Question

Scenario Question In March 2010, McDonald's Corp. announced a policy to increase summer sales by selling all soft drinks, no matter the size, for $1.00.

Scenario Question

In March 2010, McDonald's Corp. announced a policy to increase summer sales by selling all soft drinks, no matter the size, for $1.00. The policy would run for 150 days starting after Memorial Day. The $1.00 drink prices were a discount from the suggested price of $1.39 for a large soda. Some franchisees worried that discounting drinks, whose sales compensate for discounts on other products, could hurt overall profits, especially if customers bought other items from the Dollar Menu. McDonald's managers expected this promotion would draw customers from other fast-food chains and from convenience stores such as 7-Eleven. Additional customers would also help McDonald's push its new beverage lineup that included smoothies and frappes. Discounted drinks did cut into McDonald's coffee sales in previous years as some customers chose the drinks rather than pricier espresso beverages. Other chains with new drink offerings, such as Burger King and Taco Bell, could face pressure from the $1.00 drinks at McDonald's

Question:

a.) Given the change in price for a large soda from $1.39 to $1.00, how much would quantity demanded have to increase for McDonald's revenues to increase? ( Use the arc elasticity formula for any percentage change calculations.)

b.) What is the sign of the implied cross-price elasticity with drinks from McDonald's competitors?

c.) What are the other benefits and costs to McDonald's of this discount drink policy?

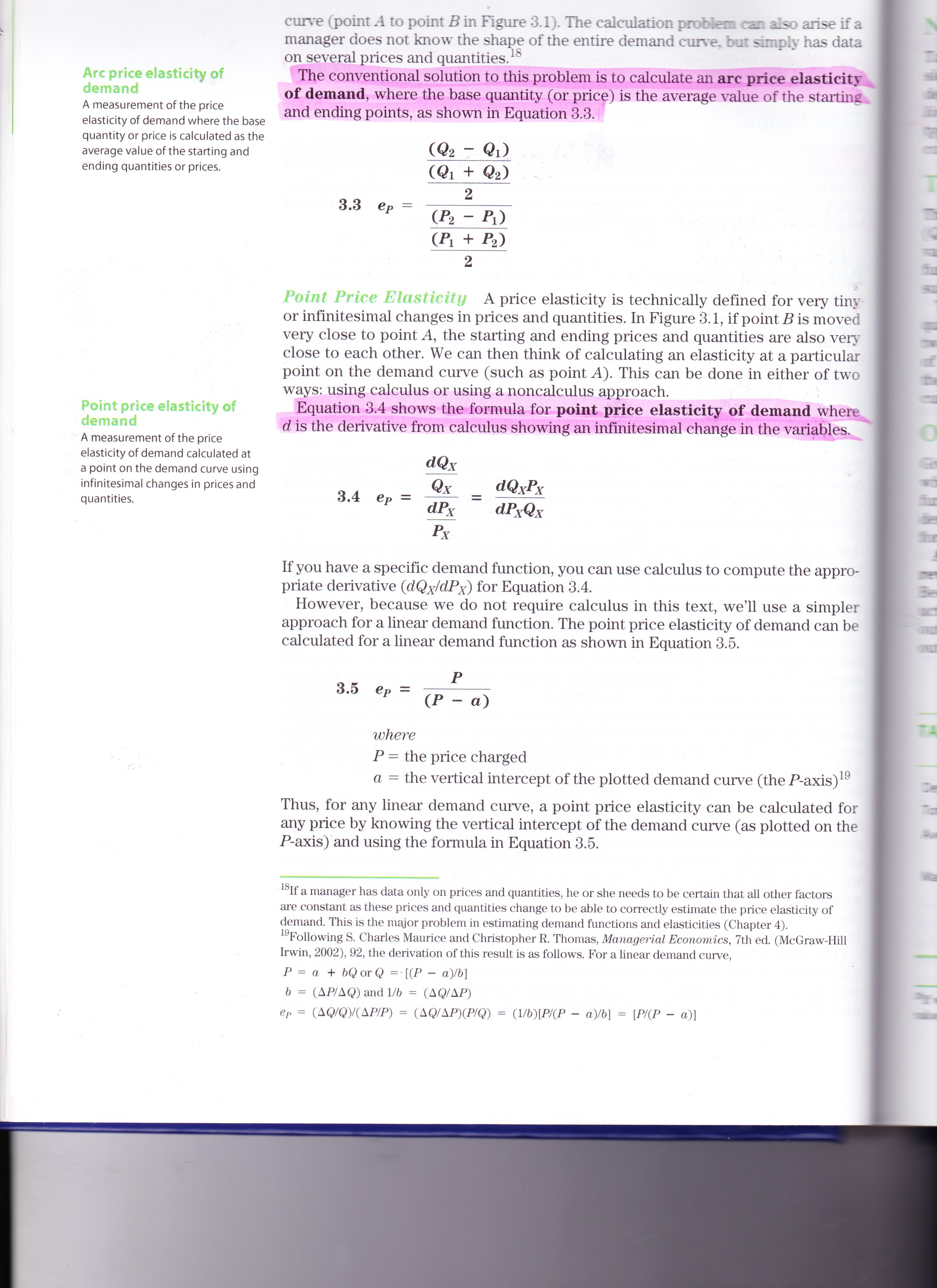

These are the formulas: arc elasticity formula (Top)

point price elasticity (Bottom)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started