Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Scenario: You are single and 35 years old. You are thinking of leaving your employer in January 2017 and becoming self employed. However replacing the

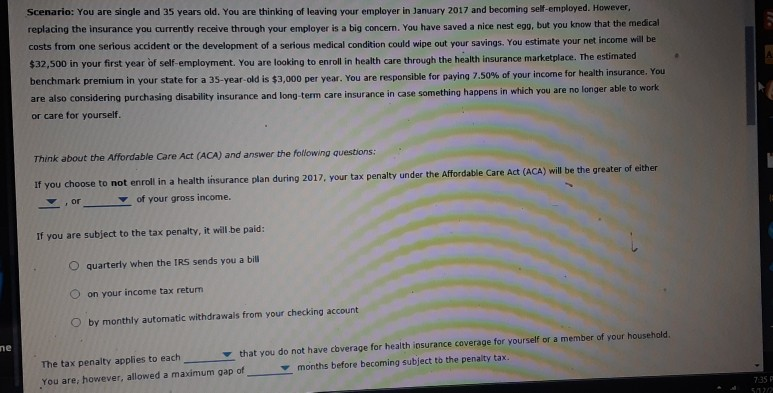

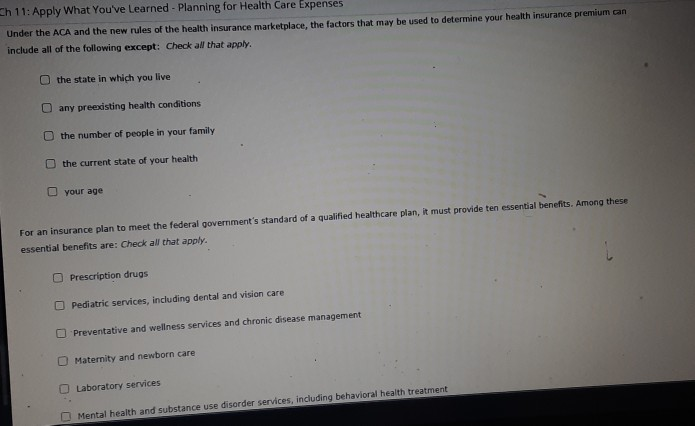

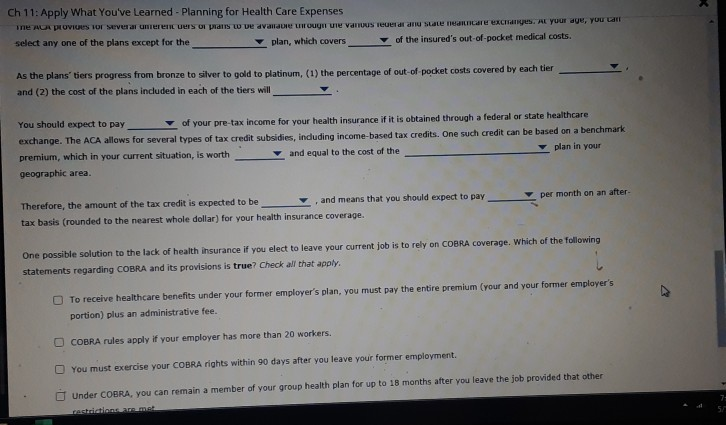

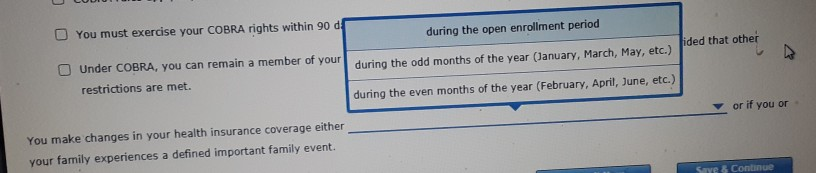

Scenario: You are single and 35 years old. You are thinking of leaving your employer in January 2017 and becoming self employed. However replacing the insurance you currently receive through your employer is a big concem. You have saved a nice nest ego, but you know that the medical costs from one serious accident or the development of a serious medical condition could wipe out your savings. You estimate your net income will be $32,500 in your first year of self-employment. You are looking to enroll in health care through the health insurance marketplace. The estimated benchmark premium in your state for a 35-year-old is $3,000 per year. You are responsible for paying 7.50% of your income for health insurance. You are also considering purchasing disability insurance and long-term care insurance in case something happens in which you are no longer able to work or care for yourself. Think about the Affordable Care Act (ACA) and answer the following questions: If you choose to not enroll in a health insurance plan during 2017, your tax penalty under the Affordable Care Act (ACA) will be the greater of either or of your gross income. If you are subject to the tax penalty, it will be paid: O quarterly when the IRS sends you a bill O on your income tax return O by monthly automatic withdrawals from your checking account The tax penalty applies to each that you do not have coverage for health insurance coverage for yourself or a member of your household You are, however, allowed a maximum gap of months before becoming subject to the penalty tax 725 512 Ch 11: Apply What You've learned - Planning for Health Care Expenses Under the ACA and the new rules of the health insurance marketplace, the factors that may be used to determine your health insurance premium can include all of the following except: Check all that apply. the state in which you live O any preesisting health conditions O the number of people in your family the current state of your health your age provide ten essential benefits. Among these For an insurance plan to meet the federal government's standard of a qualified healthcare plan, it essential benefits are: Check all that apply. Prescription drugs Pediatric services, including dental and vision care Preventative and wellness services and chronic disease management Maternity and newborn care Laboratory services Mental health and substance use disorder services, including behavioral health treatment Ch 11: Apply What You've learned - Planning for Health Care Expenses in A PROVES TO Mvuar unter US pas u ve avanture LORI UN VITORIS select any one of the plans except for the plan, which covers , you can Ver s ale RTC Ch . Ak Yuur of the insured's out-of-pocket medical costs. As the plans tiers progress from bronze to silver to gold to platinum. (1) the percentage of out of pocket costs covered by each tier and (2) the cost of the plans included in each of the tiers will You should expect to pay of your pre-tax income for your health insurance if it is obtained through a federal or state healthcare exchange. The ACA allows for several types of tax credit subsidies, including income-based tax credits. One such credit can be based on a benchmark premium, which in your current situation, is worth our current situation, is worth and equal to the cost of the plan in your geographic area. per month on an after- Therefore, the amount of the tax credit is expected to be y, and means that you should expect to pay tax basis (rounded to the nearest whole dollar) for your health insurance coverage. One possible solution to the lack of health insurance if you elect to leave your current job is to rely on COBRA coverage. Which of the following statements regarding COBRA and its provisions is true? Check all that apply. To receive healthcare benefits under your former employer's plan, you must pay the entire premium (your and your former employer's portion) plus an administrative fee. O COBRA rules apply if your employer has more than 20 workers. You must exercise your COBRA rights within 90 days after you leave your former employment. T Under COBRA, you can remain a member of your group health plan for up to 18 months after you leave the job provided that other You must exercise your COBRA rights within 90 d during the open enrollment period Under COBRA, you can remain a member of your restrictions are met. during the odd months of the year (January March May, etc) fided that other during the even months of the year (February, April, June, etc.) or if you or You make changes in your health insurance coverage either your family experiences a defined important family event

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started