Answered step by step

Verified Expert Solution

Question

1 Approved Answer

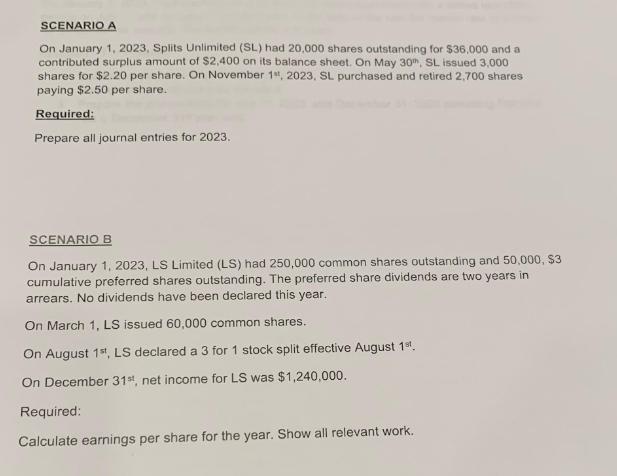

SCENARIO A On January 1, 2023, Splits Unlimited (SL) had 20,000 shares outstanding for $36,000 and a contributed surplus amount of $2,400 on its

SCENARIO A On January 1, 2023, Splits Unlimited (SL) had 20,000 shares outstanding for $36,000 and a contributed surplus amount of $2,400 on its balance sheet. On May 30, SL issued 3,000 shares for $2.20 per share. On November 1, 2023, SL purchased and retired 2,700 shares paying $2.50 per share. Required: Prepare all journal entries for 2023. SCENARIO B On January 1, 2023, LS Limited (LS) had 250,000 common shares outstanding and 50,000, $3 cumulative preferred shares outstanding. The preferred share dividends are two years in arrears. No dividends have been declared this year. On March 1, LS issued 60,000 common shares. On August 1st, LS declared a 3 for 1 stock split effective August 1st. On December 31st, net income for LS was $1,240,000. Required: Calculate earnings per share for the year. Show all relevant work.

Step by Step Solution

★★★★★

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION SCENARIO A Journal Entries for 2023 1 January 1 Balance Sheet Assets Cash 36000 Contributed Surplus 2400 Share Capital 20000 x 36000 720000 L...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started