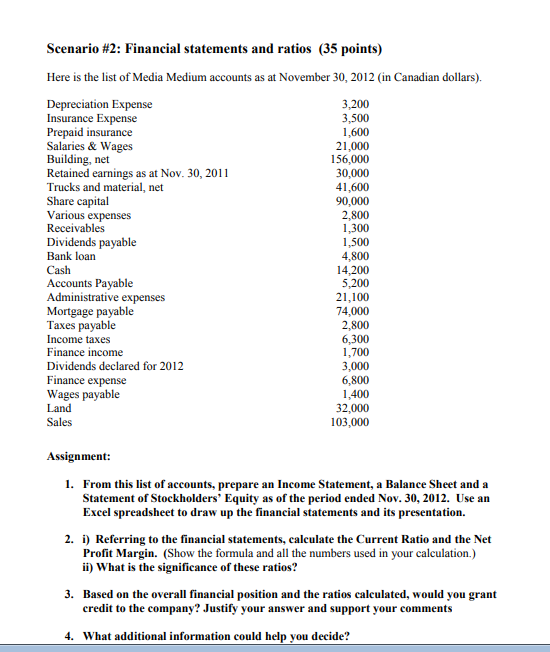

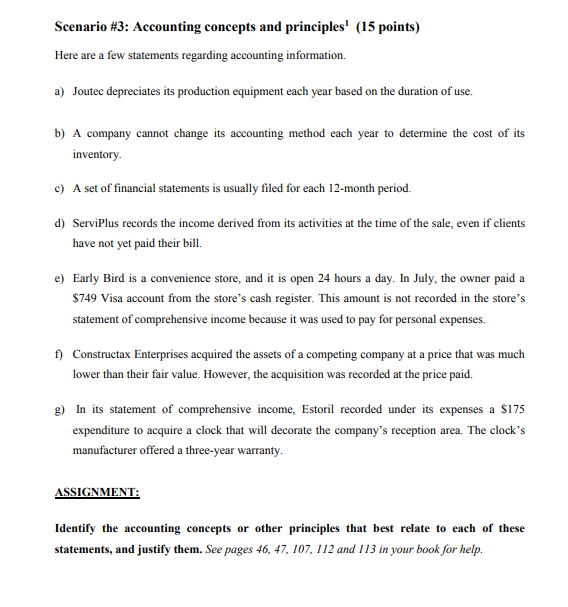

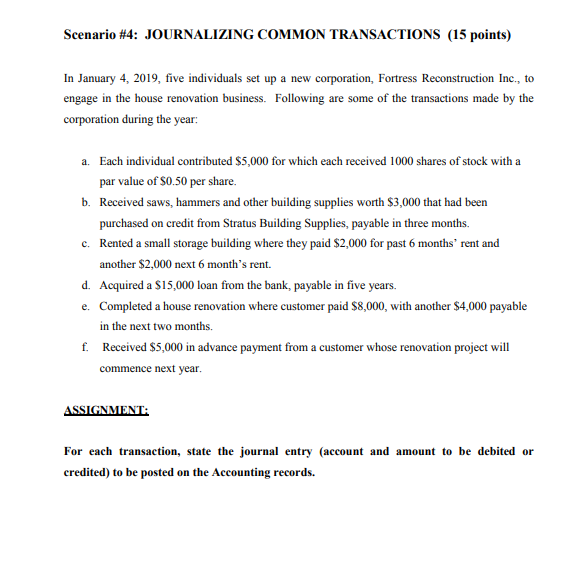

Below you will find the list of accounts of Limo Belle Services Inc. (in Canadian dollars) September 30, 2012 September 30, 2011 Accumulated Depreciation - limousines Depreciation Expense - limousines Other expenses Retained Earnings Share capital Income taxes Interest Expenses Wages Limousines Dividends declared & paid at yearend Cash Term Loan (non-current) Expenses payable Repairs & Maintenance Expenses Wages Payable Sales Accounts Receivable 30,000 10,000 70,000 4,000* 1,000 25,000 18,000 100,000 86,000 25,000 4,500 48,500 1,500 47,000 2,000 300,000 1,500 20,000 1. From this list of accounts, prepare the following: 4,000 1,000 60,000 4,000 30,000 10,000 1,000 "(Note that the $4,000 Retained Earnings for 2012 is only the beginning balance, i.e. the same amount carried over from 2011. You need to determine the ending balance of 2012 R/E through the Statement of Shareholders' Equity as of Sept. 30, 2012). an Income Statement for period ended Sept. 30, 2012 a Balance Sheet as of Sept. 30, 2012 with comparative figures for 2011 a Statement of Stockholders' Equity as of Sept. 30, 2012. Use an Excel spreadsheet to write your answer. Pay attention to the presentation and structure of financial statements as discussed in the book. For the presentation of the Statement of Stockholders' Equity, refer to Exhibit 1.4, page 12. 2. i) Referring to the financial statements, calculate the Current Ratio and the Net Profit Margin. Show the formula and all the numbers used in your calculation. ii) What is the significance of these ratios? 3. If you were a Car Financing company that is looking at Limo Belle Services Inc. as a prospective new customer for a used limousine priced at $40,000, would you consider Limo Belle Services Inc. to be a low-risk or a high-risk customer after reviewing above financials and ratios? Justify your answer. 2 Scenario #2: Financial statements and ratios (35 points) Here is the list of Media Medium accounts as at November 30, 2012 (in Canadian dollars). Depreciation Expense 3,200 3,500 Insurance Expense Prepaid insurance 1,600 21,000 156,000 Salaries & Wages Building, net Retained earnings as at Nov. 30, 2011 Trucks and material, net Share capital Various expenses Receivables Dividends payable Bank loan Cash Accounts Payable Administrative expenses Mortgage payable Taxes payable Income taxes Finance income Dividends declared for 2012 Finance expense Wages payable Land Sales 30,000 41,600 90,000 2,800 1,300 1,500 4,800 14,200 5,200 21,100 74,000 2,800 6,300 1,700 3,000 6,800 1,400 32,000 103,000 Assignment: 1. From this list of accounts, prepare an Income Statement, a Balance Sheet and a Statement of Stockholders' Equity as of the period ended Nov. 30, 2012. Use an Excel spreadsheet to draw up the financial statements and its presentation. 2. i) Referring to the financial statements, calculate the Current Ratio and the Net Profit Margin. (Show the formula and all the numbers used in your calculation.) ii) What is the significance of these ratios? 3. Based on the overall financial position and the ratios calculated, would you grant credit to the company? Justify your answer and support your comments 4. What additional information could help you decide? Scenario #3: Accounting concepts and principles (15 points) Here are a few statements regarding accounting information. a) Joutec depreciates its production equipment each year based on the duration of use. b) A company cannot change its accounting method each year to determine the cost of its inventory. c) A set of financial statements is usually filed for each 12-month period. d) ServiPlus records the income derived from its activities at the time of the sale, even if clients have not yet paid their bill. e) Early Bird is a convenience store, and it is open 24 hours a day. In July, the owner paid a $749 Visa account from the store's cash register. This amount is not recorded in the store's statement of comprehensive income because it was used to pay for personal expenses. f) Constructax Enterprises acquired the assets of a competing company at a price that was much lower than their fair value. However, the acquisition was recorded at the price paid. g) In its statement of comprehensive income, Estoril recorded under its expenses a $175 expenditure to acquire a clock that will decorate the company's reception area. The clock's manufacturer offered a three-year warranty. ASSIGNMENT: Identify the accounting concepts or other principles that best relate to each of these statements, and justify them. See pages 46, 47, 107, 112 and 113 in your book for help. Scenario #4: JOURNALIZING COMMON TRANSACTIONS (15 points) In January 4, 2019, five individuals set up a new corporation, Fortress Reconstruction Inc., to engage in the house renovation business. Following are some of the transactions made by the corporation during the year: a. Each individual contributed $5,000 for which each received 1000 shares of stock with a par value of $0.50 per share. b. Received saws, hammers and other building supplies worth $3,000 that had been purchased on credit from Stratus Building Supplies, payable in three months. c. Rented a small storage building where they paid $2,000 for past 6 months' rent and another $2,000 next 6 month's rent. d. Acquired a $15,000 loan from the bank, payable in five years. e. Completed a house renovation where customer paid $8,000, with another $4,000 payable in the next two months. f. Received $5,000 in advance payment from a customer whose renovation project will commence next year. ASSIGNMENT: For each transaction, state the journal entry (account and amount to be debited or credited) to be posted on the Accounting records.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the journal entries for each transaction a Each individual contributed 5000 for which each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started