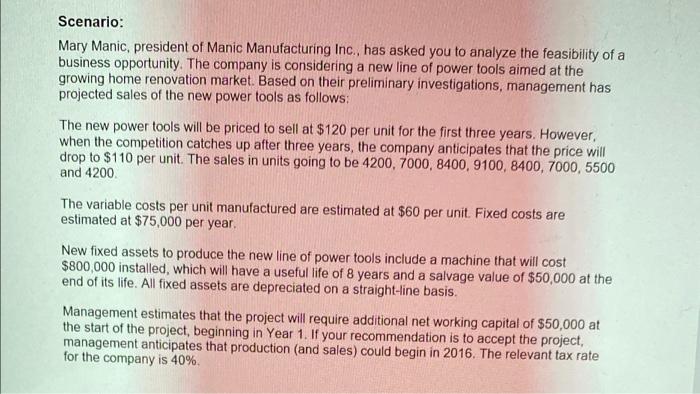

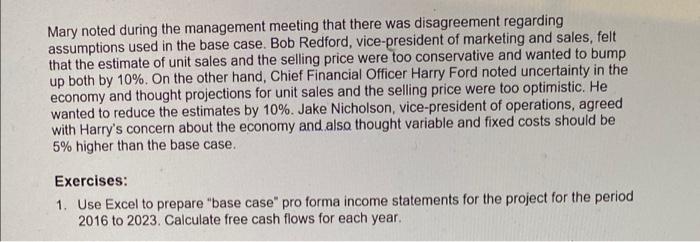

Scenario: Mary Manic, president of Manic Manufacturing Inc., has asked you to analyze the feasibility of a business opportunity. The company is considering a new line of power tools aimed at the growing home renovation market. Based on their preliminary investigations, management has projected sales of the new power tools as follows: The new power tools will be priced to sell at $120 per unit for the first three years. However, when the competition catches up after three years, the company anticipates that the price will drop to $110 per unit. The sales in units going to be 4200, 7000, 8400, 9100, 8400, 7000, 5500 and 4200 The variable costs per unit manufactured are estimated at $60 per unit. Fixed costs are estimated at $75,000 per year. New fixed assets to produce the new line of power tools include a machine that will cost $800,000 installed, which will have a useful life of 8 years and a salvage value of $50,000 at the end of its life. All fixed assets are depreciated on a straight-line basis. Management estimates that the project will require additional net working capital of $50,000 at the start of the project, beginning in Year 1. If your recommendation is to accept the project, management anticipates that production (and sales) could begin in 2016. The relevant tax rate for the company is 40%. Mary noted during the management meeting that there was disagreement regarding assumptions used in the base case. Bob Redford, vice-president of marketing and sales, felt that the estimate of unit sales and the selling price were too conservative and wanted to bump up both by 10%. On the other hand, Chief Financial Officer Harry Ford noted uncertainty in the economy and thought projections for unit sales and the selling price were too optimistic. He wanted to reduce the estimates by 10%. Jake Nicholson, vice-president of operations, agreed with Harry's concern about the economy and also thought variable and fixed costs should be 5% higher than the base case. Exercises: 1. Use Excel to prepare "base case" pro forma income statements for the project for the period 2016 to 2023. Calculate free cash flows for each year