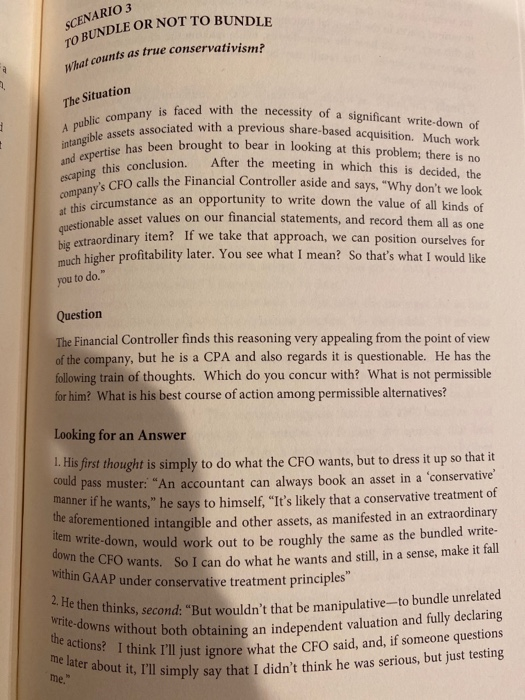

SCENARIO 3 TO BUNDLE ORN BUNDLE OR NOT TO BUND unts as true conservativism? What counts as to - The Situation TT A public company is faced wi intangible assets associated with and expertise has been escaping this conclusie company's CFO calls th at this circumstance as questionable asset valu faced with the necessity of a significant write down of inted with a previous share-based acquisition. Much work has been brought to bear in looking at this problem; there is no conclusion. After the meeting in which this is decided, the CFO calls the Financial Controller aside and says, "Why don't we look umstance as an opportunity to write down the value of all kinds of ble asset values on our financial statements, and record them all as one raordinary item? If we take that approach, we can position ourselves for Ich higher profitability later. You see what I mean? So that's what I would like you to do." Question The Financial Controller finds this reasoning very appealing from the point of view of the company, but he is a CPA and also regards it is questionable. He has the following train of thoughts. Which do you concur with? What is not permissible for him? What is his best course of action among permissible alternatives? Looking for an Answer 1. His first thought is simply to do what the CFO wants, but to dress it up so that it could pass muster: "An accountant can always book an asset in a 'conservative nner if he wants," he says to himself, "It's likely that a conservative treatment of aforementioned intangible and other assets, as manifested in an extraordinary -down, would work out to be roughly the same as the bundled write- wants. So I can do what he wants and still, in a sense, make it fall within GAAP under conservative treatment principles item write-down, would wo down the CFO wants. So I can 2. He then thinks, second: B write-downs without both obtain the actions? I think I'll justi mks, second: "But wouldn't that be manipulative-to bundle unrelated both obtaining an independent valuation and fully declaring ink I'll just ignore what the CFO said, and, if someone questions imply say that I didn't think he was serious, but just testing e later about it, I'll simply say that I didnt me