Scenario_1.

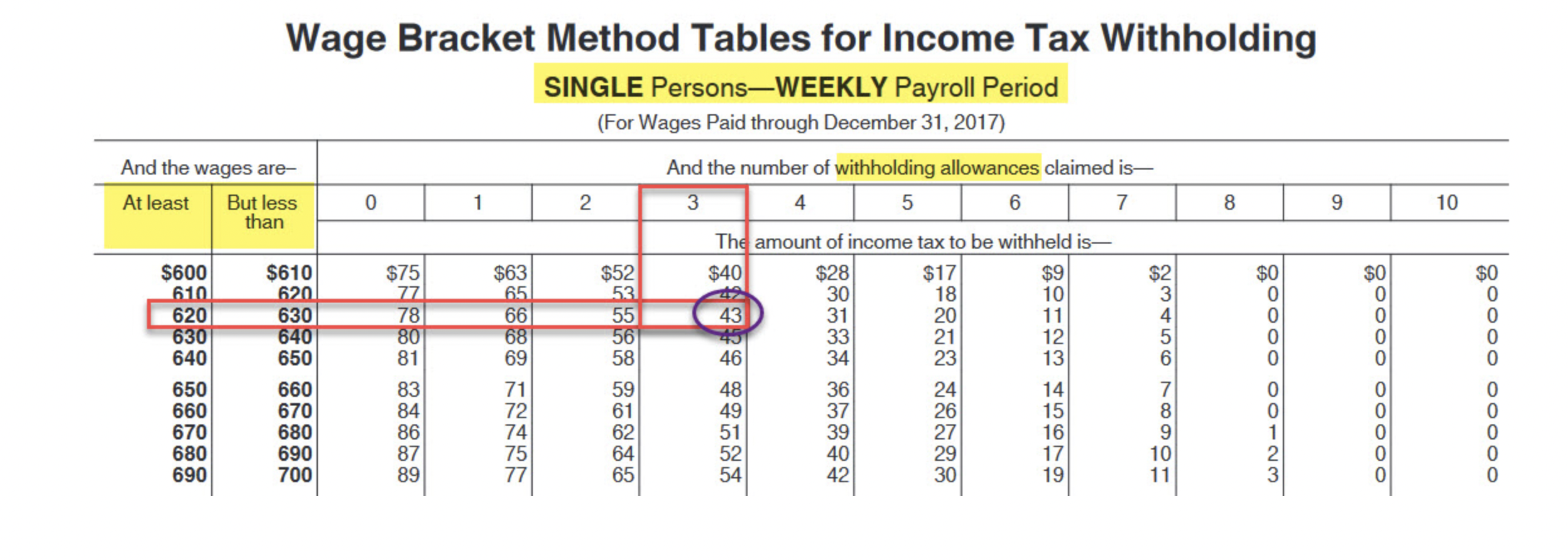

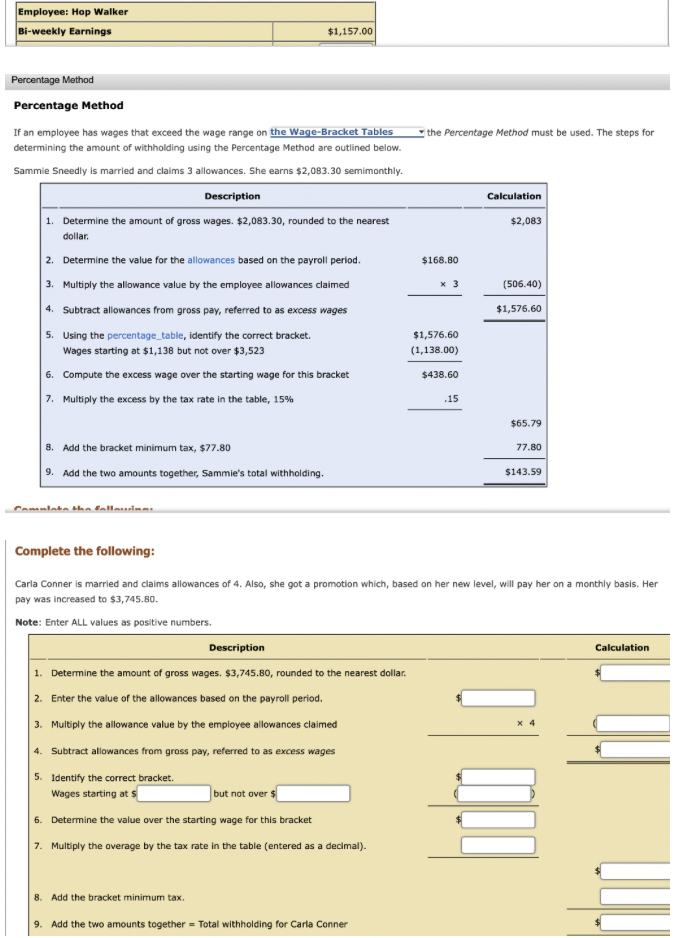

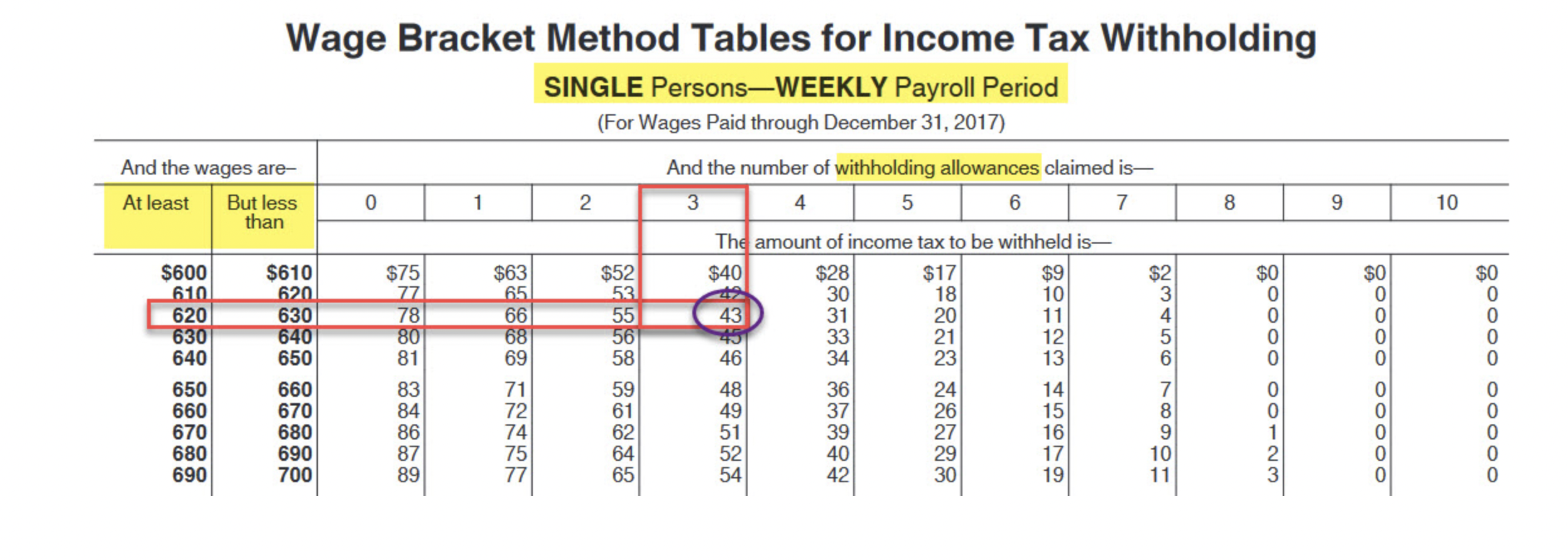

Ben Franklin is quoted as saying ... In this world, nothing is certain but death and taxes. Circular E. Employers Tay was One of the many employer responsibilities is to withhold Income taxes from employees' wages and paying these taxes to the federal government. In addition, many , employers must also comply with state, city, and county , , income tax withholding laws. The following pages will outline how to use Circular E, how to determine the amount of withholding, and amounts that are included and excluded in gross wages. wiary tax Freire Overview Overview Generally, a worker who performs services when the right to control what will be done and how it will be done is defined as under common-law criteria. Wages include total compensation paid to employees for services with employers withholding on gross income. One that is excluded from taxation when received Fringe benefits that are nontaxable for transportation purposes include Group-Term life insurance (up to $ [ of coverage), when authorized, is when determining federal income tax withholding An employer uses the Form to compute the amount of income tax to withhold from employees' wages. On the Employees Withholding Allowance Certificate, an employee begins with the number of personal exemptions claimed. To receive a higher paycheck, they would allowances. Wage-Bracket Method Wage-Bracket Method Under the wage bracket method, the process is to navigate to the proper table for the company's payroll period and the employee's marital status. Determine the intersection of withholding allowances and current wages which isolates the amount of withholding. Federal income tax rates and withholding rates can change on short notice, due to new legislation passed by Congress. The most recent version of Publication 15 can be found at the Internal Revenue Service internet site (IRS). Complete the following steps: 1. Click link: Publication 15. 2. The Circular E) Employer's Tax Guide launches. 3. Scroll the Table of Contents to view the topic titled How To Use the Income Tax Withholding Tables 4. Click the associated page number, advancing to where this particular topic begins. a If the publication does not launch, click the RS link above and search Publication 15 on the IRS website. Click to open the pdf file. The IRS provides statutory wage tables for weekly, biweekly, semimonthly, monthly, daily or miscellaneous pay periods for married and single , , persons. Scenario 1: Tony Hickman is single with 3 withholding allowances. He earns $622.50 each week. What is the amount of withholding? Steps Description 1. Scroll through Publication 15 to the table titled Wage Bracket Method Tables for Income Tax Withholding 2. 3. Looking at the top of the table, locate Single Persons-Weekly Payroll Period. In the far left column, scroll to locate At least $620 But less than $630. Look for the intersection of the row of wage range from $620 to $630 and the column of "3" (withholding allowances). 4. Scenario 2: 2 Continuing from Scenario 1, Tony has gotten married and received a raise (Go Tony!!). In order have a bit more in his paycheck, he has increased his allowances by one. Based on his raise, he now earns $653.60 each week. What is the amount that should be withheld? , ? Steps Description 1. 1 Scroll through Publication 15 to the table titled Wage Bracket Method Tables for Income Tax Withholding 2. Looking at the top of the table, locate Married Persons-Weekly Payroll Period. 3. In the far left column, scroll to locate At least $650 But less than $660. 4. Look for the intersection of the row of wage range from $650 to $660 and the applicable withholding allowance column. 5. Click the link to view the amount of tax withheld for Tony: Scenario_2. : Complete the following for each employee. Note: Enter ALL values as positive numbers. Lucy Cooper earns $842 weekly. She has 2 allowances and is married. . Employee: Lucy Cooper Weekly Earnings $842.00 Federal Income Tax Withholding: Hop Walker has bi-weekly wages of $1,157. He is single with one allowance. $ Employee: Hop Walker Bi-weekly Earnings $1,157.00 Employee: Hop Walker Bi-weekly Earnings $1,157.00 the Percentage Method must be used. The steps for Percentage Method Percentage Method If an employee has wages that exceed the wage range on the Wage-Bracket Tables determining the amount of withholding using the Percentage Method are outlined below. Sammie Sneedly is married and claims 3 allowances. She earns $2,083.30 semimonthly. Description 1. Determine the amount of gross wages. $2,083.30, rounded to the nearest Calculation $2,083 dollar $168.80 x 3 (506.40) $1,576.60 2. Determine the value for the allowances based on the payroll period. 3. Multiply the allowance value by the employee allowances claimed 4. Subtract allowances from gross pay, referred to as excess wages 5. Using the percentage_table, identify the correct bracket Wages starting at $1,138 but not over $3,523 6. Compute the excess wage over the starting wage for this bracket 7. Multiply the excess by the tax rate in the table, 15% $1,576.60 (1,138.00) $438.60 .15 $65.79 77.80 8. Add the bracket minimum tax, $77.80 9. Add the two amounts together, Sammie's total withholding, $143.59 Common the ball Complete the following: Calculation Carla Conner is married and claims allowances of 4. Also, she got a promotion which, based on her new level, will pay her on a monthly basis. Her pay was increased to $3,745.80. Note: Enter ALL values as positive numbers. Description 1. Determine the amount of gross wages. $3,745.80, rounded to the nearest dollar. 2. Enter the value of the allowances based on the payroll period. 3. Multiply the allowance value by the employee allowances claimed 4. Subtract allowances from grass pay, referred to as excess wages 5. Identify the correct bracket Wages starting at: but not over 6. Determine the value over the starting wage for this bracket 7. Multiply the average by the tax rate in the table (entered as a decimal). 8. Add the bracket minimum tax 9. Add the two amounts together = Total withholding for Carla Conner 2 9 10 Wage Bracket Method Tables for Income Tax Withholding SINGLE PersonsWEEKLY Payroll Period (For Wages Paid through December 31, 2017) And the wages are And the number of withholding allowances claimed is- At least But less 0 1 3 4 5 6 7 8 than The amount of income tax to be withheld is- $600 $610 $75 $63 $52 $40 $28 $17 $9 $2 $0 610 620 77 53 30 10 0 620 630 78 66 55 43 31 20 11 0 630 640 80 68 56 33 21 12 0 640 650 81 69 58 46 34 23 13 0 650 660 71 59 24 14 7 660 670 72 61 37 26 15 8 670 680 86 74 62 51 39 27 16 9 1 680 690 87 75 64 52 40 29 10 2 690 700 89 77 65 54 42 30 19 11 3 $0 $0 65 18 0 2H2B 45679 3888 7 83 48 36 ooooooooo 84 49 Ben Franklin is quoted as saying ... In this world, nothing is certain but death and taxes. Circular E. Employers Tay was One of the many employer responsibilities is to withhold Income taxes from employees' wages and paying these taxes to the federal government. In addition, many , employers must also comply with state, city, and county , , income tax withholding laws. The following pages will outline how to use Circular E, how to determine the amount of withholding, and amounts that are included and excluded in gross wages. wiary tax Freire Overview Overview Generally, a worker who performs services when the right to control what will be done and how it will be done is defined as under common-law criteria. Wages include total compensation paid to employees for services with employers withholding on gross income. One that is excluded from taxation when received Fringe benefits that are nontaxable for transportation purposes include Group-Term life insurance (up to $ [ of coverage), when authorized, is when determining federal income tax withholding An employer uses the Form to compute the amount of income tax to withhold from employees' wages. On the Employees Withholding Allowance Certificate, an employee begins with the number of personal exemptions claimed. To receive a higher paycheck, they would allowances. Wage-Bracket Method Wage-Bracket Method Under the wage bracket method, the process is to navigate to the proper table for the company's payroll period and the employee's marital status. Determine the intersection of withholding allowances and current wages which isolates the amount of withholding. Federal income tax rates and withholding rates can change on short notice, due to new legislation passed by Congress. The most recent version of Publication 15 can be found at the Internal Revenue Service internet site (IRS). Complete the following steps: 1. Click link: Publication 15. 2. The Circular E) Employer's Tax Guide launches. 3. Scroll the Table of Contents to view the topic titled How To Use the Income Tax Withholding Tables 4. Click the associated page number, advancing to where this particular topic begins. a If the publication does not launch, click the RS link above and search Publication 15 on the IRS website. Click to open the pdf file. The IRS provides statutory wage tables for weekly, biweekly, semimonthly, monthly, daily or miscellaneous pay periods for married and single , , persons. Scenario 1: Tony Hickman is single with 3 withholding allowances. He earns $622.50 each week. What is the amount of withholding? Steps Description 1. Scroll through Publication 15 to the table titled Wage Bracket Method Tables for Income Tax Withholding 2. 3. Looking at the top of the table, locate Single Persons-Weekly Payroll Period. In the far left column, scroll to locate At least $620 But less than $630. Look for the intersection of the row of wage range from $620 to $630 and the column of "3" (withholding allowances). 4. Scenario 2: 2 Continuing from Scenario 1, Tony has gotten married and received a raise (Go Tony!!). In order have a bit more in his paycheck, he has increased his allowances by one. Based on his raise, he now earns $653.60 each week. What is the amount that should be withheld? , ? Steps Description 1. 1 Scroll through Publication 15 to the table titled Wage Bracket Method Tables for Income Tax Withholding 2. Looking at the top of the table, locate Married Persons-Weekly Payroll Period. 3. In the far left column, scroll to locate At least $650 But less than $660. 4. Look for the intersection of the row of wage range from $650 to $660 and the applicable withholding allowance column. 5. Click the link to view the amount of tax withheld for Tony: Scenario_2. : Complete the following for each employee. Note: Enter ALL values as positive numbers. Lucy Cooper earns $842 weekly. She has 2 allowances and is married. . Employee: Lucy Cooper Weekly Earnings $842.00 Federal Income Tax Withholding: Hop Walker has bi-weekly wages of $1,157. He is single with one allowance. $ Employee: Hop Walker Bi-weekly Earnings $1,157.00 Employee: Hop Walker Bi-weekly Earnings $1,157.00 the Percentage Method must be used. The steps for Percentage Method Percentage Method If an employee has wages that exceed the wage range on the Wage-Bracket Tables determining the amount of withholding using the Percentage Method are outlined below. Sammie Sneedly is married and claims 3 allowances. She earns $2,083.30 semimonthly. Description 1. Determine the amount of gross wages. $2,083.30, rounded to the nearest Calculation $2,083 dollar $168.80 x 3 (506.40) $1,576.60 2. Determine the value for the allowances based on the payroll period. 3. Multiply the allowance value by the employee allowances claimed 4. Subtract allowances from gross pay, referred to as excess wages 5. Using the percentage_table, identify the correct bracket Wages starting at $1,138 but not over $3,523 6. Compute the excess wage over the starting wage for this bracket 7. Multiply the excess by the tax rate in the table, 15% $1,576.60 (1,138.00) $438.60 .15 $65.79 77.80 8. Add the bracket minimum tax, $77.80 9. Add the two amounts together, Sammie's total withholding, $143.59 Common the ball Complete the following: Calculation Carla Conner is married and claims allowances of 4. Also, she got a promotion which, based on her new level, will pay her on a monthly basis. Her pay was increased to $3,745.80. Note: Enter ALL values as positive numbers. Description 1. Determine the amount of gross wages. $3,745.80, rounded to the nearest dollar. 2. Enter the value of the allowances based on the payroll period. 3. Multiply the allowance value by the employee allowances claimed 4. Subtract allowances from grass pay, referred to as excess wages 5. Identify the correct bracket Wages starting at: but not over 6. Determine the value over the starting wage for this bracket 7. Multiply the average by the tax rate in the table (entered as a decimal). 8. Add the bracket minimum tax 9. Add the two amounts together = Total withholding for Carla Conner 2 9 10 Wage Bracket Method Tables for Income Tax Withholding SINGLE PersonsWEEKLY Payroll Period (For Wages Paid through December 31, 2017) And the wages are And the number of withholding allowances claimed is- At least But less 0 1 3 4 5 6 7 8 than The amount of income tax to be withheld is- $600 $610 $75 $63 $52 $40 $28 $17 $9 $2 $0 610 620 77 53 30 10 0 620 630 78 66 55 43 31 20 11 0 630 640 80 68 56 33 21 12 0 640 650 81 69 58 46 34 23 13 0 650 660 71 59 24 14 7 660 670 72 61 37 26 15 8 670 680 86 74 62 51 39 27 16 9 1 680 690 87 75 64 52 40 29 10 2 690 700 89 77 65 54 42 30 19 11 3 $0 $0 65 18 0 2H2B 45679 3888 7 83 48 36 ooooooooo 84 49