Question

You own a home with a market value of $175,000. Of this amount, $50,000 is apportioned to the land and $125,000 is apportioned to the

You own a home with a market value of $175,000. Of this amount, $50,000 is apportioned to the land and $125,000 is apportioned to the house. It is estimated that the house would cost $135,000 to rebuild. The personal property in your own home is worth $55,000, including a $3,5000 diamond ring and a $4,500 computer system. You also own a car worth $25,000. You live in a state where there is a high risk for earthquakes. You have $100,000 in savings and investments that could be drawn on in case of emergency. You currently have a standard HO-3 homeowner's policy with a $1,000 deductible, which insures your house for $175,000 and your personal belongings for $85,000, and you carry the minimum requirements of your state for car insurance. You have been advised to adjust your insurance coverage based on the large-loss principle.

Based on the large-loss principle and your particular situation a ($0, $500, $1000, $5000) is most appropriate for your homeowner's policy.

Given your current insurance coverage, in the event of a fire, your house and household belongings are over-insured by ($55,000, $70,000, $145,000, $30,000)

If you were to reduce the coverage on your home to its replacement value of $135,000, then your personal property coverage could also be reduced to ($76,000, $67,500 , $112,500). This is because the minimum personal coverage available on an HO-3 policy is (35%, 40%, 50%, 60%) of the home coverage.

If you were to total your car in an accident at which you are at fault, your insurance company is likely to pay ($0, $19,500, $25,000).

Assume your state's minimum liability limits for an automobile policy 25/50/25. Next assume that your cause an accident that involves multiple injuries to three people, each with medical expenses of $200,000. The maximum bodily injury payout that could be made on your behalf by your insurance company for this accident is ($25,000 , $1,000,000 , $150,000 , $600,000 , $500,000 , $75,000 , $50,000 ).

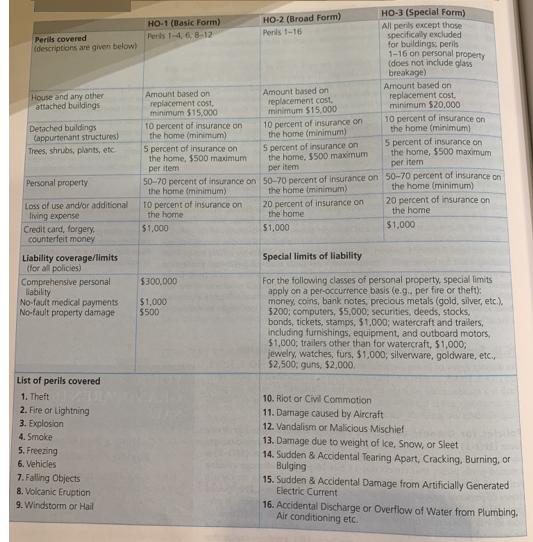

Perils covered (descriptions are given below) House and any other attached buildings Detached buildings Cappurtenant structures) Trees, shrubs, plants, etc. Personal property Loss of use and/or additional Iiving expense Credit card, forgery, counterfeit money Liability coverage/limits (for all policies) Comprehensive personal liability No-fault medical payments No-fault property damage List of perils covered 1. Theft 2. Fire or Lightning 3. Explosion 4. Smoke 5. Freezing 6. Vehicles 7. Falling Objects 8. Volcanic Eruption 9. Windstorm or Hail HO-1 (Basic Form) Peris 1-4, 6, 8-12- Amount based on replacement cost, minimum $15,000 10 percent of insurance on the home (minimum) 5 percent of insurance on the home, $500 maximum per item 50-70 percent of insurance on the home (minimum) 10 percent of insurance on the home $1,000 $300,000 $1,000 $500 HO-2 (Broad Form) Perils 1-16 Amount based on replacement cost. minimum $15,000 HO-3 (Special Form) All penils except those specifically excluded. for buildings: peris 1-16 on personal property (does not include glass breakage) 20 percent of insurance on the home $1,000 Amount based on replacement cost, minimum $20,000 10 percent of insurance on the home (minimum) 10 percent of insurance on the home (minimum) 5 percent of insurance on the home, $500 maximum per item 50-70 percent of insurance on 50-70 percent of insurance on the home (minimum) the home (minimum) 5 percent of insurance on the home, $500 maximum per item 20 percent of insurance on the home $1,000 Special limits of liability For the following classes of personal property, special limits apply on a per-occurrence basis (e.g.. per fire or theft): money, coins, bank notes, precious metals (gold, silver, etc.), $200; computers, $5,000, securities, deeds, stocks, bonds, tickets, stamps, $1,000; watercraft and trailers, including furnishings, equipment, and outboard motors, $1,000; trailers other than for watercraft, $1,000, jewelry, watches, furs, $1,000, silverware, goldware, etc., $2,500; guns, $2,000. 10. Riot or Civil Commotion 11. Damage caused by Aircraft 12. Vandalism or Malicious Mischief 13. Damage due to weight of Ice, Snow, or Sleet 14. Sudden & Accidental Tearing Apart, Cracking, Burning, or Bulging 15. Sudden & Accidental Damage from Artificially Generated Electric Current 16. Accidental Discharge or Overflow of Water from Plumbing, Air conditioning etc.

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Based on the largeloss principle and the given situation a 1000 deductible is most appropriat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started