Answered step by step

Verified Expert Solution

Question

1 Approved Answer

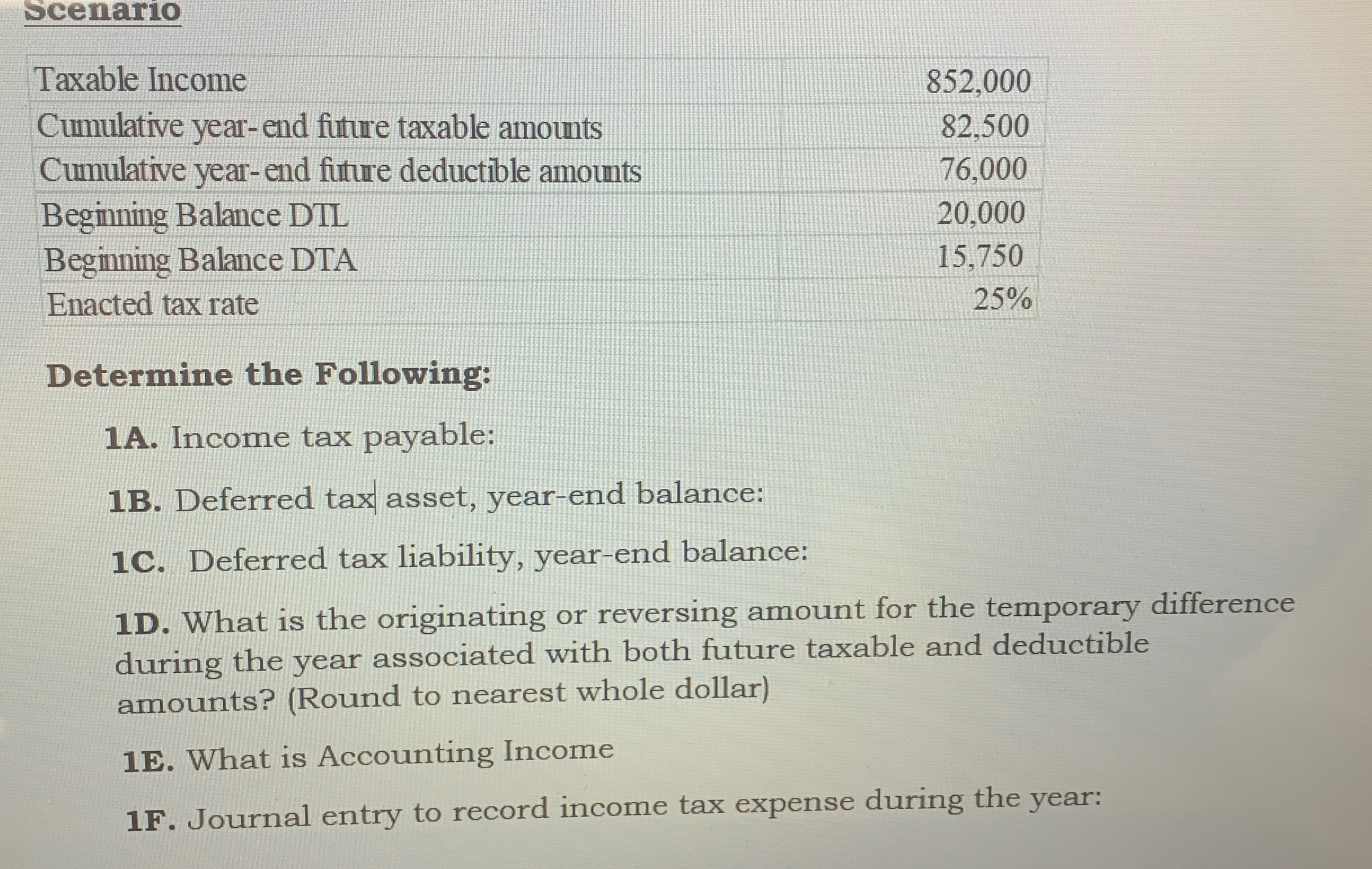

Scenario Taxable Income 852,000 Cumulative year-end future taxable amounts 82.500 Cumulative year-end future deductible amounts 76,000 Beginning Balance DTL 20.000 Beginning Balance DTA 15.750

Scenario Taxable Income 852,000 Cumulative year-end future taxable amounts 82.500 Cumulative year-end future deductible amounts 76,000 Beginning Balance DTL 20.000 Beginning Balance DTA 15.750 Enacted tax rate 25% Determine the Following: 1A. Income tax payable: 1B. Deferred tax asset, year-end balance: 1C. Deferred tax liability, year-end balance: 1D. What is the originating or reversing amount for the temporary difference during the year associated with both future taxable and deductible amounts? (Round to nearest whole dollar) 1E. What is Accounting Income 1F. Journal entry to record income tax expense during the year:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1A Income tax payable can be computed as Taxable Income Enacted Tax Rate Substituting the values Inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66426f5dc5ff2_980585.pdf

180 KBs PDF File

66426f5dc5ff2_980585.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started