Question

SCENARIO INFORMATION: Greg and Danielle Miller live with their children in Berrysburg, PA. Both enjoy good health and eyesight. Greg owns and operates a landscaping

SCENARIO INFORMATION:

Greg and Danielle Miller live with their children in Berrysburg, PA. Both enjoy good health and eyesight. Greg owns and operates a landscaping business and during winter months, when business is slow, he works as a substitute teacher. Danielle is a firefighter for the City of Harrisburg and is retired from the United States Army.

TAXPAYER INFORMATION

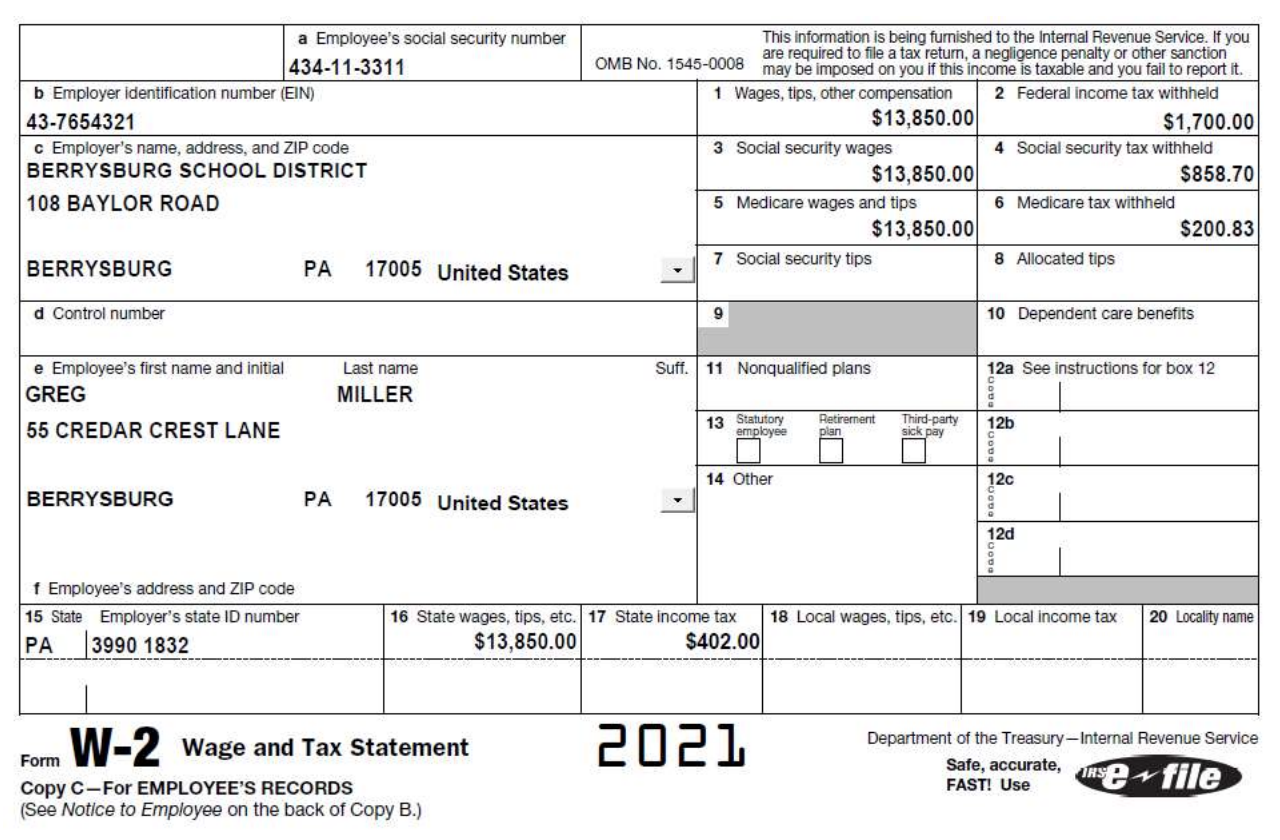

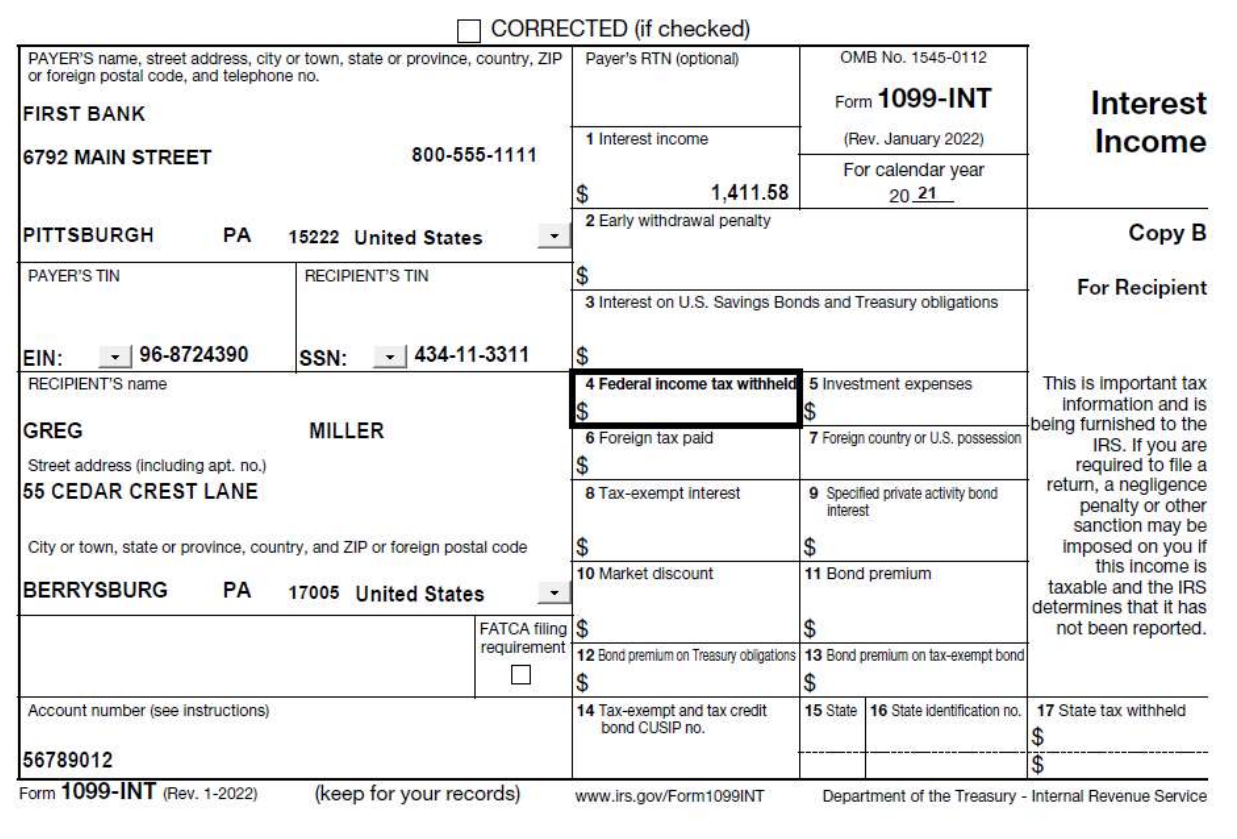

NAME: Greg Miller

SSN: 434113311

DATE OF BIRTH: 02221977

OCCUPATION: Landscaper

SPOUSE INFORMATION:

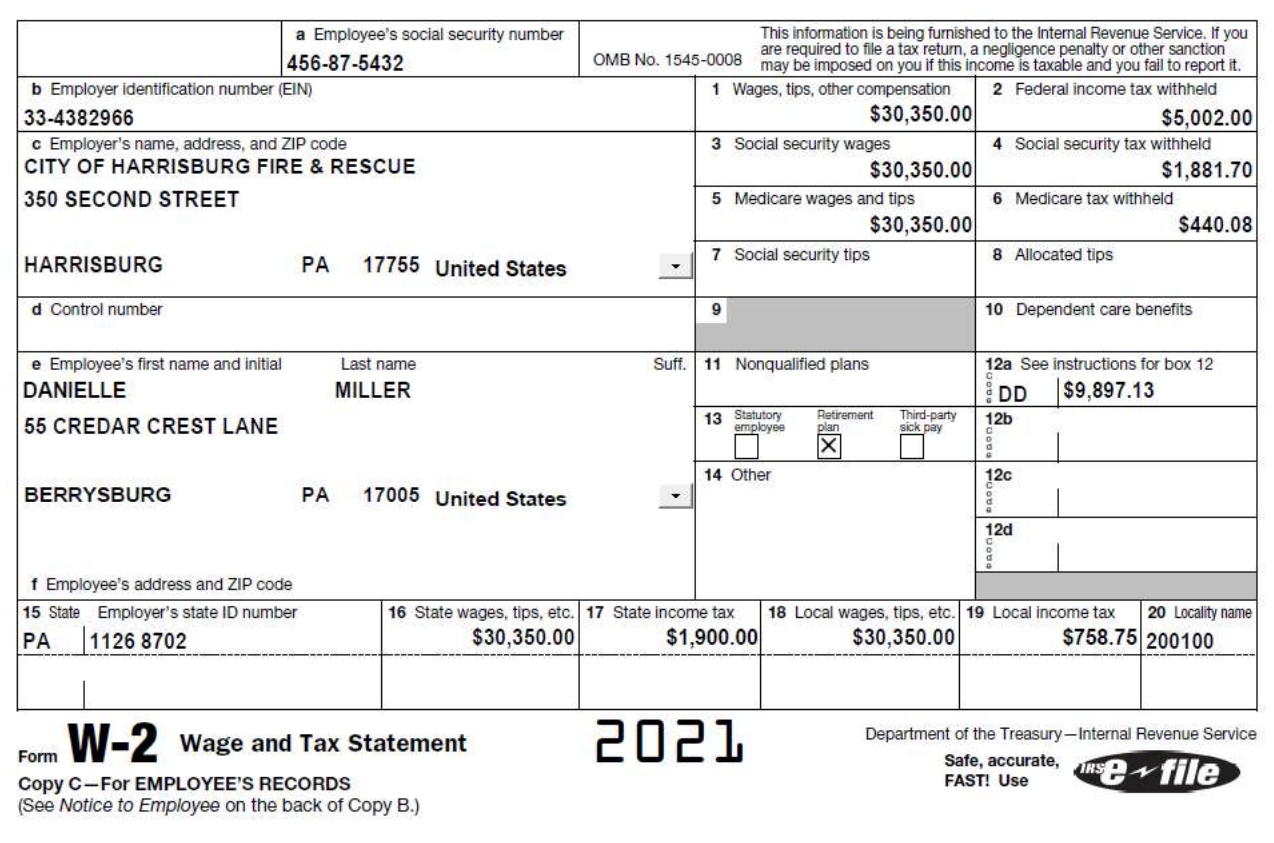

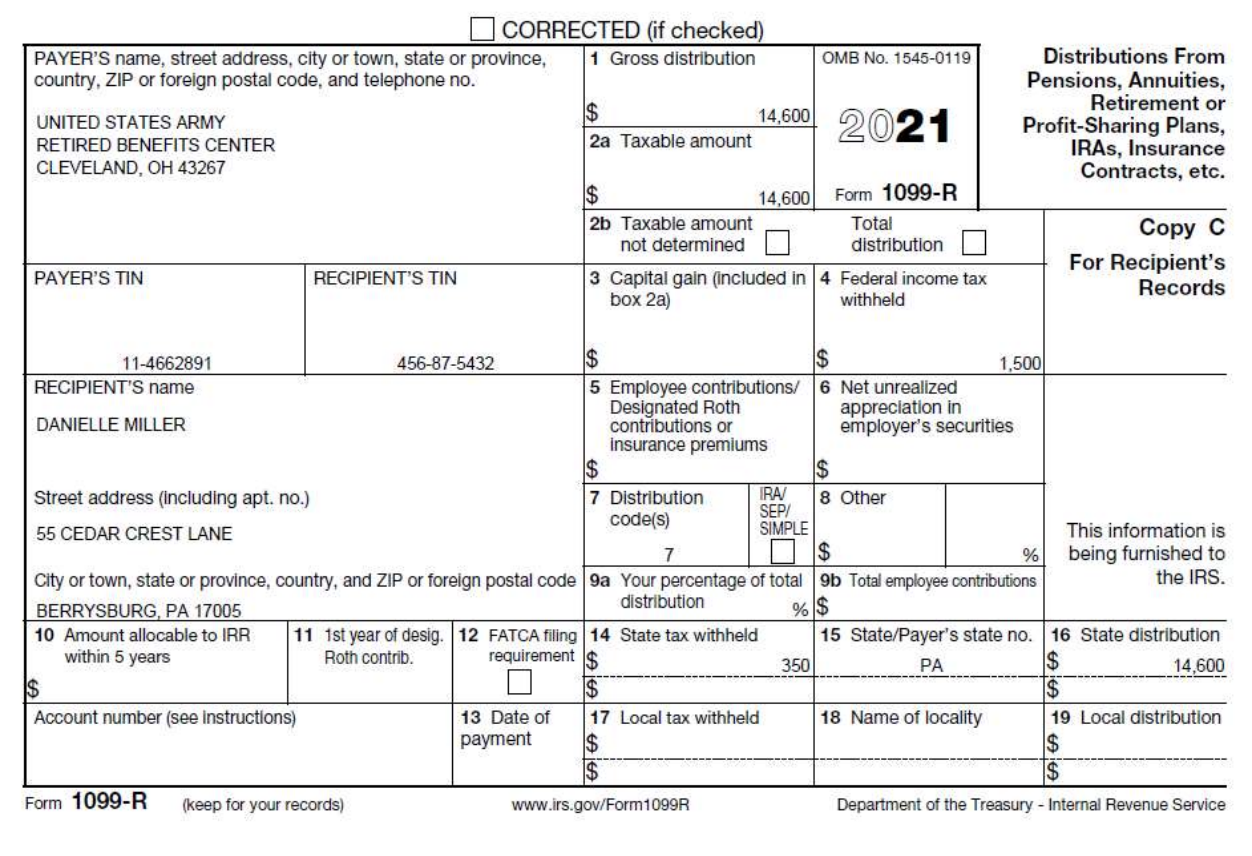

NAME: Danielle Miller

SSN: 456875432

DATE OF BIRTH: 05011978

OCCUPATION: Firefighter

Address: 55 Cedar Crest Lane, Berrysburg, PA 17005

DEPENDENT INFORMATION: 2

NAME: Colt Miller (son)

SSN: 598012345

DATE OF BIRTH: 12162016

NAME: Paige Miller (daughter)

SSN: 554332411

DATE OF BIRTH: 06122019

INCOME:

Gregs landscaping business is located at 907 Palm Drive, Berrysburg, PA 17005. The name of his business is By the Blade, and the taxpayer identification number is 959876556. Since you handle the bookkeeping for the business, you have printed the Income Statement from your accounting software. Travel costs are business related and do not include meals. The detail of the Meals and Entertainment Expenses account is as follows: Meals associated with business travel $ 400 Employee holiday party 300 Overtime meals for employees 100 Baseball tickets for entertaining large customers 600 $1,400

RENTAL PROPERTY:

Greg and Danielle own a condo and use it as rental property. The address is 108 Oak Terrace, Unit B, Harrisburg, PA 17111. The unit was purchased for $82,500 in 2004 and no significant improvements have been made to the property. Greg provides the management services for the property including the selection of tenants, maintenance, repairs, rent collection, and other services as needed. He spends approximately 2 hours per week on rental activity, on average. The revenues and expenses for the year are as follows: Rental income $ 14,000 Insurance 600 Interest expense 5,700 Property taxes 1,000 Miscellaneous expenses 700

MISCELLANEOUS DEDUCTIONS:

Greg and Danielle paid the following amounts during the year (by check): Political contributions $ 250 Church donations (attached) 5,025 Real estate taxes on their home 2,400 Mortgage interest for their home (attached) 10,105 Medical payments for doctors visits 700 Tax return preparation fees 350 Credit card interest 220 Auto insurance premiums 600 Uniforms for Danielle 125 State sales tax paid 1,076 Contribution to Danielles IRA 6,000

TAX DOCUMENTS:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started