Answered step by step

Verified Expert Solution

Question

1 Approved Answer

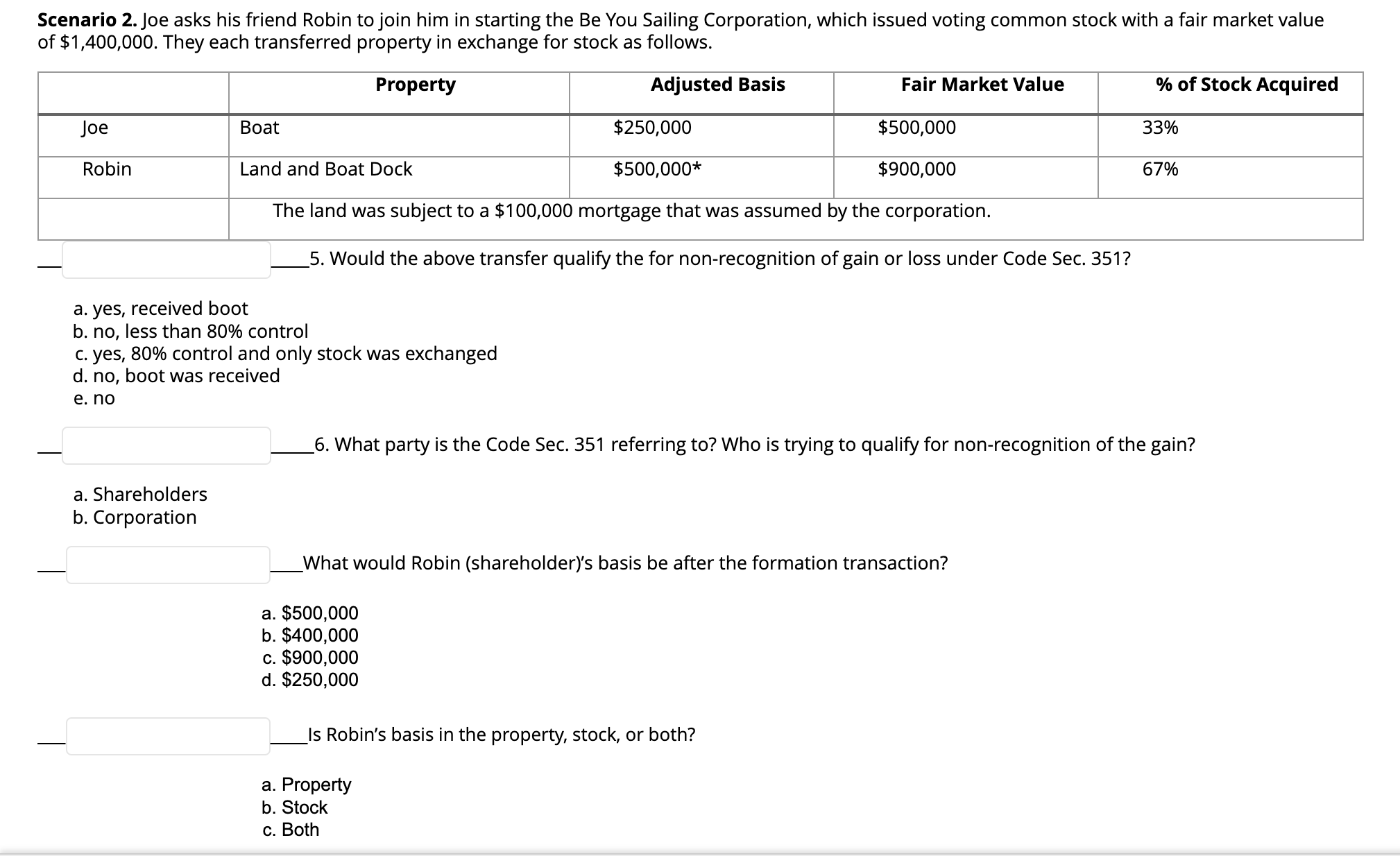

Scenario 2. Joe asks his friend Robin to join him in starting the Be You Sailing Corporation, which issued voting common stock with a

Scenario 2. Joe asks his friend Robin to join him in starting the Be You Sailing Corporation, which issued voting common stock with a fair market value of $1,400,000. They each transferred property in exchange for stock as follows. Property Joe Robin Boat Land and Boat Dock Adjusted Basis Fair Market Value % of Stock Acquired $250,000 $500,000* $500,000 33% $900,000 67% a. yes, received boot The land was subject to a $100,000 mortgage that was assumed by the corporation. b. no, less than 80% control 5. Would the above transfer qualify the for non-recognition of gain or loss under Code Sec. 351? c. yes, 80% control and only stock was exchanged d. no, boot was received e. no a. Shareholders _6. What party is the Code Sec. 351 referring to? Who is trying to qualify for non-recognition of the gain? b. Corporation What would Robin (shareholder)'s basis be after the formation transaction? a. $500,000 b. $400,000 c. $900,000 d. $250,000 _Is Robin's basis in the property, stock, or both? a. Property b. Stock c. Both

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Analysis of Be You Sailing Corporation Scenario 5 Would the above transfer qualify for nonrecognition of gain or loss under Code Sec 351 c yes 80 cont...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started