Answered step by step

Verified Expert Solution

Question

1 Approved Answer

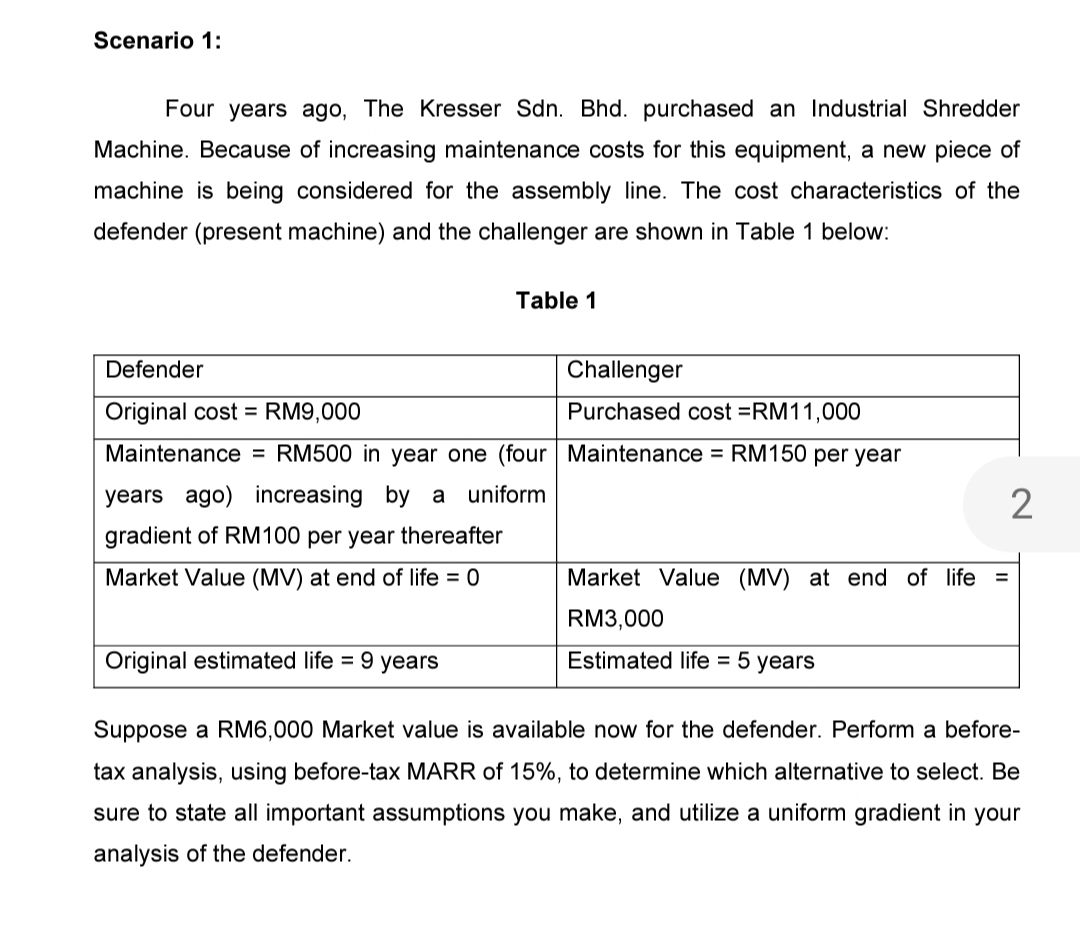

Scenario 1: Four years ago, The Kresser Sdn. Bhd. purchased an Industrial Shredder Machine. Because of increasing maintenance costs for this equipment, a new

Scenario 1: Four years ago, The Kresser Sdn. Bhd. purchased an Industrial Shredder Machine. Because of increasing maintenance costs for this equipment, a new piece of machine is being considered for the assembly line. The cost characteristics of the defender (present machine) and the challenger are shown in Table 1 below: Defender Original cost = RM9,000 Table 1 Maintenance = RM500 in year one (four years ago) increasing by a uniform gradient of RM100 per year thereafter Market Value (MV) at end of life = 0 Original estimated life = 9 years Challenger Purchased cost =RM11,000 Maintenance = RM150 per year 2 Market Value (MV) at end of life = RM3,000 Estimated life = 5 years Suppose a RM6,000 Market value is available now for the defender. Perform a before- tax analysis, using before-tax MARR of 15%, to determine which alternative to select. Be sure to state all important assumptions you make, and utilize a uniform gradient in your analysis of the defender.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started