Question

Scenario (90 minutes) Printing Plus Inc. (PPI) is a small social enterprise that provides a variety of printing services. PPI provides hands-on job experience for

Scenario (90 minutes) Printing Plus Inc. (PPI) is a small social enterprise that provides a variety of printing services. PPI provides hands-on job experience for at-risk youth while also providing qu...

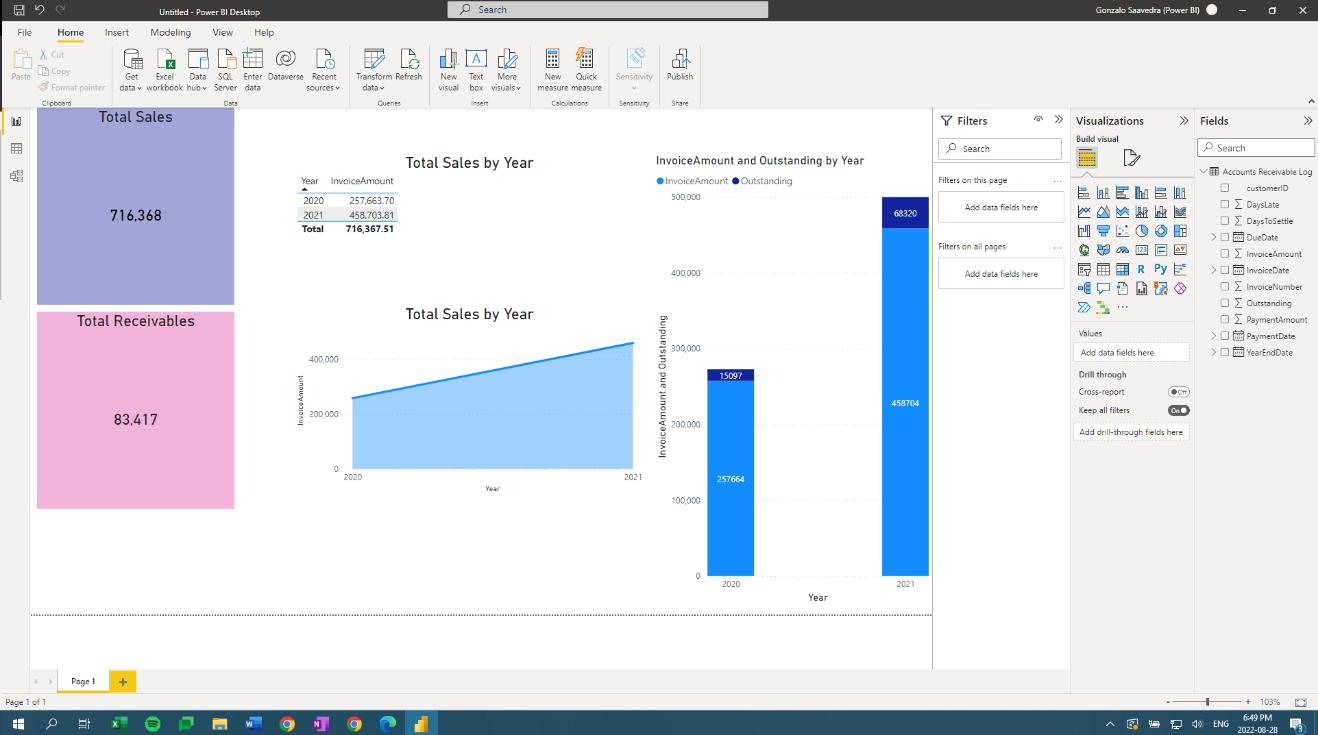

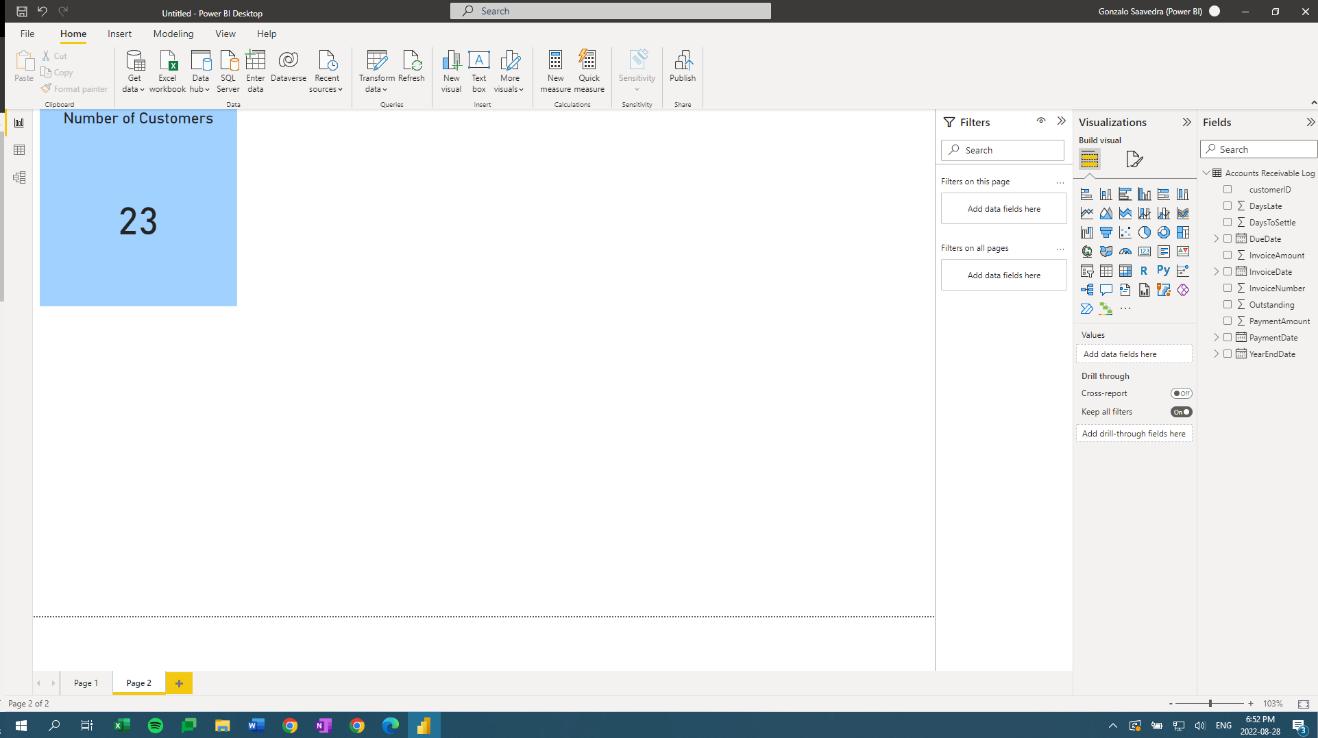

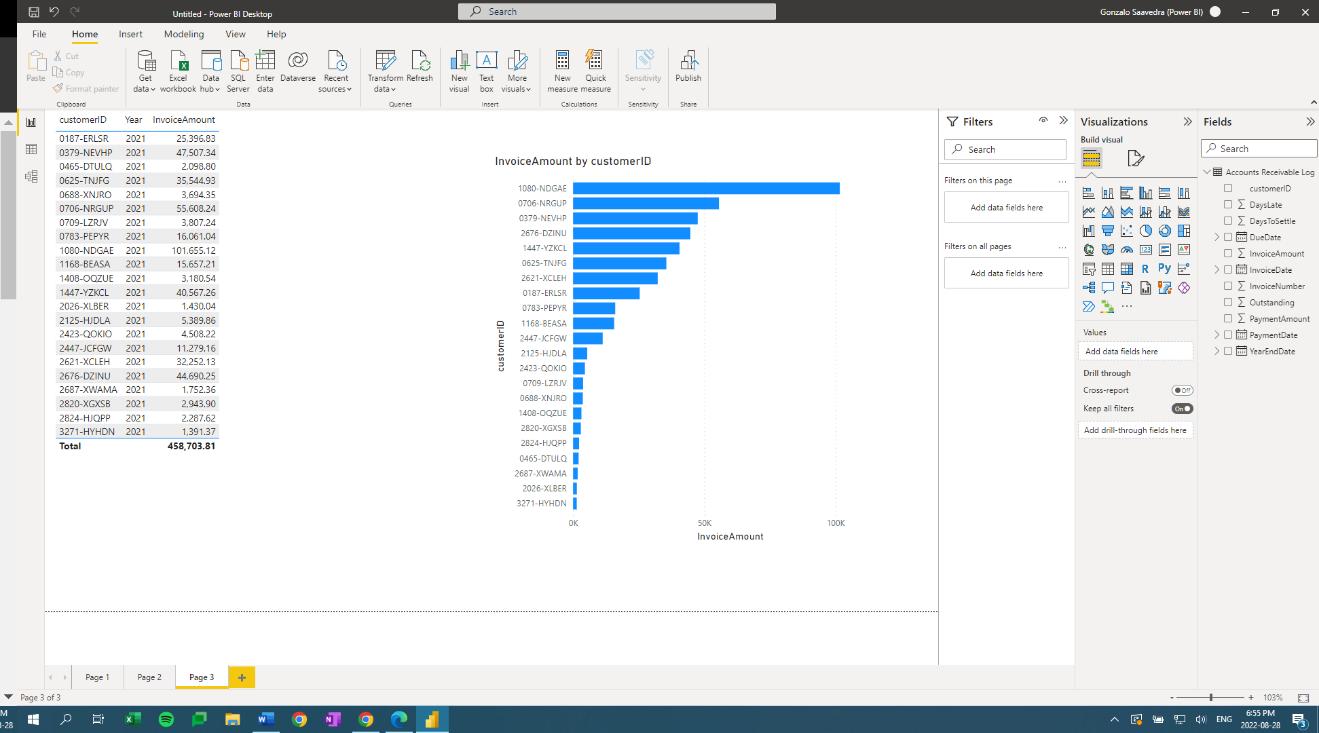

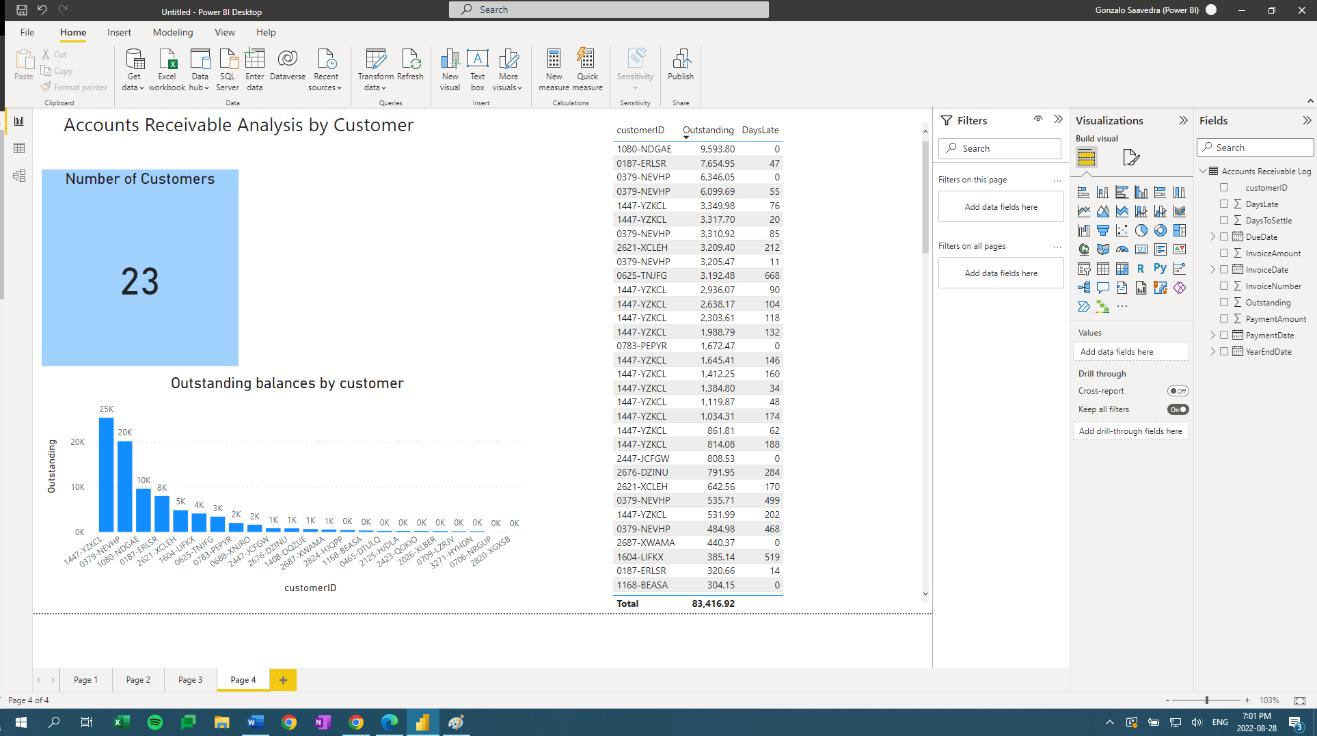

Printing Plus Inc. (PPI) is a small social enterprise that provides a variety of printing services. PPI provides hands-on job experience for at-risk youth while also providing quality products to the small-business community that it serves. It has a small, but loyal, customer base. PPI provides credit to its customers, with a 30-day payment term.

You, CPA, have just been assigned as the audit senior on the inaugural PPI audit for the period ended December 31, 2021. Previously, PPI had reviews completed by your firm. As the senior on the audit, you will be responsible for dealing with accounts where professional judgment is required, including accounts that require management estimation. The first account you are to analyze is the allowance for doubtful accounts.

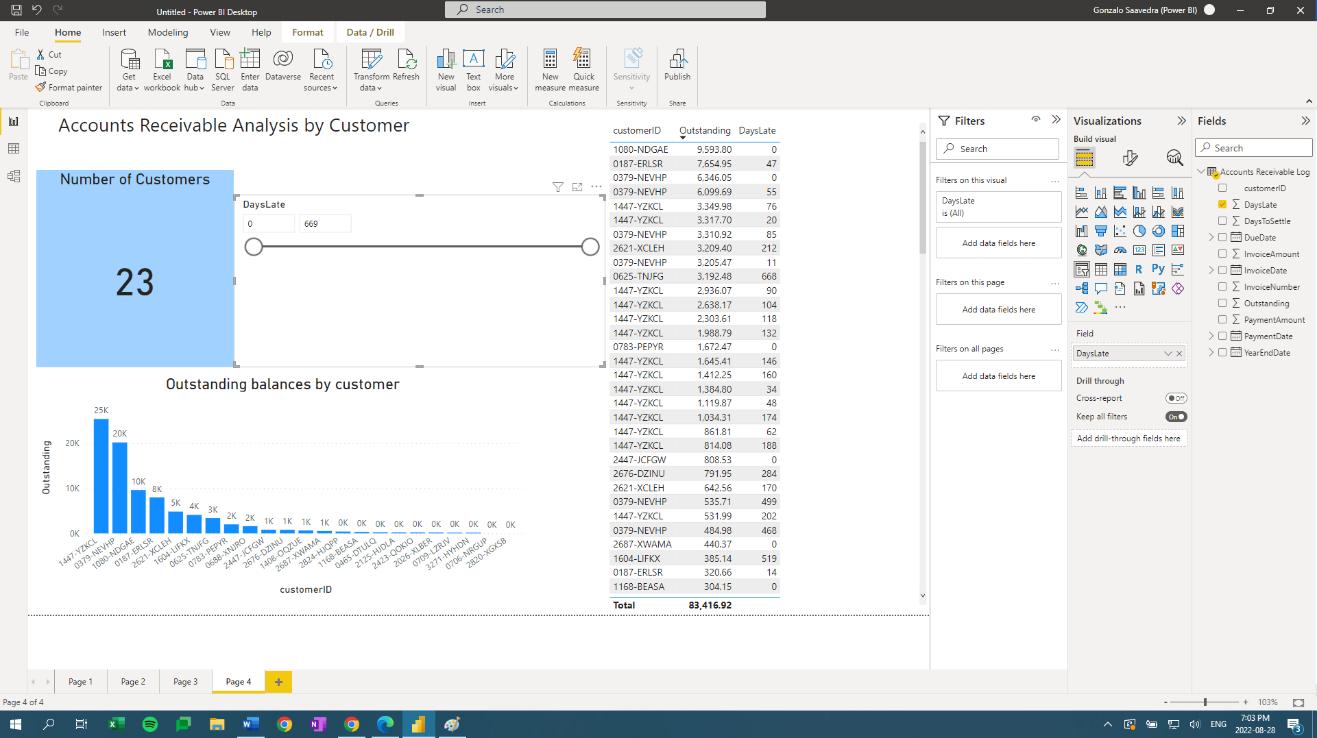

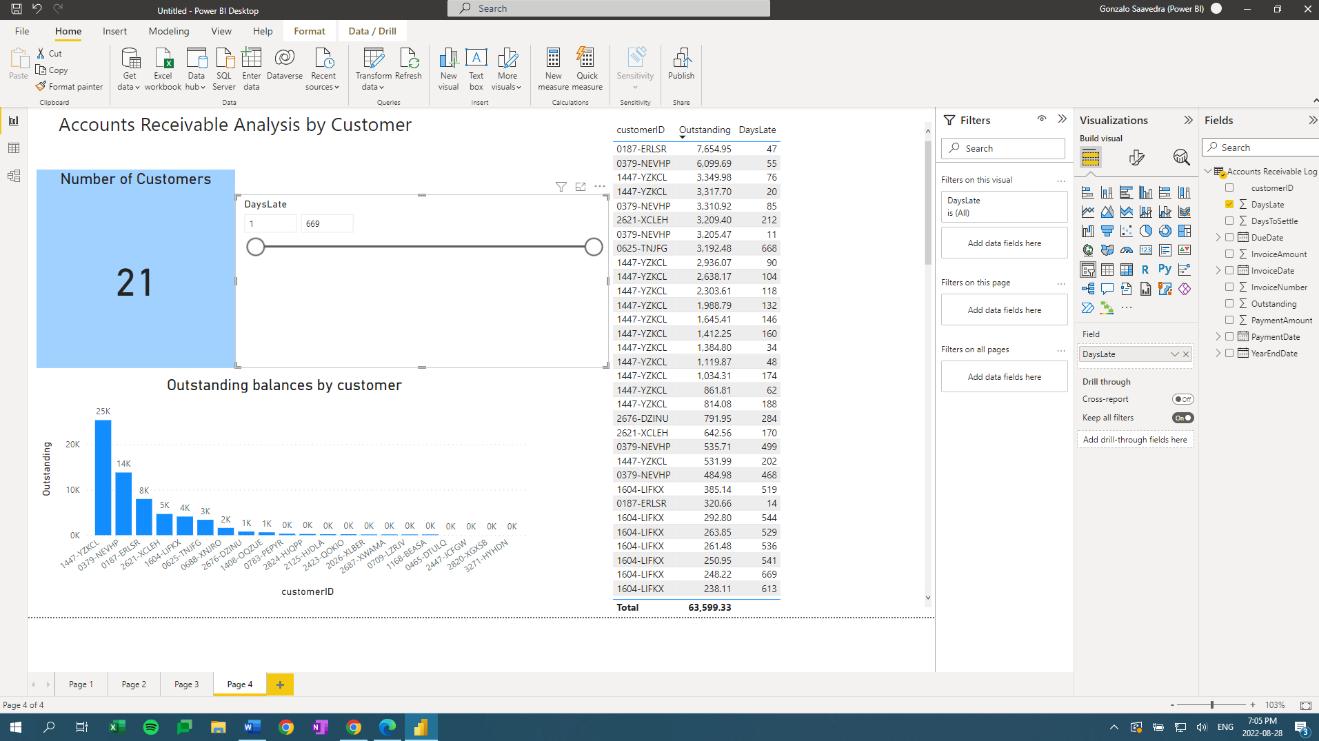

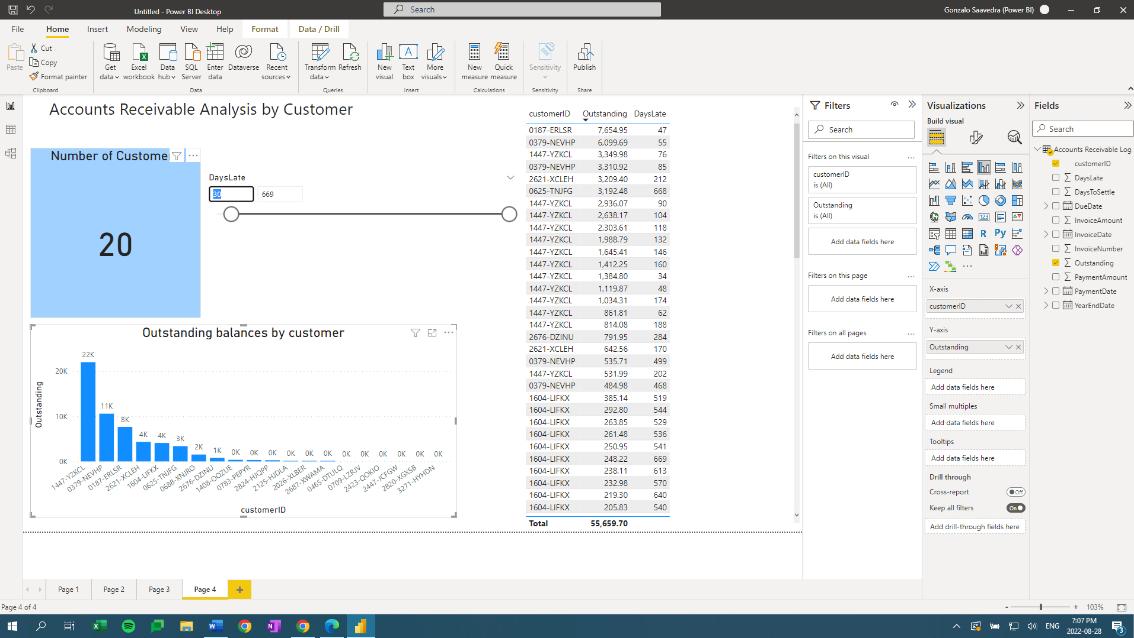

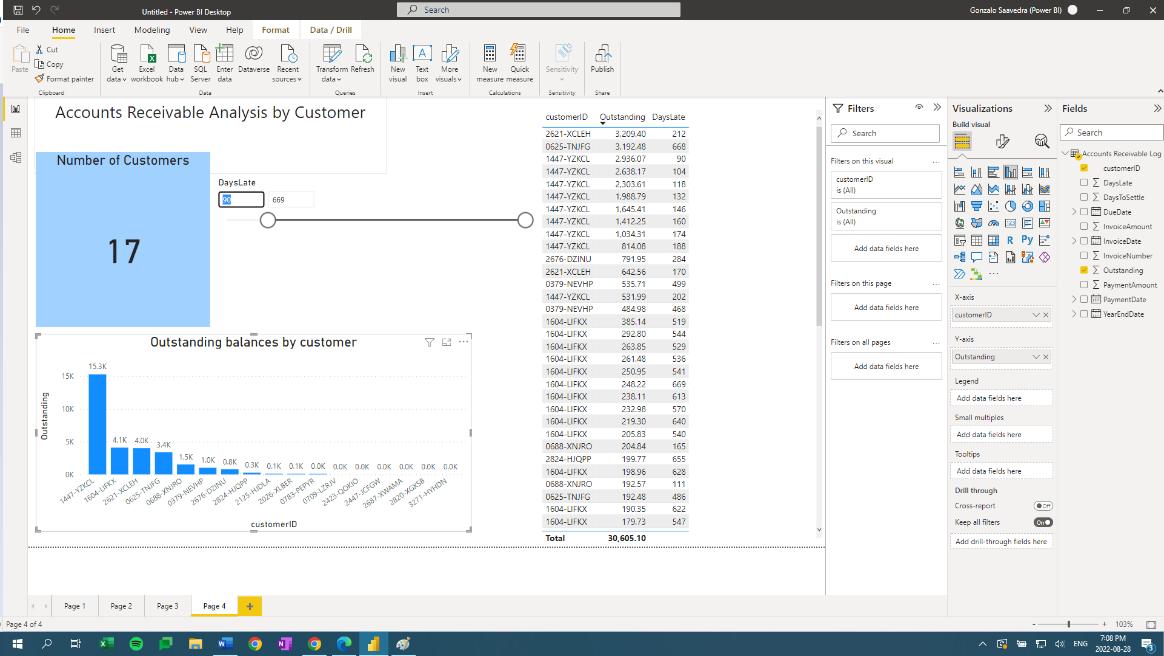

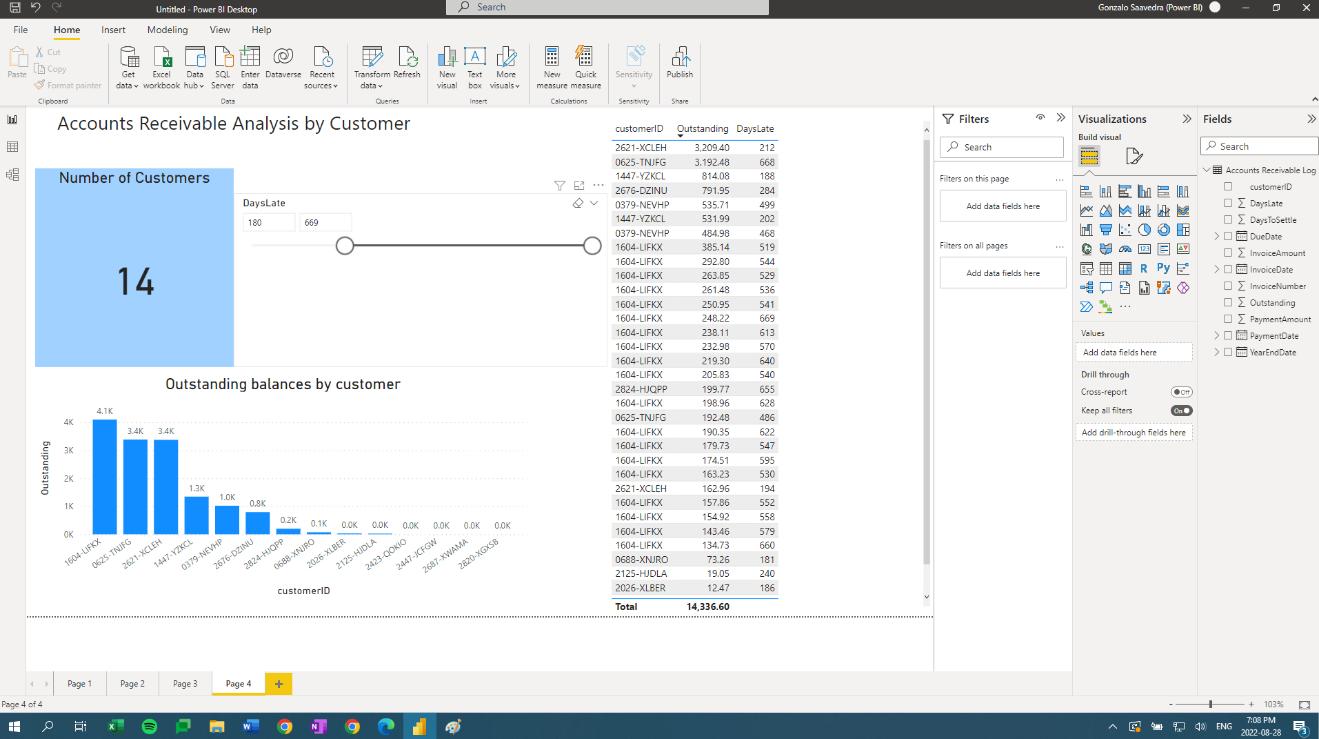

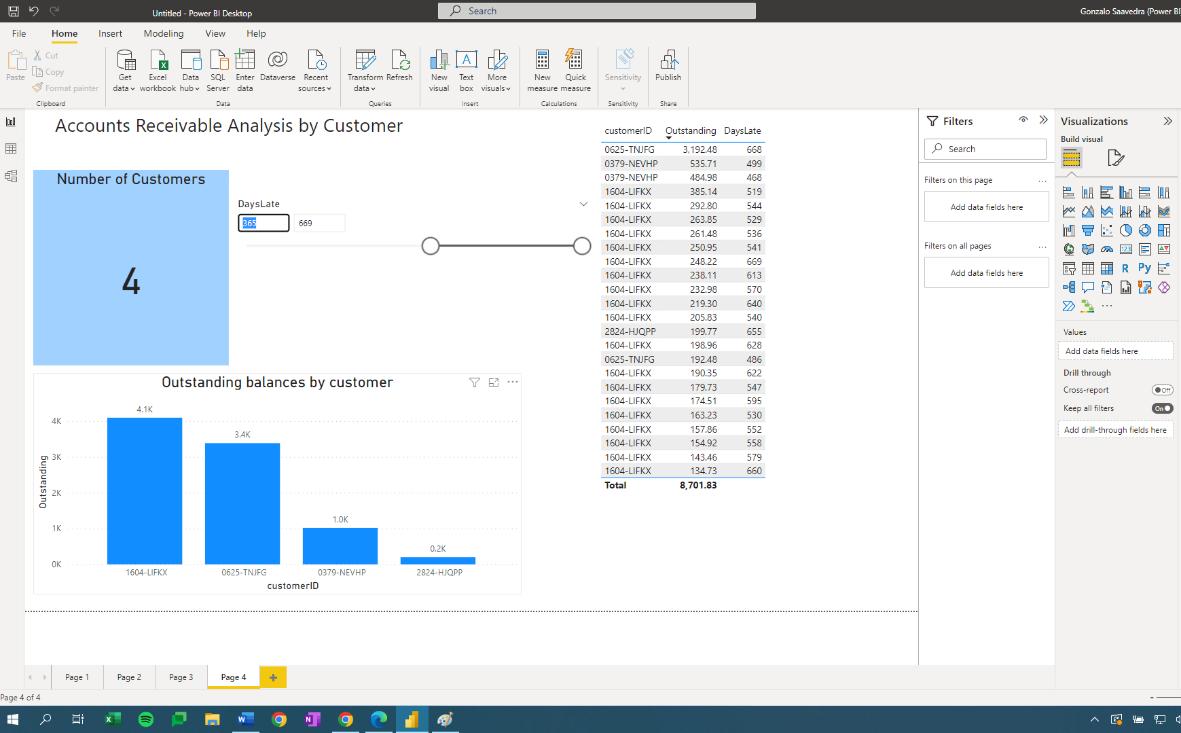

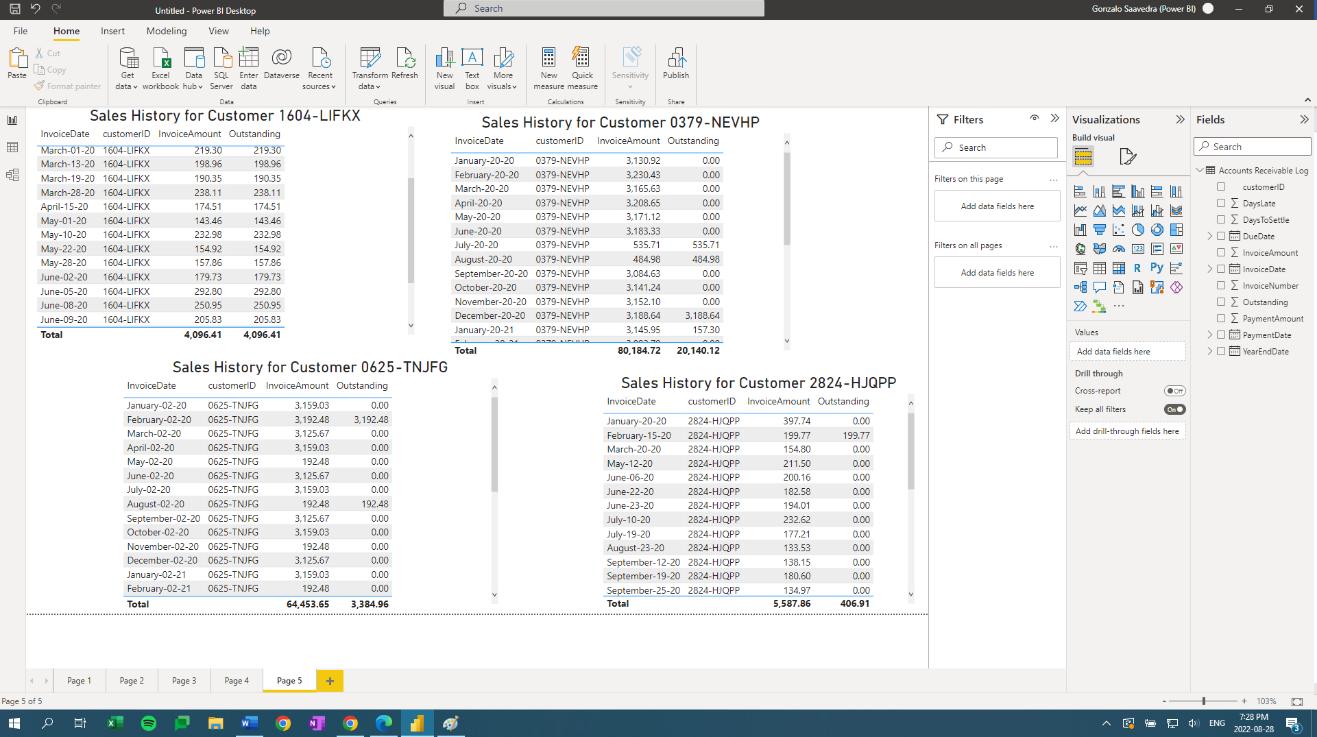

PPI has provided you with an electronic copy of its accounts receivable log for the past two years to help you determine if the allowance for doubtful accounts is appropriate. PPI's policy is to record an allowance equal to 3% of outstanding receivable balances at year end.

At December 31, 2020, PPI had outstanding receivable balances of $45,690 and recorded an allowance for doubtful accounts of $1,400.

At December 31, 2021, the balance in the allowance for doubtful accounts was $2,503.

Info:

I. ii.

ii. iii.

iii. iv.

iv. v.

v. vi.

vi. vii.

vii.

Info 2:

i. ii.

ii. iii.

iii. iv.

iv.

v.

Question 1:

Put together a memo to the audit partner on the appropriateness of the allowance for doubtful accounts using the information you have gathered above. The partner may wish to discuss the allowance with PPI's management, so be as specific as possible with your examples, and state any assumptions you have made in your analysis.

QUestion 2:

PPI's management has also asked for some guidance on best practices for data security and privacy when collecting and storing customer data. Put together a memo to the audit partner that she can share with PPI.

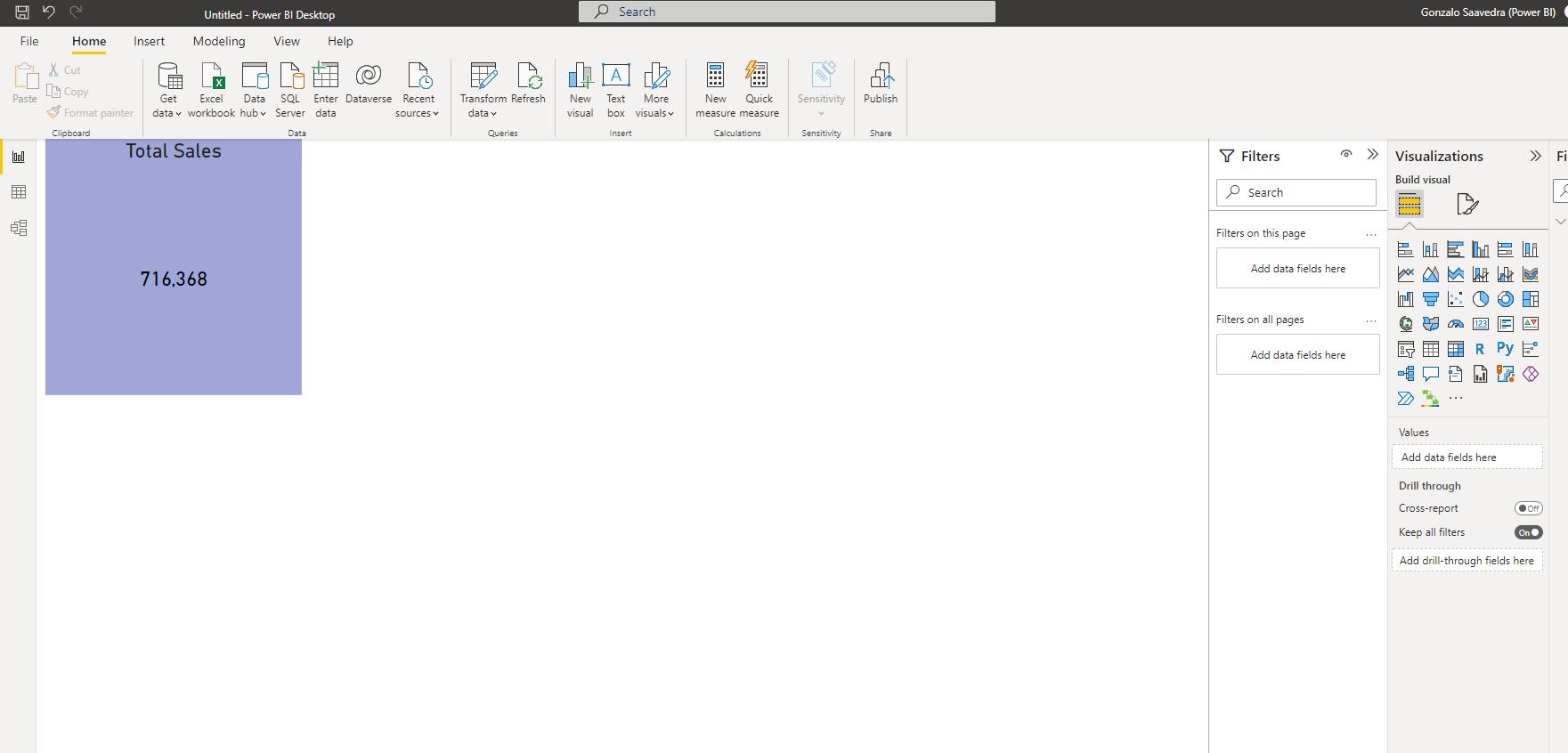

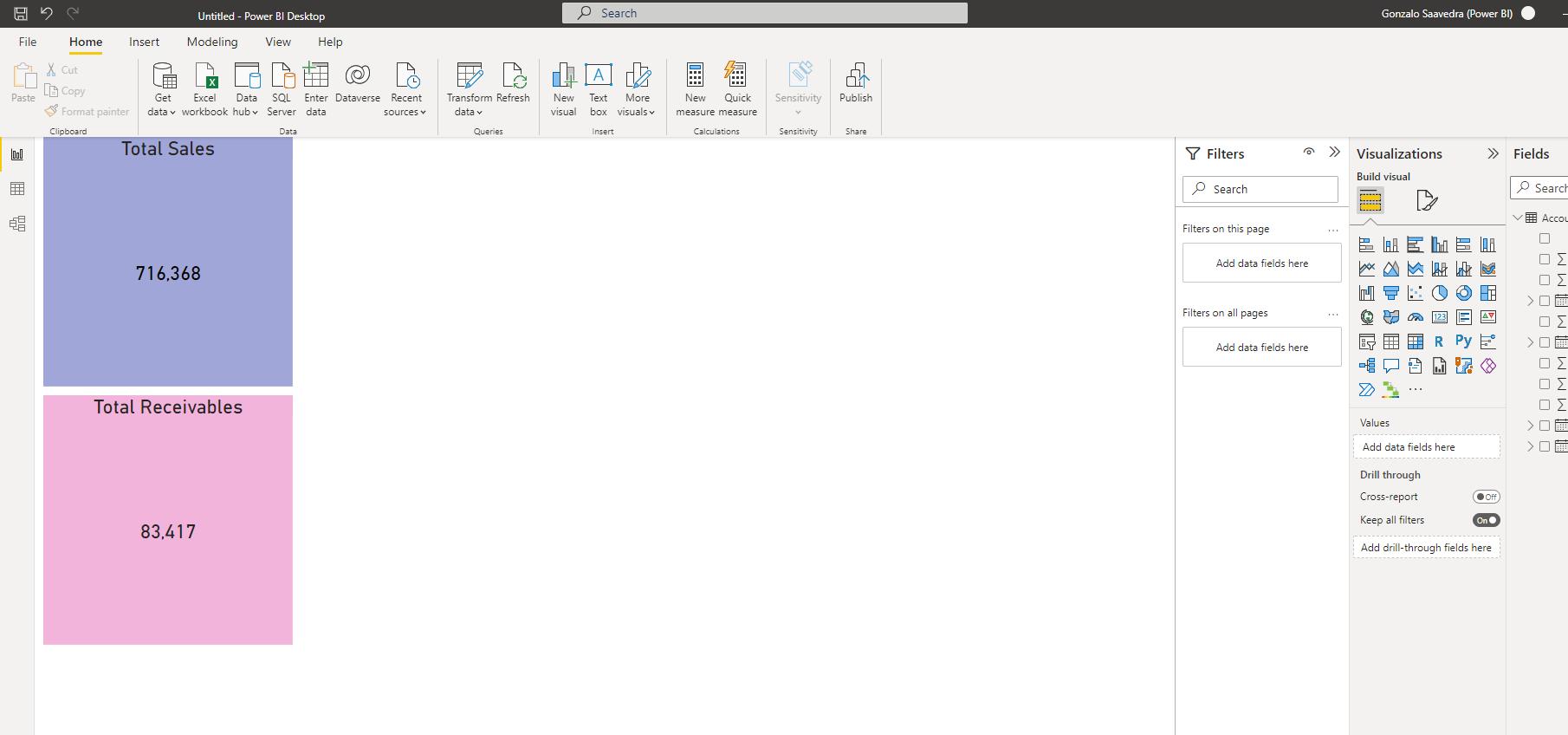

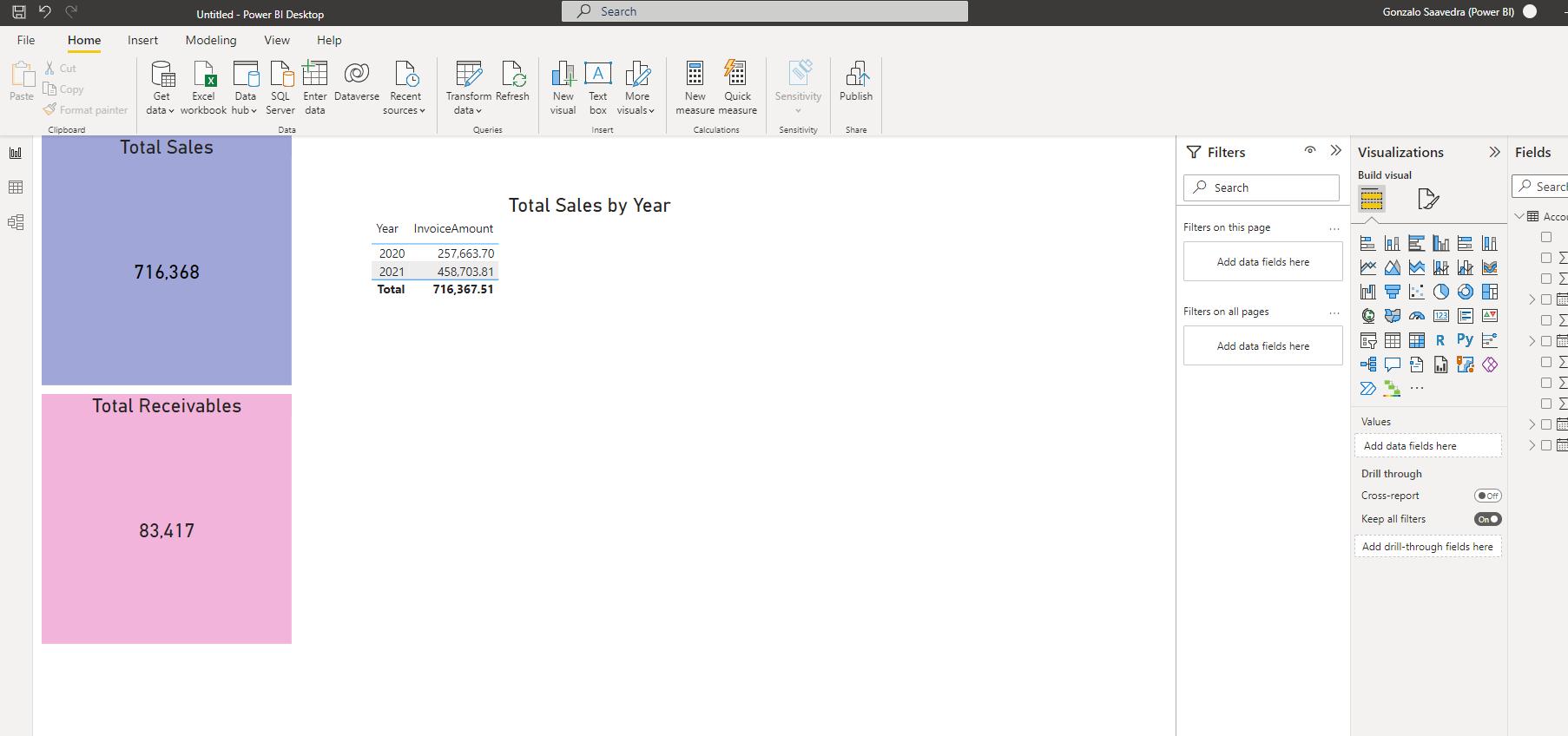

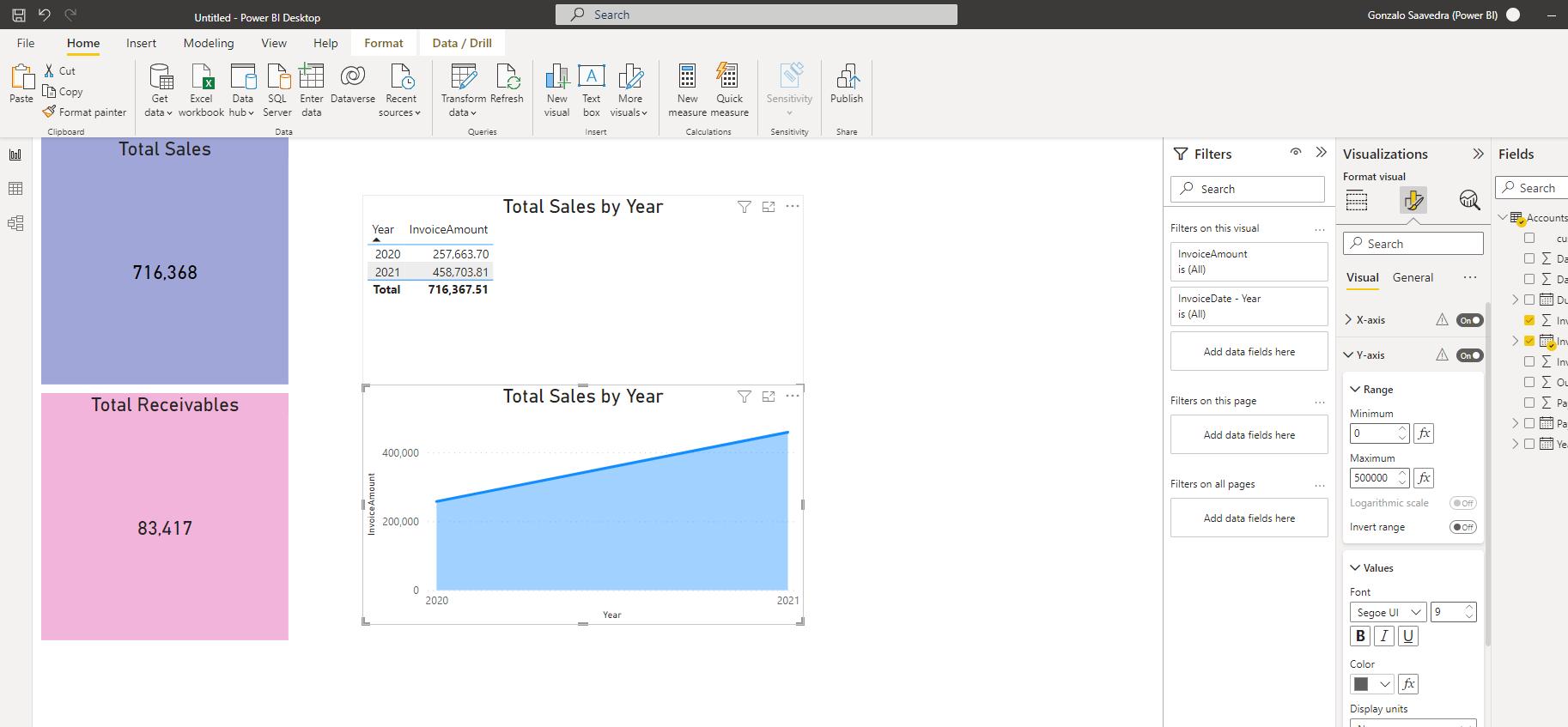

H Untitled - Power BI Desktop File Home Insert Modeling Cut View Help Search A sources Transform Refresh data New Text More visual box visuals Queries Insert Get Excel Data SQL Enter Dataverse Recent data workbook hub Server data Copy Paste Format painter Clipboard Total Sales 716,368 Data New Quick Sensitivity Publish measure measure Calculations Sensitivity Share Gonzalo Saavedra (Power BI) Filters >>> Visualizations >>> Fi Build visual Search Filters on this page Add data fields here Filters on all pages A Add data fields here ET + 1 = 1 4 E A Values Add data fields here Drill through Cross-report Keep all filters AV Off On Add drill-through fields here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Memo 1 Evaluation of the Allowance for Doubtful Accounts To Audit Partner From Your Name Audit Senior Date Insert Date Subject Evaluation of Allowance for Doubtful Accounts for Printing Plus Inc PPI O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started