Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a senior accountant employed by YYZ Accountants LLP (YYZ). You have recently been assigned to work on the audit of Jewelry by

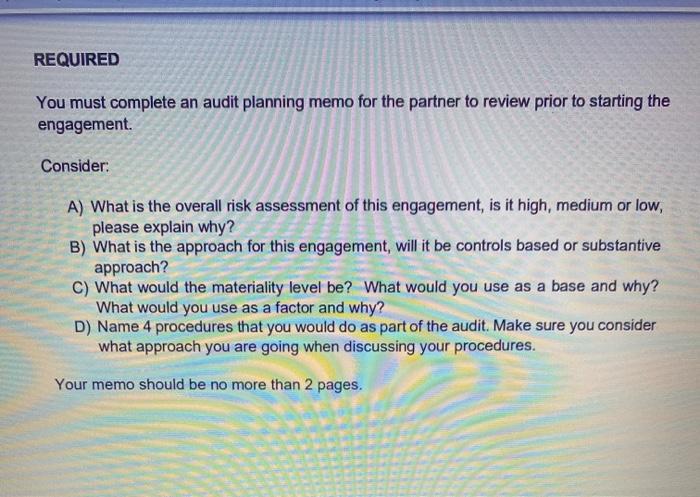

You are a senior accountant employed by YYZ Accountants LLP (YYZ). You have recently been assigned to work on the audit of Jewelry by Jamison (JBJ), a long-time audit client of your firm. JBJ is a private company with a July 31 year end, that owns and operates a total of six jewelry stores, all located in the Greater Toronto Area (GTA). It is now September 26, and the partner in charge of the JBJ engagement has requested that you accompany him to a meeting with Hank Jamison, JBJ s President and CEO. On the way to the meeting the partner hands you a file with some background information on JBJ s operations. BACKGROUND INFORMATION ON JBJ OPERATIONS Customer Base JBJ has a core base of loyal customers that place a high degree of importance on Jamison s reputation, quality of service and product. These customers tend to be older and have been shopping at Jamison s for many years. Although JBJ s stores are well known in their communities, the stores have been struggling to attract and retain a broader base of customers, including the next generation of jewelry buyers. Store Operations JBJ s stores are open from 8am to 9pm, seven days a week. Customer traffic varies throughout the week and time of day. The stores are busiest on weekdays between 6pm and 9pm and weekends between 10am and 2pm. During peak times, Hank insists that there be at least 6 employees in the store, which ensures that there is enough staff to help with the clients. Hank believes this is a key factor in maintaining Jamison s core base of loyal customers. Given the importance of exceptional service and quality, Hank deals with all customer complaints personally. He prides himself on the low number of customer complaints, which he interprets as meaning that Jamison s customers are very satisfied with the service received in the stores. Payment Methods Customers can pay by credit card, debit card or cash. All credit card purchases are subject to a processing fee of 1% of the total purchase amount, while each debit card transaction is subject to a twenty-five cents per transaction. Advertising and Promotion JBJ advertises primarily through radio advertisements on local stations. In addition, JBJ is very involved in the communities that it serves through sponsorship of sports teams and special events. The Jamison name is well known and respected in those communities. Management Each store is run by a store manager and two assistant managers. Hank believes in developing management from within and most of the managers started out as salespeople or other entry level positions. Turnover at the management level is quite low with the average length of employment at 10 years for assistant managers and 15 years for store managers. Sales of Jewelry Sales are done through the point of sales system, every item in inventory is given a unique serial number and that number is entered when the sale happens. Sales are set by Hank as cost + 35%. Repair revenue also has a set of unique code that are entered into the system when services are scheduled. At the end each day, the store manager reconciles all the tills they reconcile the cash, debit and credit receipts and differences> $100 are investigated by Hank. . Cheque Signing All cheques require two signatures and Hank must sign all cheques. Each store manager prepares a package for Hank with: The invoices M The packing receipt (which came with the jewelry) The original purchase order, signed off by Hank and a store manager, prior to the purchase Inventory management Hank prides himself on his inventory management system. He uses a point of sale system that integrates with all stores; therefore, he knows what is in each store as any given point and the system can provide him with sales trends with helps with purchasing. The point of sale system was purchased 15 years ago. JBJ has entered a contract with service provider to maintain the system for the next 5 years at a cost of $750 per month. Each month his staff perform inventory counts. The counts are done in pairs. The staff go through the stores and count all the inventory and then compare it to the system. Discrepancies should be minimal, but if there is, they are investigated by store managers, or escalated to Hank if necessary. The inventory count packages are signed off by the team that counted the inventory and signed off by the store manager. Moreover, all discrepancies> $500 include a formal report that is signed off by Hank and the store manager. Payroll Each store manager is paid a salary of $45,000+ commission and each assistant manager is paid salary of $35,000 commission. Regular store staff are paid $20 per hour commission. Commission is 1% of the sale price. For example, if some sold a $5,000 engagement ring, they would receive a commission of $50. All store managers are eligible for a bonus, they are eligible, if the gross margin ratio is higher than 80% and if the inventory turns more than 10 times are year or every 36 days. Lawsuits Recently, store #2 was named in a lawsuit regarding incorrect disposal of watch batteries. It is a National environmental association that is suing Hank s. Hank s lawyer feels that the claim does not have merit and the maximum exposure to Hank would be $5,000. The lawsuit was filed August 4th Month end-procedures The store managers are provided with the month end financial statements and are required to provide Hank with a report on what happened at each store, successful products and the highs and lows of the month. Financing In order facility buying inventory JBJ has a line of credit from the bank. They are required to maintain a debt to equity ratio of no more than 3:1. They are required to provide an auditor s report to the bank no more than 90 days after the year-end. REQUIRED You must complete an audit planning memo for the partner to review prior to starting the engagement. Consider: A) What is the overall risk assessment of this engagement, is it high, medium or low, please explain why? B) What is the approach for this engagement, will it be controls based or substantive approach? C) What would the materiality level be? What would you use as a base and why? What would you use as a factor and why? D) Name 4 procedures that you would do as part of the audit. Make sure you consider what approach you are going when discussing your procedures. Your memo should be no more than 2 pages.

Step by Step Solution

★★★★★

3.26 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started