Question

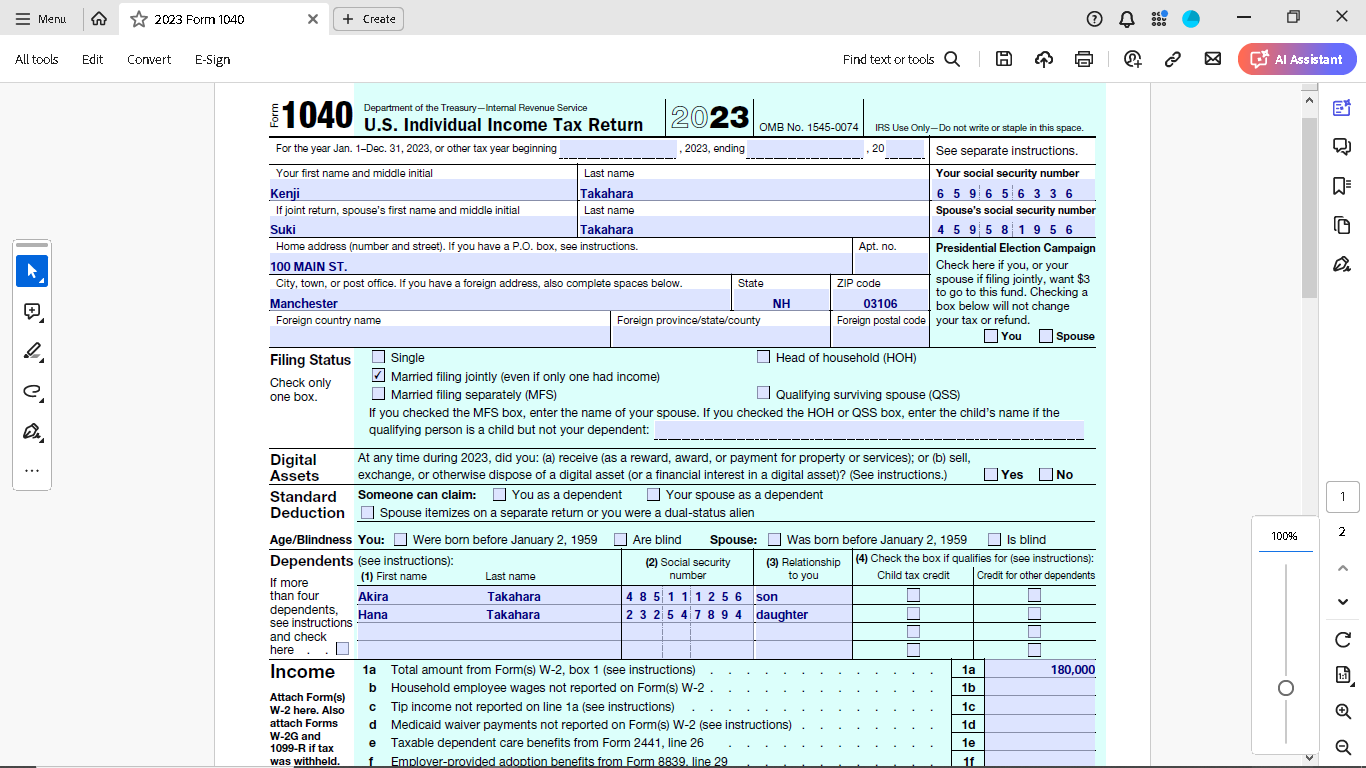

Scenario You are a tax professional and have been asked to present tax return for new client Kenji and Suki Takahara. The Takaharas are married,

Scenario

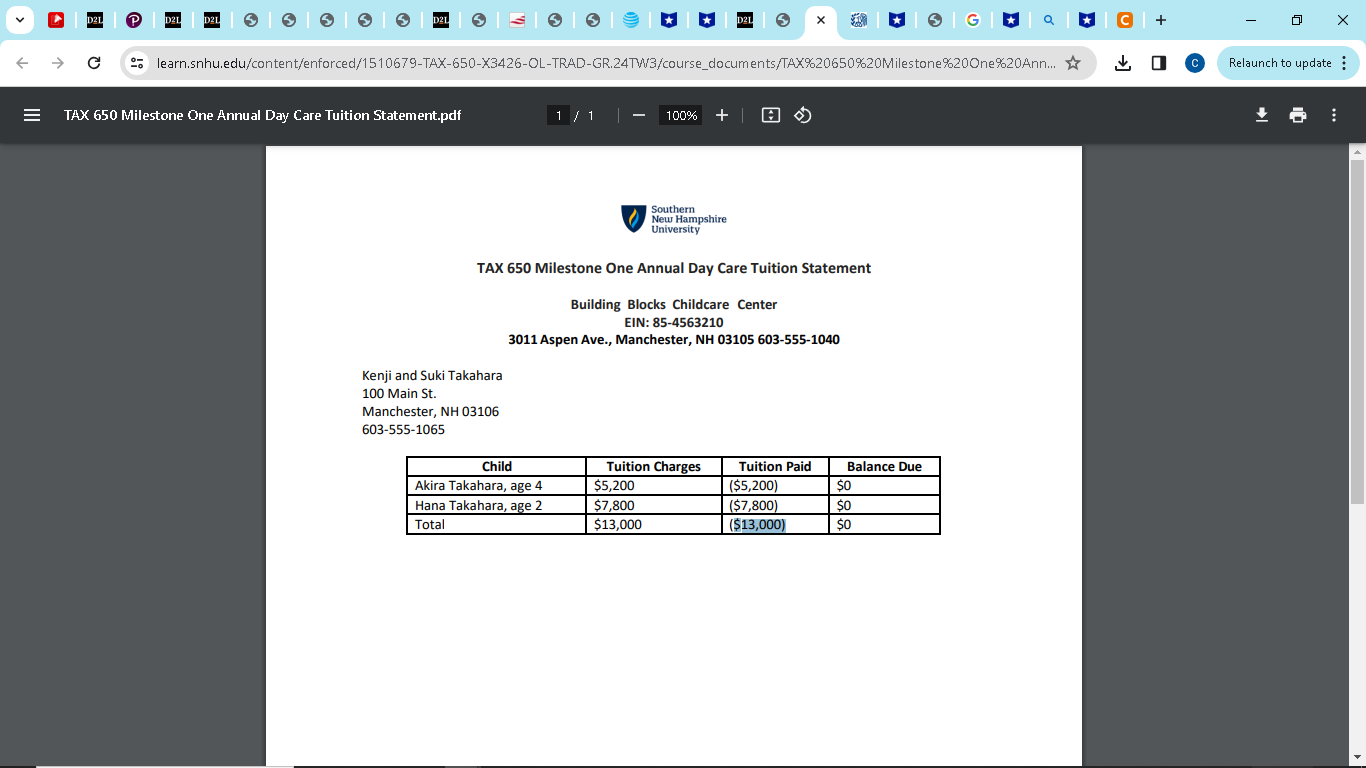

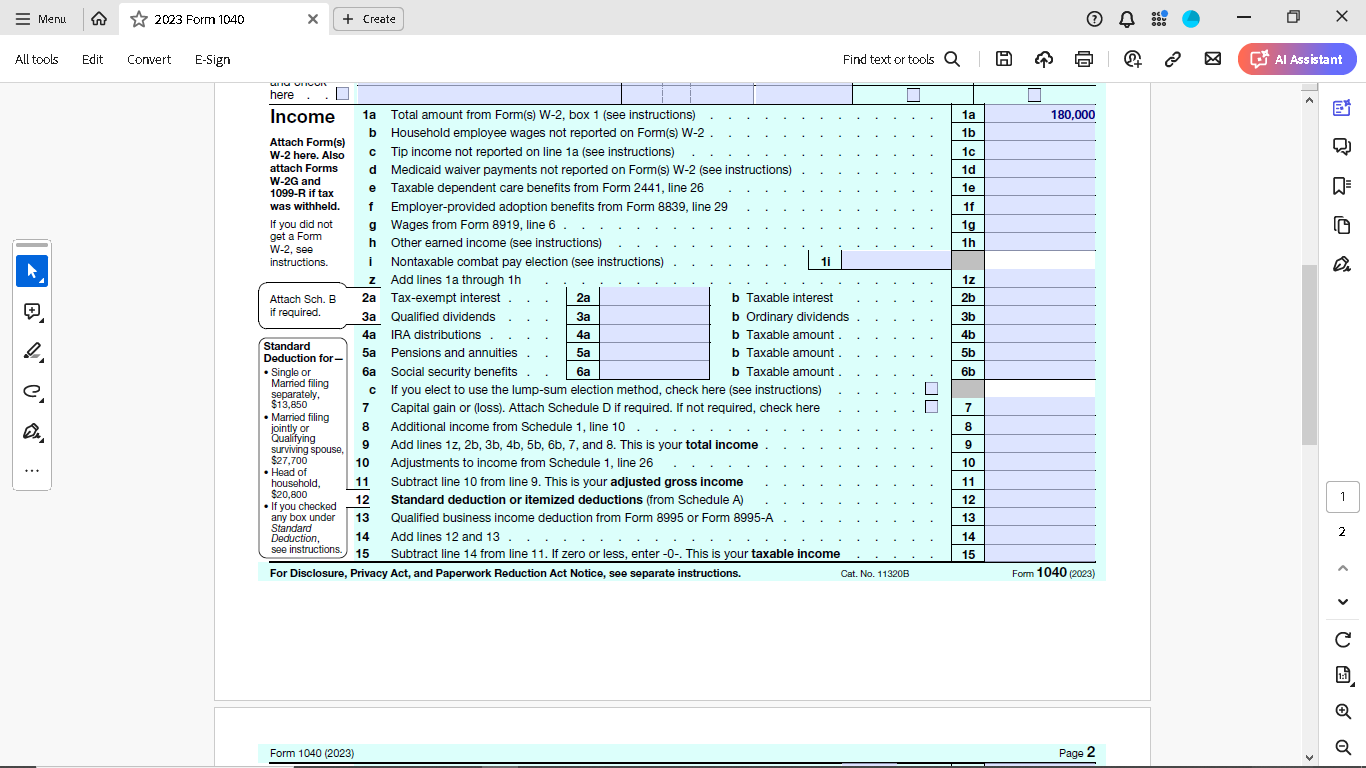

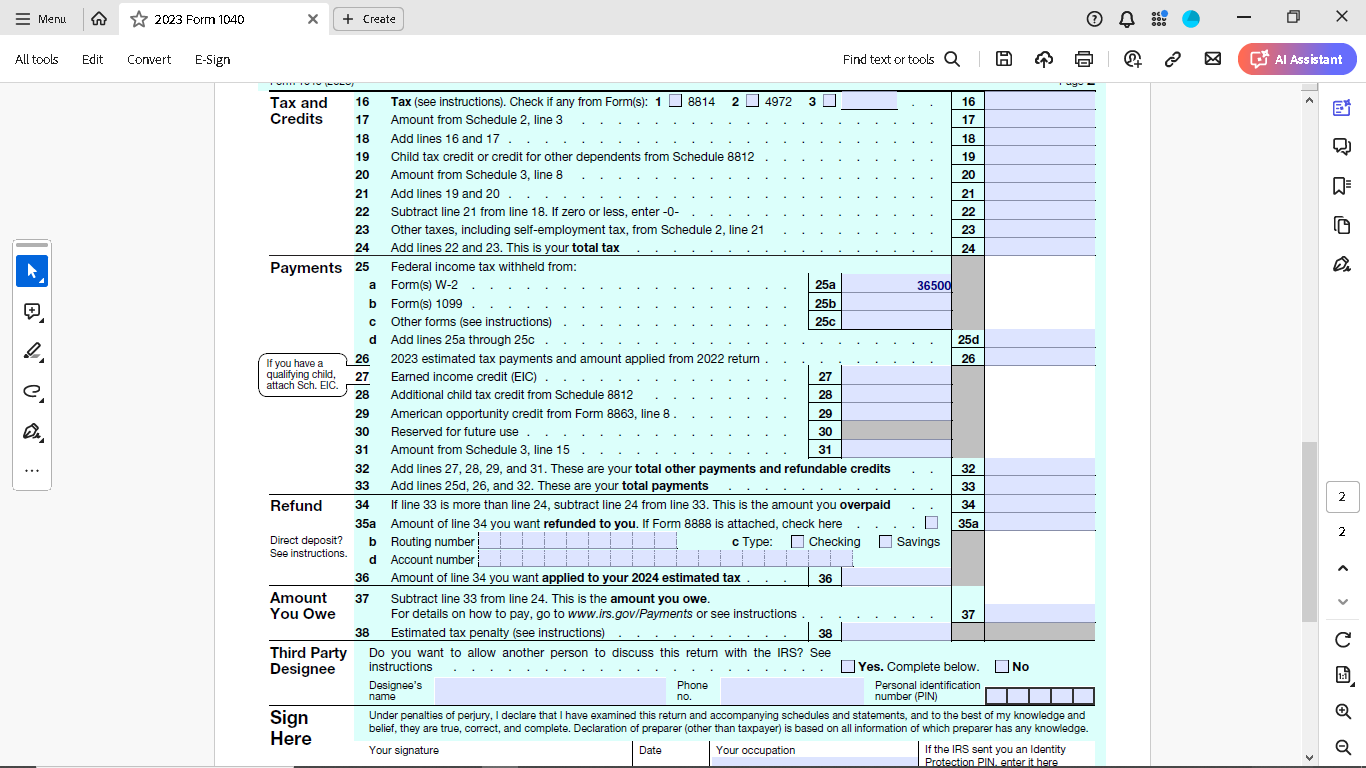

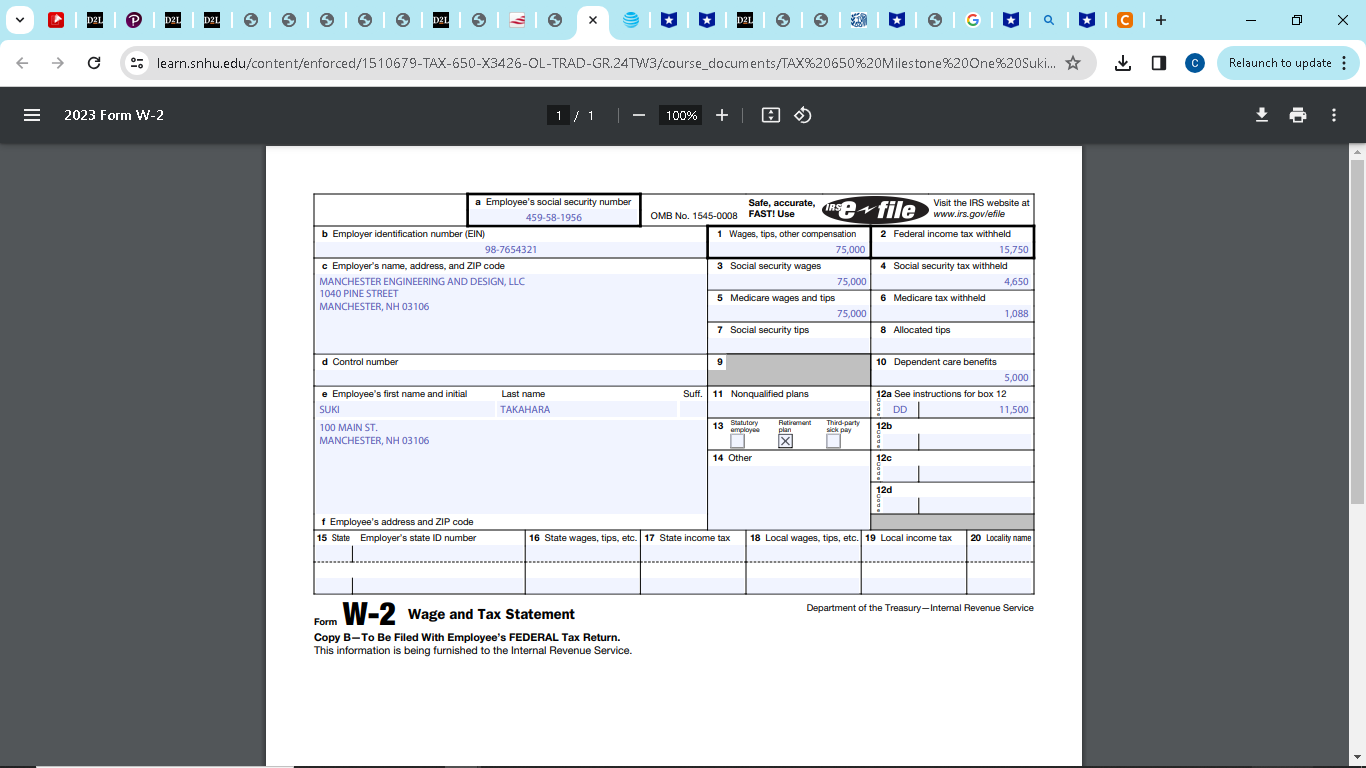

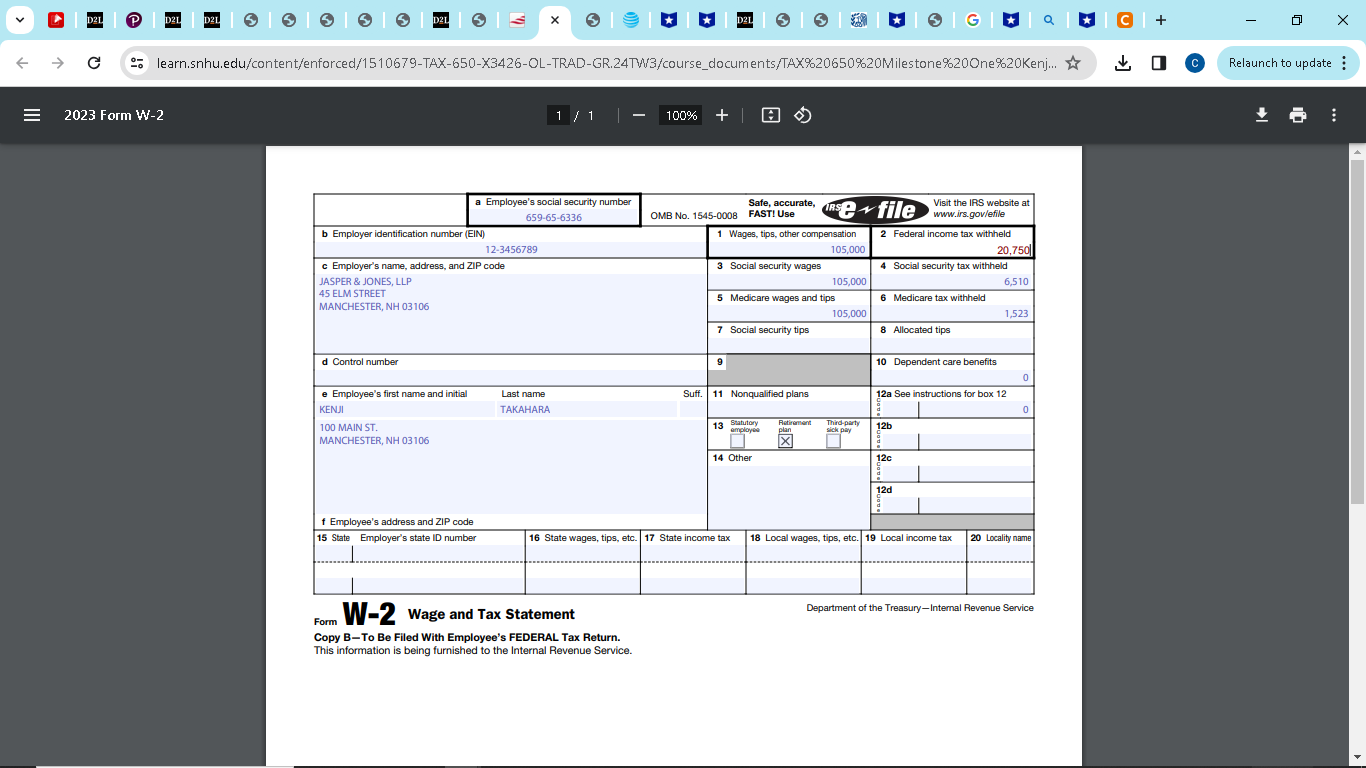

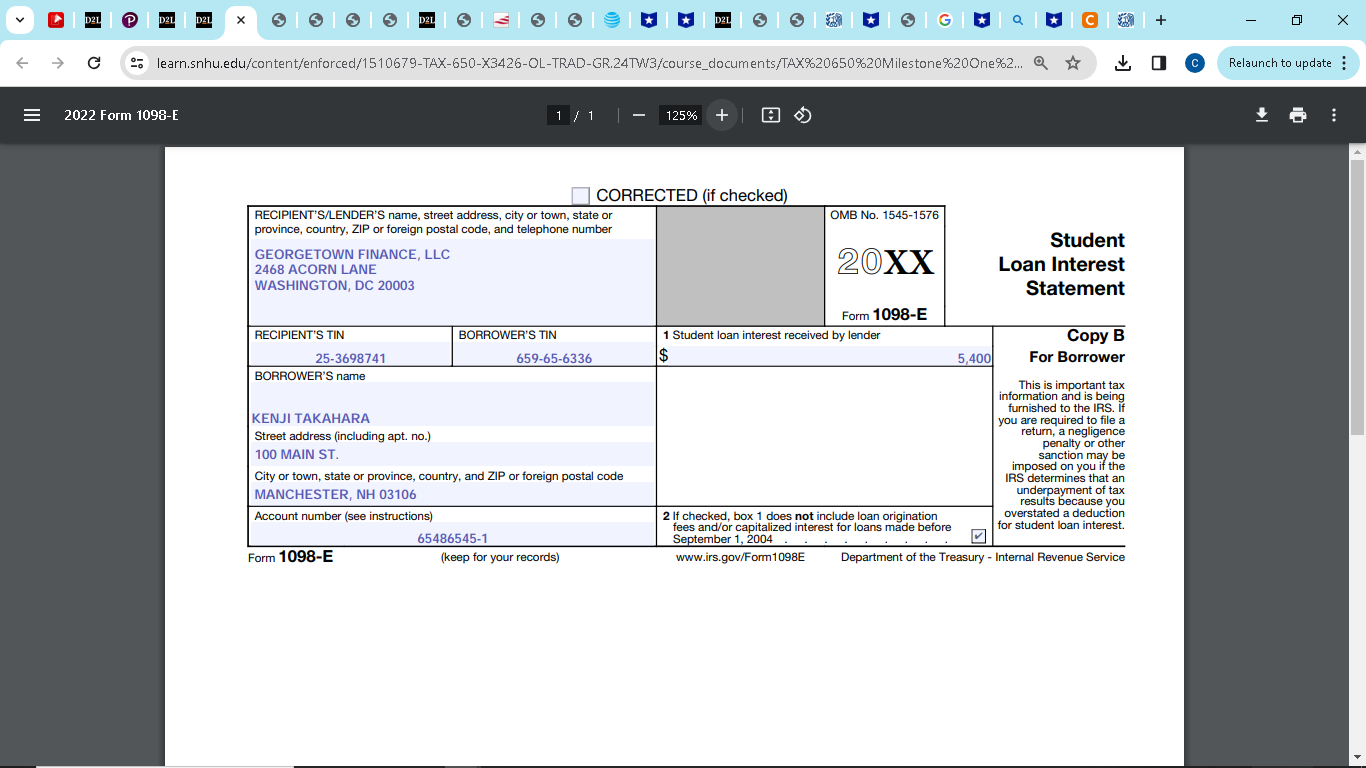

You are a tax professional and have been asked to present tax return for new client Kenji and Suki Takahara. The Takaharas are married, rent a home, and have two young children in day care. Kenji is employed as a lawyer and Suki as an engineer. They are still paying on their student loans, but they donate to charity. Suki also contributes $5,000 to a day care flexible spending account. They will claim the standard deduction. The Takaharas provide documentation you request during their interview. To properly display this income tax return, you will need to apply the appropriate tax laws, regulations, and codes.

Directions

Here is an individual federal tax return for the current year. Refer to the resources, including the IRS website, for access to the correct tax return forms.

Specifically, you must address the following rubric criteria:

- 1. Connect the client's information to the appropriate tax forms needed to finish the tax return.

- 2. Apply the relevant information from the provided taxpayer source documentation to the tax forms.

- 3. Assess the character of all income sources.

- 4. Evaluate whether the taxpayer's deductions should be itemized or not based on ethical standards for determining and communicating deductions.

- 5. Distinguish between the expenses connected with the client's employment that are eligible for deduction and those that are not.

Can you explain how I complete this 1040 for a married couple with the given information?

= Menu All tools e VC' Q 2023 Form 1040 + Create Edit Convert E-Sign Find text or tools Q A $1040 Department of the Treasury-Internal Revenue Service U.S. Individual Income Tax Return 2023 OMB No. 1545-0074 2023, ending For the year Jan. 1-Dec. 31, 2023, or other tax year beginning Your first name and middle initial Kenji If joint return, spouse's first name and middle initial Suki Last name Takahara Last name Takahara Home address (number and street). If you have a P.O. box, see instructions. 100 MAIN ST. City, town, or post office. If you have a foreign address, also complete spaces below. Manchester Foreign country name Filing Status Check only one box. IRS Use Only-Do not write or staple in this space. 20 See separate instructions. Apt. no. Your social security number 659656336 Spouse's social security number 459581956 Presidential Election Campaign Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change your tax or refund. You Spouse State ZIP code NH Foreign province/state/county 03106 Foreign postal code Head of household (HOH) Qualifying surviving spouse (QSS) Single Married filing jointly (even if only one had income) Married filing separately (MFS) If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QSS box, enter the child's name if the qualifying person is a child but not your dependent: Dependents (see instructions): If more (1) First name than four Akira dependents, Hana Digital Assets Standard Deduction You as a dependent At any time during 2023, did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, exchange, or otherwise dispose of a digital asset (or a financial interest in a digital asset)? (See instructions.) Someone can claim: Your spouse as a dependent Spouse itemizes on a separate return or you were a dual-status alien Yes No Age/Blindness You: Were born before January 2, 1959 Are blind Spouse: Last name Takahara Takahara (2) Social security number 485 111256 son 232547894 daughter to you Was born before January 2, 1959 Is blind (3) Relationship (4) Check the box if qualifies for (see instructions): Credit for other dependents Child tax credit see instructions and check here Income 1a b Total amount from Form(s) W-2, box 1 (see instructions) Household employee wages not reported on Form(s) W-2. 1a 1b 180,000 Attach Form(s) W-2 here. Also c Tip income not reported on line 1a (see instructions) 1c attach Forms d Medicaid waiver payments not reported on Form(s) W-2 (see instructions) 1d W-2G and e Taxable dependent care benefits from Form 2441, line 26 1e 1099-R if tax was withheld. Emplover-provided adoption benefits from Form 8839, line 29 1f I Al Assistant D 1 100% 2 ( Q Q

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainly Based on the information provided lets break down how to complete the 1040 for Kenji and S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started