Answered step by step

Verified Expert Solution

Question

1 Approved Answer

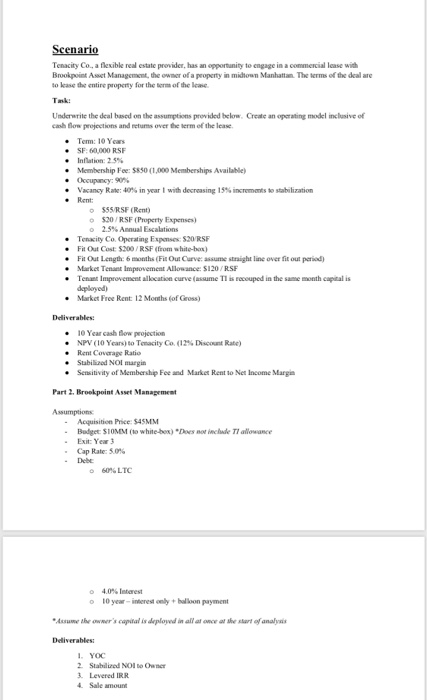

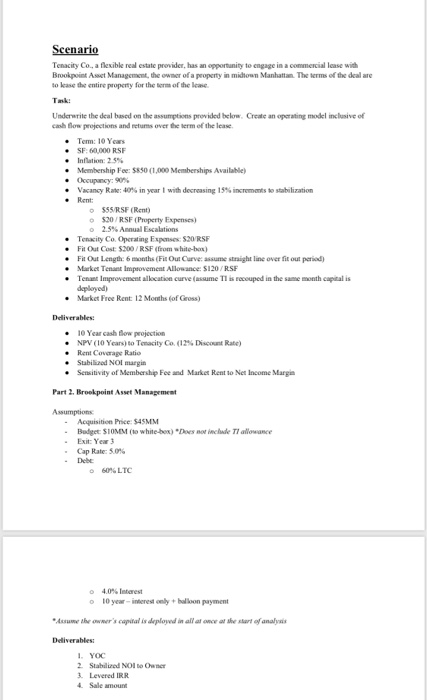

Scenario Tenacity Co., a flexible real estate provider, has an opportunity to engage in a commercial lease widh Brookpoint Asset Management, the owner of a

Scenario Tenacity Co., a flexible real estate provider, has an opportunity to engage in a commercial lease widh Brookpoint Asset Management, the owner of a property in midtown Manhattan The terms of the deal are to kease the entire property for the term of the lease Tak: Underwrite the deal based on the assumptions provided below. Create an operating model inclusive of cash Blow projections and retums over the term of the lease Tem: 10 Yeas SF: 60,000 RSF Inflation: 2.5% Membership Fee: $850 (1,000 Memberships Available) Occupancy: 90% Vacancy Rate: 40% in year I with decreasing 15% increments to stabilization Rent: $55/RSF (Rent) o$20/RSF (Property Expenses) o2.5 % Annual Escalations Tenacity Co. Operating Expenses: $20/RSF Fit Out Cost $200/RSF (from white-box) Fit Out Length: 6 months (Fit Out Curve: assume straight line over fit out period) Market Tenant Impsovement Allowance: $120/RSF Tenant Improvement allocation curve (assume TI is recouped in the same month capital is daplayed) Market Free Rent 12 Months (of Gross) Deliverables 10 Year cash dow projection NPV (10 Years) to Temacity Co. (12% Discount Rate) Rent Covarage Ratio Stabilized NOl margin Sensitivity of Membership Fee and Market Rent to Net Income Margin Part 2. Brookpoint Asset Management Assumptions Acquisition Price: $45MM Bodget $10MM (to white-bex) "Does not include TI allowance Exit: Year 3 Cap Rate: 5.0% Debe o 60% LTC o 4.0% Intgrest o10 year-interest only + baloon payment Aume the owner's capital is deploved in all at once at she start of analysis Deliverables 1. YOC 2 Stabilized NOI to Owner 3. Levered IRR 4. Sale amount Scenario Tenacity Co., a flexible real estate provider, has an opportunity to engage in a commercial lease widh Brookpoint Asset Management, the owner of a property in midtown Manhattan The terms of the deal are to kease the entire property for the term of the lease Tak: Underwrite the deal based on the assumptions provided below. Create an operating model inclusive of cash Blow projections and retums over the term of the lease Tem: 10 Yeas SF: 60,000 RSF Inflation: 2.5% Membership Fee: $850 (1,000 Memberships Available) Occupancy: 90% Vacancy Rate: 40% in year I with decreasing 15% increments to stabilization Rent: $55/RSF (Rent) o$20/RSF (Property Expenses) o2.5 % Annual Escalations Tenacity Co. Operating Expenses: $20/RSF Fit Out Cost $200/RSF (from white-box) Fit Out Length: 6 months (Fit Out Curve: assume straight line over fit out period) Market Tenant Impsovement Allowance: $120/RSF Tenant Improvement allocation curve (assume TI is recouped in the same month capital is daplayed) Market Free Rent 12 Months (of Gross) Deliverables 10 Year cash dow projection NPV (10 Years) to Temacity Co. (12% Discount Rate) Rent Covarage Ratio Stabilized NOl margin Sensitivity of Membership Fee and Market Rent to Net Income Margin Part 2. Brookpoint Asset Management Assumptions Acquisition Price: $45MM Bodget $10MM (to white-bex) "Does not include TI allowance Exit: Year 3 Cap Rate: 5.0% Debe o 60% LTC o 4.0% Intgrest o10 year-interest only + baloon payment Aume the owner's capital is deploved in all at once at she start of analysis Deliverables 1. YOC 2 Stabilized NOI to Owner 3. Levered IRR 4. Sale amount

Scenario Tenacity Co., a flexible real estate provider, has an opportunity to engage in a commercial lease widh Brookpoint Asset Management, the owner of a property in midtown Manhattan The terms of the deal are to kease the entire property for the term of the lease Tak: Underwrite the deal based on the assumptions provided below. Create an operating model inclusive of cash Blow projections and retums over the term of the lease Tem: 10 Yeas SF: 60,000 RSF Inflation: 2.5% Membership Fee: $850 (1,000 Memberships Available) Occupancy: 90% Vacancy Rate: 40% in year I with decreasing 15% increments to stabilization Rent: $55/RSF (Rent) o$20/RSF (Property Expenses) o2.5 % Annual Escalations Tenacity Co. Operating Expenses: $20/RSF Fit Out Cost $200/RSF (from white-box) Fit Out Length: 6 months (Fit Out Curve: assume straight line over fit out period) Market Tenant Impsovement Allowance: $120/RSF Tenant Improvement allocation curve (assume TI is recouped in the same month capital is daplayed) Market Free Rent 12 Months (of Gross) Deliverables 10 Year cash dow projection NPV (10 Years) to Temacity Co. (12% Discount Rate) Rent Covarage Ratio Stabilized NOl margin Sensitivity of Membership Fee and Market Rent to Net Income Margin Part 2. Brookpoint Asset Management Assumptions Acquisition Price: $45MM Bodget $10MM (to white-bex) "Does not include TI allowance Exit: Year 3 Cap Rate: 5.0% Debe o 60% LTC o 4.0% Intgrest o10 year-interest only + baloon payment Aume the owner's capital is deploved in all at once at she start of analysis Deliverables 1. YOC 2 Stabilized NOI to Owner 3. Levered IRR 4. Sale amount Scenario Tenacity Co., a flexible real estate provider, has an opportunity to engage in a commercial lease widh Brookpoint Asset Management, the owner of a property in midtown Manhattan The terms of the deal are to kease the entire property for the term of the lease Tak: Underwrite the deal based on the assumptions provided below. Create an operating model inclusive of cash Blow projections and retums over the term of the lease Tem: 10 Yeas SF: 60,000 RSF Inflation: 2.5% Membership Fee: $850 (1,000 Memberships Available) Occupancy: 90% Vacancy Rate: 40% in year I with decreasing 15% increments to stabilization Rent: $55/RSF (Rent) o$20/RSF (Property Expenses) o2.5 % Annual Escalations Tenacity Co. Operating Expenses: $20/RSF Fit Out Cost $200/RSF (from white-box) Fit Out Length: 6 months (Fit Out Curve: assume straight line over fit out period) Market Tenant Impsovement Allowance: $120/RSF Tenant Improvement allocation curve (assume TI is recouped in the same month capital is daplayed) Market Free Rent 12 Months (of Gross) Deliverables 10 Year cash dow projection NPV (10 Years) to Temacity Co. (12% Discount Rate) Rent Covarage Ratio Stabilized NOl margin Sensitivity of Membership Fee and Market Rent to Net Income Margin Part 2. Brookpoint Asset Management Assumptions Acquisition Price: $45MM Bodget $10MM (to white-bex) "Does not include TI allowance Exit: Year 3 Cap Rate: 5.0% Debe o 60% LTC o 4.0% Intgrest o10 year-interest only + baloon payment Aume the owner's capital is deploved in all at once at she start of analysis Deliverables 1. YOC 2 Stabilized NOI to Owner 3. Levered IRR 4. Sale amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started