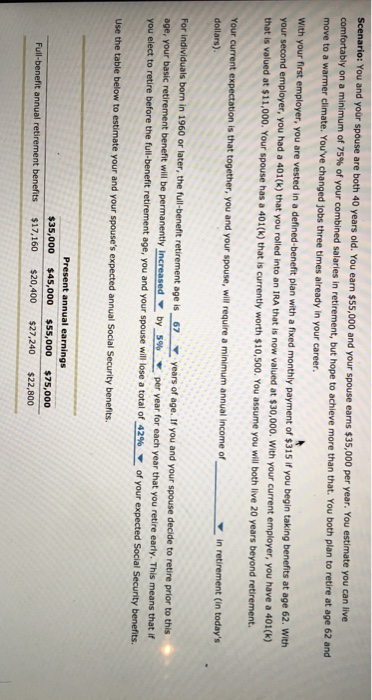

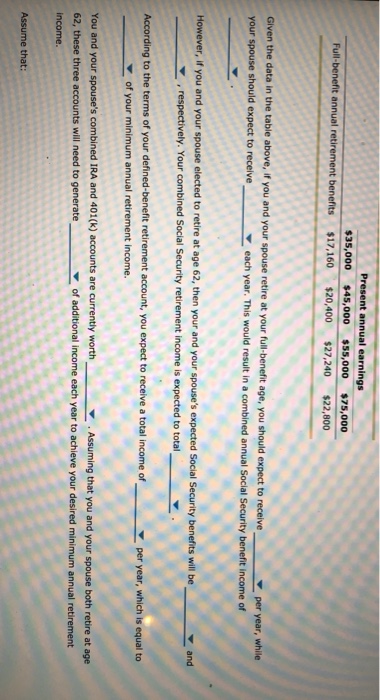

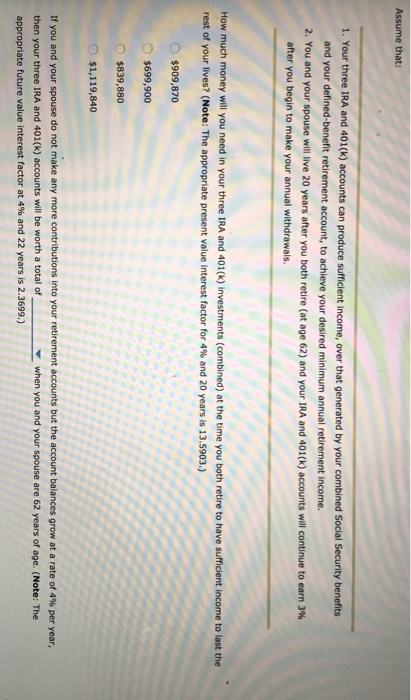

Scenario: You and yor spouse are both 40 years old. You earn $55,000 and your spouse earns $35,000 per year. You estimate you can live comfortably on a minimum of 75% of your combined salaries in retirement, but hope to achieve more than that. Y move to a warmer climate. You've changed jobs three times already in your career. ou both plan to retire at age 62 and with your first employer, you are vested in a defined-benefit plan with a fixed monthly payment of $315 if you begin taking benefits at age 62. with your second employer, you had a 401k) that you rolled into an IRA that is now valued at $30,000. with your current employer, you have a 401k) that is valued at $11,000. Your spouse has a 401(k) that is currently worth $10,500. You assume you will both live 20 years beyond retirement. in retirement (in today's Your current expectation is that together, you and your spouse, will require a minimum annual income of dollars) born in 1960 or later, the ful-benefit retirement age is 67 years of age. If you and your spouse decide to retire prior to this retirement benefit wi" be permanently increased by 5% w per year for each year that you retire early. This means that if you e ect to retire before the full benefit retire ent age, you and your spouse will lose a total of 42% of your expected Social Security benefits. Use the table below to estimate your and your spouse's expected annual Social Security benefits. Present annual earnings $35,000 $45,000 $55,000 $75,000 nefit annual benefits $17,160 $20,400 $27,240 $22,800 Scenario: You and yor spouse are both 40 years old. You earn $55,000 and your spouse earns $35,000 per year. You estimate you can live comfortably on a minimum of 75% of your combined salaries in retirement, but hope to achieve more than that. Y move to a warmer climate. You've changed jobs three times already in your career. ou both plan to retire at age 62 and with your first employer, you are vested in a defined-benefit plan with a fixed monthly payment of $315 if you begin taking benefits at age 62. with your second employer, you had a 401k) that you rolled into an IRA that is now valued at $30,000. with your current employer, you have a 401k) that is valued at $11,000. Your spouse has a 401(k) that is currently worth $10,500. You assume you will both live 20 years beyond retirement. in retirement (in today's Your current expectation is that together, you and your spouse, will require a minimum annual income of dollars) born in 1960 or later, the ful-benefit retirement age is 67 years of age. If you and your spouse decide to retire prior to this retirement benefit wi" be permanently increased by 5% w per year for each year that you retire early. This means that if you e ect to retire before the full benefit retire ent age, you and your spouse will lose a total of 42% of your expected Social Security benefits. Use the table below to estimate your and your spouse's expected annual Social Security benefits. Present annual earnings $35,000 $45,000 $55,000 $75,000 nefit annual benefits $17,160 $20,400 $27,240 $22,800