Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jacob and Taylor Weaver, ages 45 and 42 respectively, are married and are filing jointly in 2019. They have three children, Ashley, age 9;

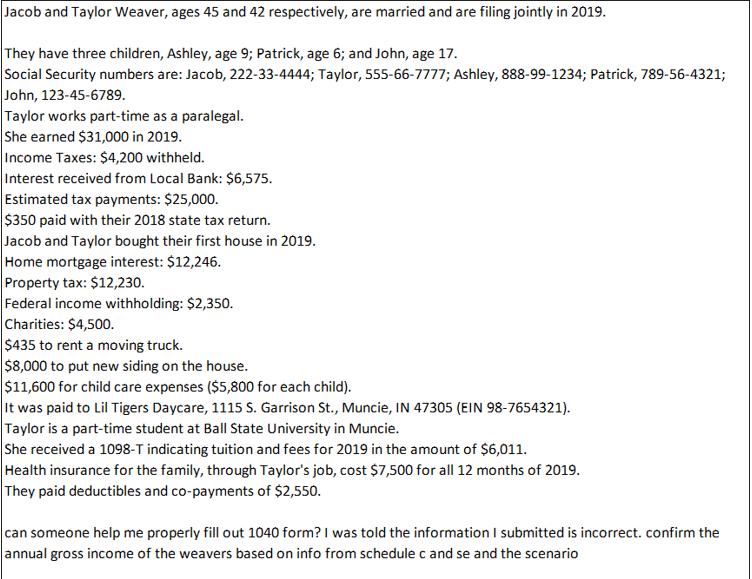

Jacob and Taylor Weaver, ages 45 and 42 respectively, are married and are filing jointly in 2019. They have three children, Ashley, age 9; Patrick, age 6; and John, age 17. Social Security numbers are: Jacob, 222-33-4444; Taylor, 555-66-7777; Ashley, 888-99-1234; Patrick, 789-56-4321; John, 123-45-6789. Taylor works part-time as a paralegal. She earned $31,000 in 2019. Income Taxes: $4,200 withheld. Interest received from Local Bank: $6,575. Estimated tax payments: $25,000. $350 paid with their 2018 state tax return. Jacob and Taylor bought their first house in 2019. Home mortgage interest: $12,246. Property tax: $12,230. Federal income withholding: $2,350. Charities: $4,500. $435 to rent a moving truck. $8,000 to put new siding on the house. $11,600 for child care expenses ($5,800 for each child). It was paid to Lil Tigers Daycare, 1115 S. Garrison St., Muncie, IN 47305 (EIN 98-7654321). Taylor is a part-time student at Ball State University in Muncie. She received a 1098-T indicating tuition and fees for 2019 in the amount of $6,011. Health insurance for the family, through Taylor's job, cost $7,500 for all 12 months of 2019. They paid deductibles and co-payments of $2,550. can someone help me properly fill out 1040 form? I was told the information I submitted is incorrect. confirm the annual gross income of the weavers based on info from schedule c and se and the scenario

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Jacob and Taylor Weaver ages 45 and 42 respectively are married and are filing jointly in 2019 They ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started