Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Scenario 1. John invests $10,000 in a 3-year CD. The earning is 8% APR compounded monthly. (a) What is the payout when this CD matures?

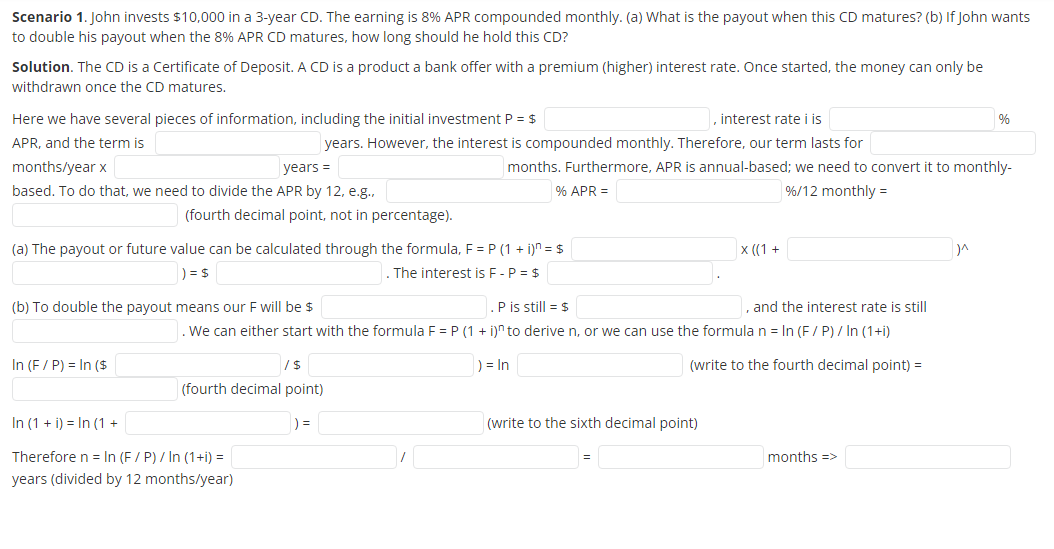

Scenario 1. John invests $10,000 in a 3-year CD. The earning is 8% APR compounded monthly. (a) What is the payout when this CD matures? (b) If John wants to double his payout when the 8% APR CD matures, how long should he hold this CD? Solution. The CD is a Certificate of Deposit. A CD is a product a bank offer with a premium (higher) interest rate. Once started, the money can only be withdrawn once the CD matures. Here we have several pieces of information, including the initial investment P=$ , interest rate i is % APR, and the term is months/year x years. However, the interest is compounded monthly. Therefore, our term lasts for based. To do that, we need to divide the APR by 12 , e.g., months. Furthermore, APR is annual-based; we need to convert it to monthly- (fourth decimal point, not in percentage). %APR= %/12 monthly = (a) The payout or future value can be calculated through the formula, F=P(1+i)n=$ x((1+ )=$ . The interest is FP=$ (b) To double the payout means our F will be $ P is still =$ , and the interest rate is still . We can either start with the formula F=P(1+i)n to derive n, or we can use the formula n=ln(F/P)/ln(1+i) ln(F/P)=ln($ ln(1+i)=ln(1+ /$ (fourth decimal point) )=ln )= Therefore n=ln(F/P)/ln(1+i)= years (divided by 12 months/year) (write to the sixth decimal point) =months

Scenario 1. John invests $10,000 in a 3-year CD. The earning is 8% APR compounded monthly. (a) What is the payout when this CD matures? (b) If John wants to double his payout when the 8% APR CD matures, how long should he hold this CD? Solution. The CD is a Certificate of Deposit. A CD is a product a bank offer with a premium (higher) interest rate. Once started, the money can only be withdrawn once the CD matures. Here we have several pieces of information, including the initial investment P=$ , interest rate i is % APR, and the term is months/year x years. However, the interest is compounded monthly. Therefore, our term lasts for based. To do that, we need to divide the APR by 12 , e.g., months. Furthermore, APR is annual-based; we need to convert it to monthly- (fourth decimal point, not in percentage). %APR= %/12 monthly = (a) The payout or future value can be calculated through the formula, F=P(1+i)n=$ x((1+ )=$ . The interest is FP=$ (b) To double the payout means our F will be $ P is still =$ , and the interest rate is still . We can either start with the formula F=P(1+i)n to derive n, or we can use the formula n=ln(F/P)/ln(1+i) ln(F/P)=ln($ ln(1+i)=ln(1+ /$ (fourth decimal point) )=ln )= Therefore n=ln(F/P)/ln(1+i)= years (divided by 12 months/year) (write to the sixth decimal point) =months Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started