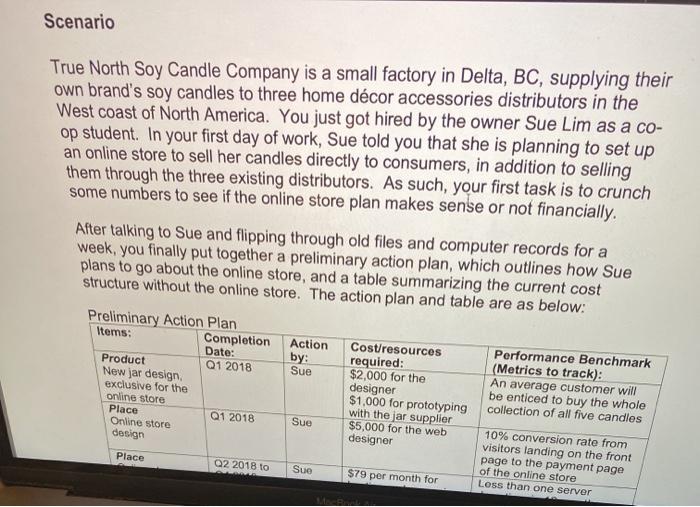

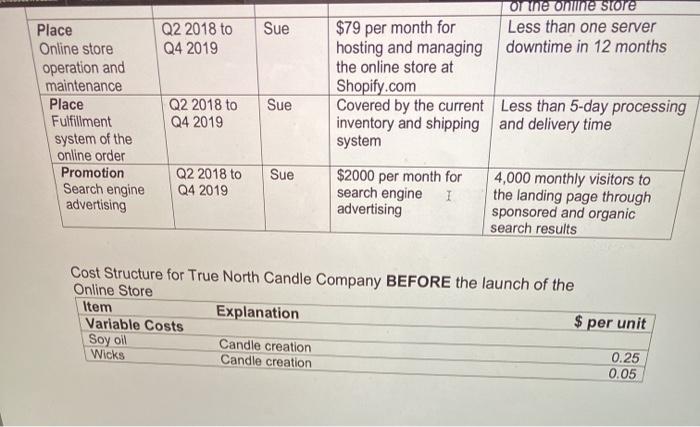

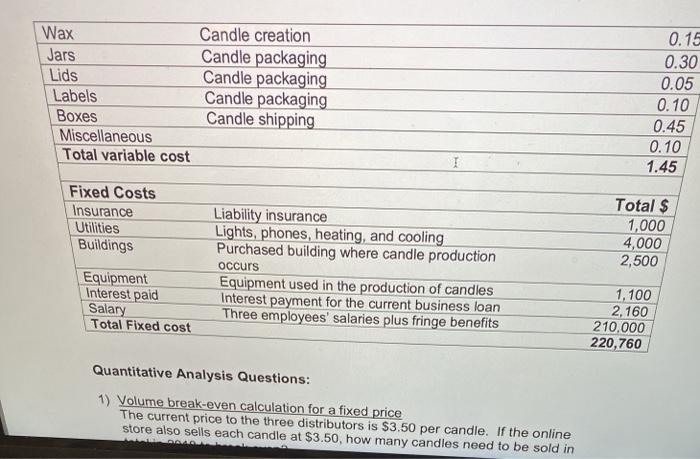

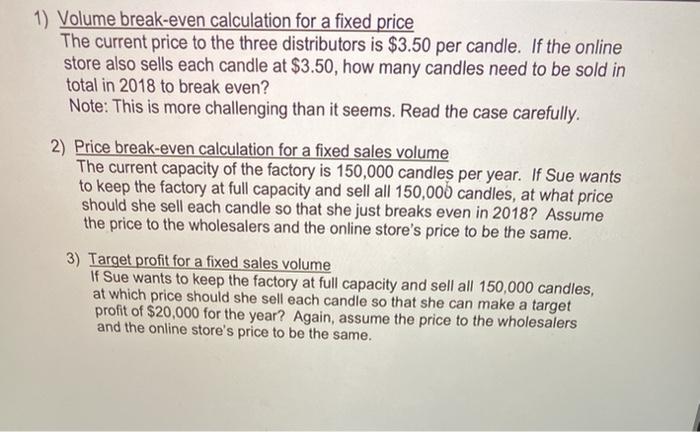

Scenario True North Soy Candle Company is a small factory in Delta, BC, supplying their own brand's soy candles to three home dcor accessories distributors in the West coast of North America. You just got hired by the owner Sue Lim as a co- op student. In your first day of work, Sue told you that she is planning to set up an online store to sell her candles directly to consumers, in addition to selling them through the three existing distributors. As such, your first task is to crunch some numbers to see if the online store plan makes sense or not financially. After talking to Sue and flipping through old files and computer records for a week, you finally put together a preliminary action plan, which outlines how Sue plans to go about the online store, and a table summarizing the current cost structure without the online store. The action plan and table are as below: Preliminary Action Plan Completion Action Cost/resources Performance Benchmark by: required: (Metrics to track): New jar design $2,000 for the An average customer will designer be enticed to buy the whole $1,000 for prototyping collection of all five candles with the jar supplier Online store $5,000 for the web 10% conversion rate from designer design visitors landing on the front Items: Product Date: Q1 2018 Sue exclusive for the online store Place Q1 2018 Sue Place Q2 2018 to Sue $79 per month for page to the payment page of the online store Less than one server Sue Q2 2018 to Q4 2019 Place Online store operation and maintenance Place Fulfillment system of the online order Promotion Search engine advertising one online store $79 per month for Less than one server hosting and managing downtime in 12 months the online store at Shopify.com Covered by the current Less than 5-day processing inventory and shipping and delivery time system Sue Q2 2018 to Q4 2019 Q2 2018 to Q4 2019 Sue $2000 per month for search engine 1 advertising 4,000 monthly visitors to the landing page through sponsored and organic search results Cost Structure for True North Candle Company BEFORE the launch of the Online Store Item Explanation $ per unit Variable Costs Soy oil Candle creation Wicks 0.25 Candle creation 0.05 Wax Candle creation Jars Candle packaging Lids Candle packaging Labels Candle packaging Boxes Candle shipping Miscellaneous Total variable cost 0.15 0.30 0.05 0.10 0.45 0.10 1.45 Fixed Costs Insurance Utilities Buildings Liability insurance Lights, phones, heating, and cooling Purchased building where candle production occurs Equipment used in the production of candles Interest payment for the current business loan Three employees' salaries plus fringe benefits Total $ 1,000 4,000 2,500 Equipment Interest paid Salary Total Fixed cost 1.100 2,160 210,000 220,760 Quantitative Analysis Questions: 1) Volume break-even calculation for a fixed price The current price to the three distributors is $3.50 per candle. If the online store also sells each candle at $3.50, how many candles need to be sold in 1) Volume break-even calculation for a fixed price The current price to the three distributors is $3.50 per candle. If the online store also sells each candle at $3.50, how many candles need to be sold in total in 2018 to break even? Note: This is more challenging than it seems. Read the case carefully. 2) Price break-even calculation for a fixed sales volume The current capacity of the factory is 150,000 candles per year. If Sue wants to keep the factory at full capacity and sell all 150,000 candles, at what price should she sell each candle so that she just breaks even in 2018? Assume the price to the wholesalers and the online store's price to be the same. 3) Target profit for a fixed sales volume If Sue wants to keep the factory at full capacity and sell all 150,000 candles, at which price should she sell each candle so that she can make a target profit of $20,000 for the year? Again, assume the price to the wholesalers and the online store's price to be the same. Scenario True North Soy Candle Company is a small factory in Delta, BC, supplying their own brand's soy candles to three home dcor accessories distributors in the West coast of North America. You just got hired by the owner Sue Lim as a co- op student. In your first day of work, Sue told you that she is planning to set up an online store to sell her candles directly to consumers, in addition to selling them through the three existing distributors. As such, your first task is to crunch some numbers to see if the online store plan makes sense or not financially. After talking to Sue and flipping through old files and computer records for a week, you finally put together a preliminary action plan, which outlines how Sue plans to go about the online store, and a table summarizing the current cost structure without the online store. The action plan and table are as below: Preliminary Action Plan Completion Action Cost/resources Performance Benchmark by: required: (Metrics to track): New jar design $2,000 for the An average customer will designer be enticed to buy the whole $1,000 for prototyping collection of all five candles with the jar supplier Online store $5,000 for the web 10% conversion rate from designer design visitors landing on the front Items: Product Date: Q1 2018 Sue exclusive for the online store Place Q1 2018 Sue Place Q2 2018 to Sue $79 per month for page to the payment page of the online store Less than one server Sue Q2 2018 to Q4 2019 Place Online store operation and maintenance Place Fulfillment system of the online order Promotion Search engine advertising one online store $79 per month for Less than one server hosting and managing downtime in 12 months the online store at Shopify.com Covered by the current Less than 5-day processing inventory and shipping and delivery time system Sue Q2 2018 to Q4 2019 Q2 2018 to Q4 2019 Sue $2000 per month for search engine 1 advertising 4,000 monthly visitors to the landing page through sponsored and organic search results Cost Structure for True North Candle Company BEFORE the launch of the Online Store Item Explanation $ per unit Variable Costs Soy oil Candle creation Wicks 0.25 Candle creation 0.05 Wax Candle creation Jars Candle packaging Lids Candle packaging Labels Candle packaging Boxes Candle shipping Miscellaneous Total variable cost 0.15 0.30 0.05 0.10 0.45 0.10 1.45 Fixed Costs Insurance Utilities Buildings Liability insurance Lights, phones, heating, and cooling Purchased building where candle production occurs Equipment used in the production of candles Interest payment for the current business loan Three employees' salaries plus fringe benefits Total $ 1,000 4,000 2,500 Equipment Interest paid Salary Total Fixed cost 1.100 2,160 210,000 220,760 Quantitative Analysis Questions: 1) Volume break-even calculation for a fixed price The current price to the three distributors is $3.50 per candle. If the online store also sells each candle at $3.50, how many candles need to be sold in 1) Volume break-even calculation for a fixed price The current price to the three distributors is $3.50 per candle. If the online store also sells each candle at $3.50, how many candles need to be sold in total in 2018 to break even? Note: This is more challenging than it seems. Read the case carefully. 2) Price break-even calculation for a fixed sales volume The current capacity of the factory is 150,000 candles per year. If Sue wants to keep the factory at full capacity and sell all 150,000 candles, at what price should she sell each candle so that she just breaks even in 2018? Assume the price to the wholesalers and the online store's price to be the same. 3) Target profit for a fixed sales volume If Sue wants to keep the factory at full capacity and sell all 150,000 candles, at which price should she sell each candle so that she can make a target profit of $20,000 for the year? Again, assume the price to the wholesalers and the online store's price to be the same