Answered step by step

Verified Expert Solution

Question

1 Approved Answer

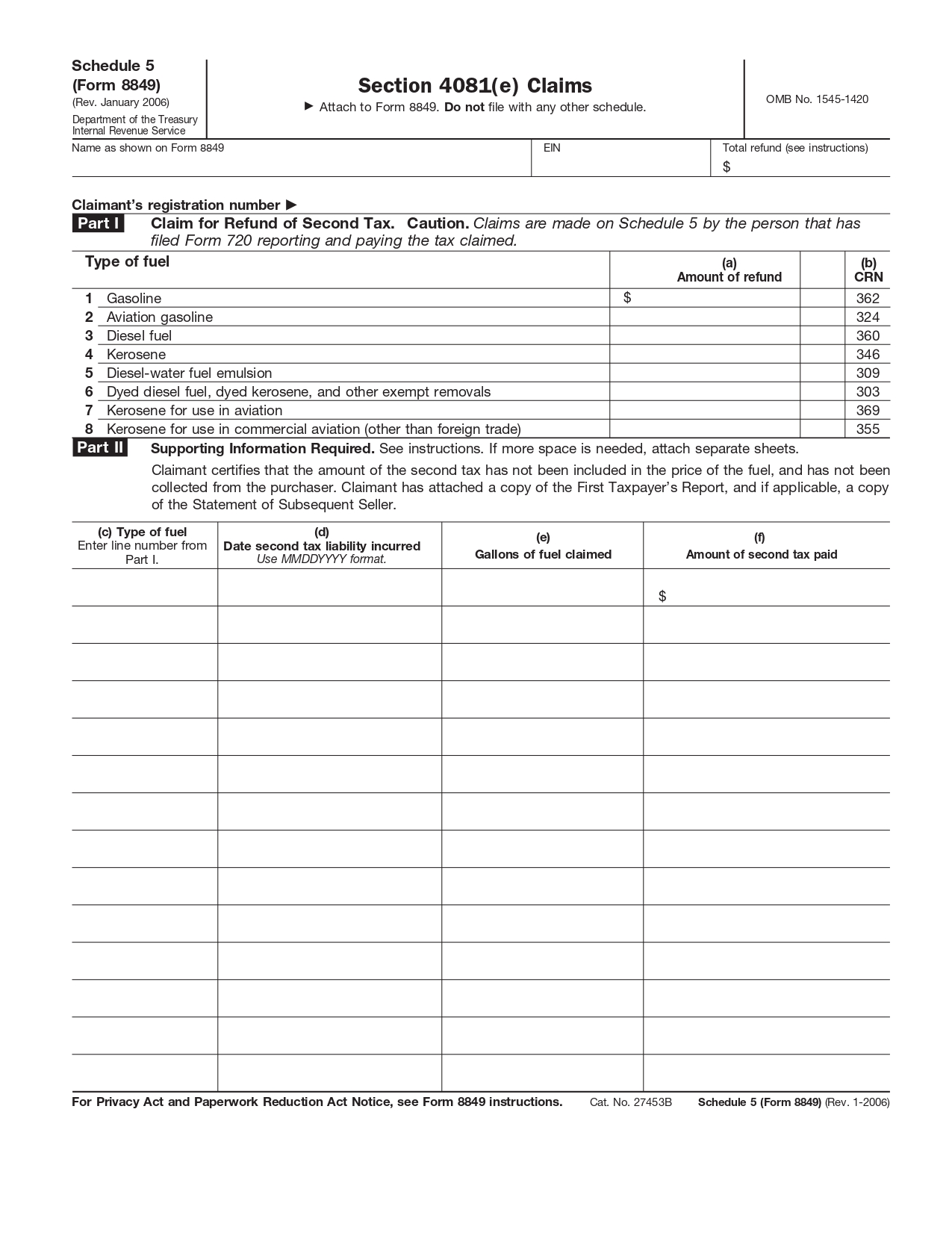

Schedule 5 (Form 8849) (Rev. January 2006) Department of the Treasury Internal Revenue Service Name as shown on Form 8849 Claimant's registration number Part

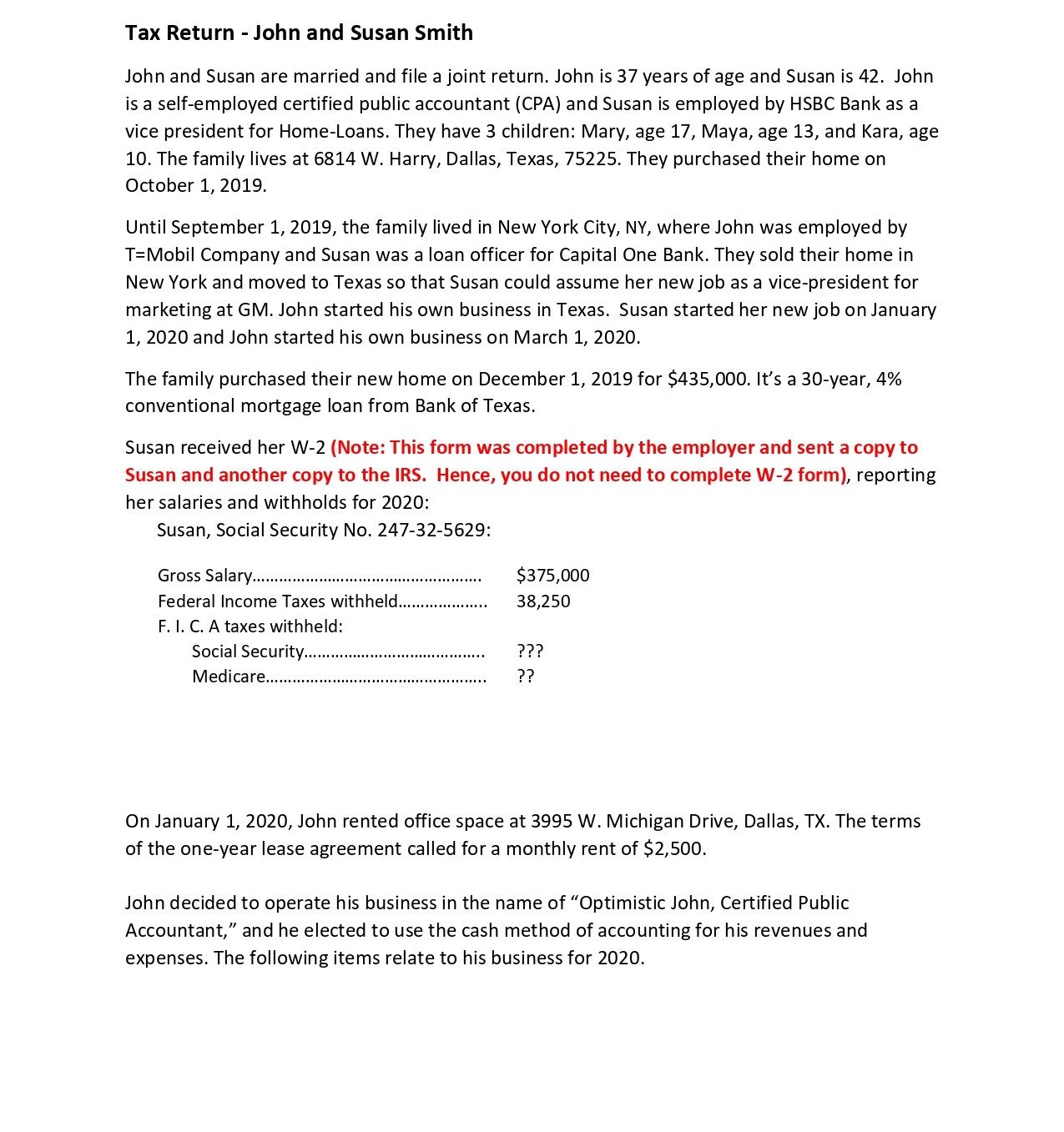

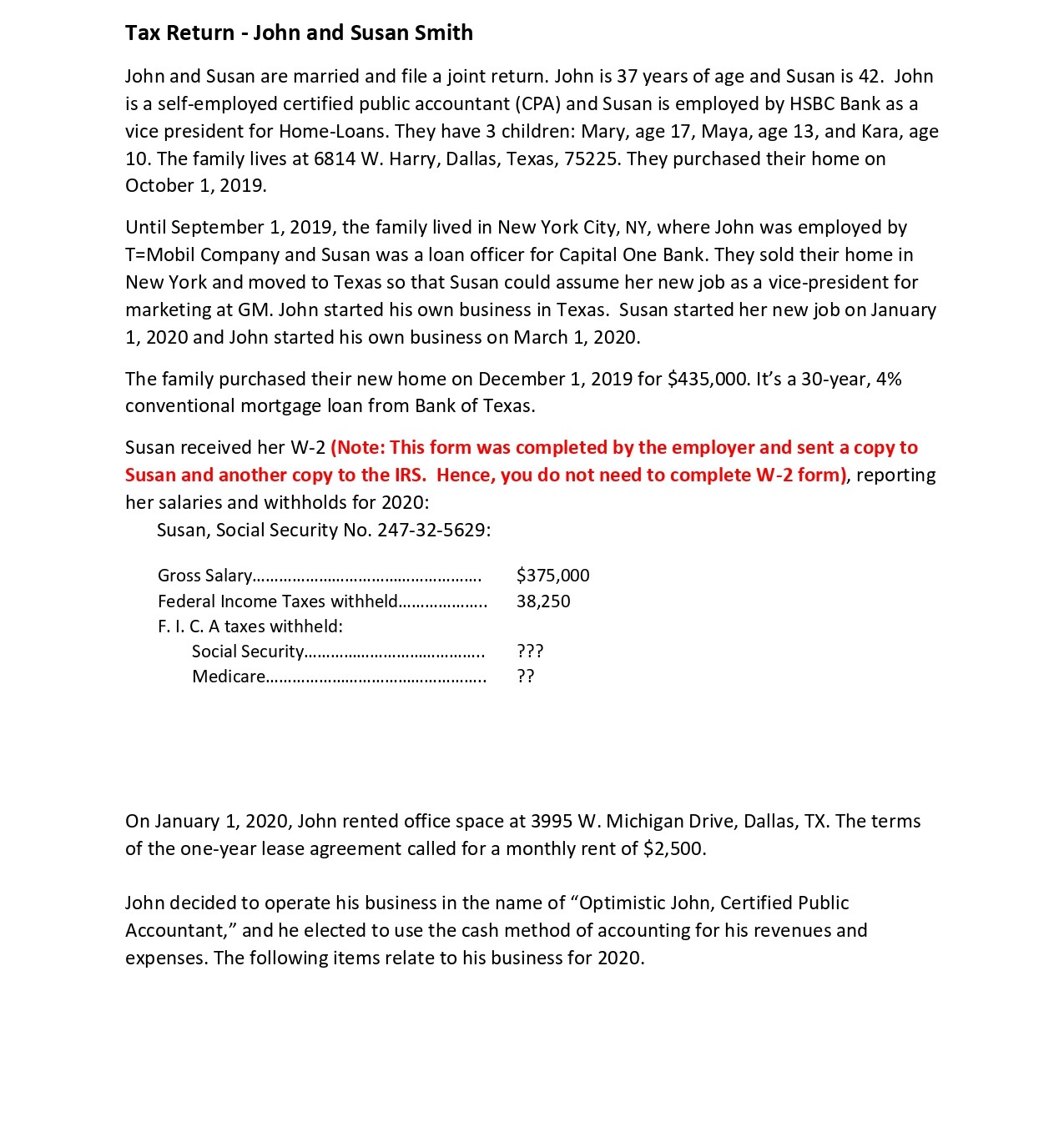

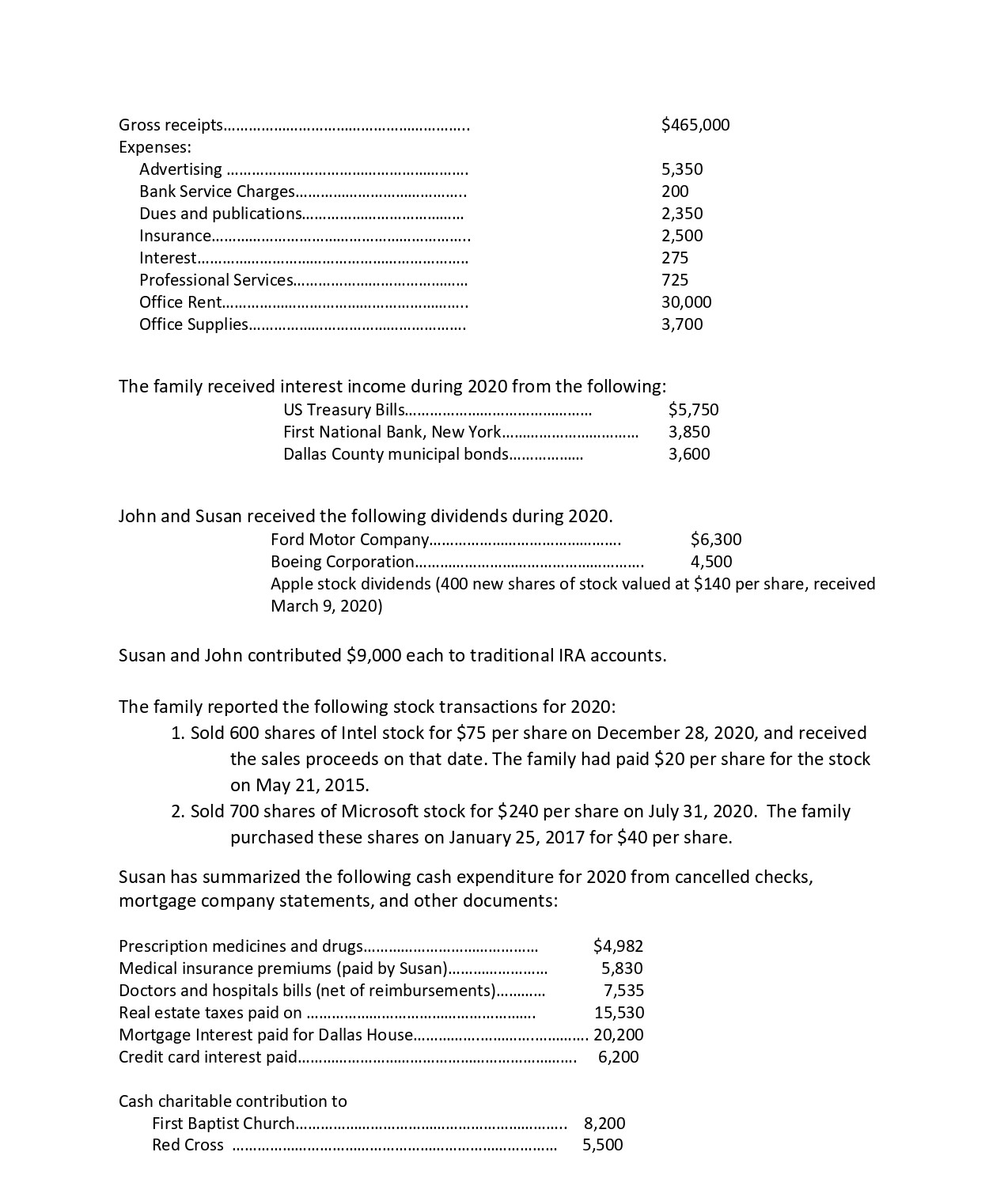

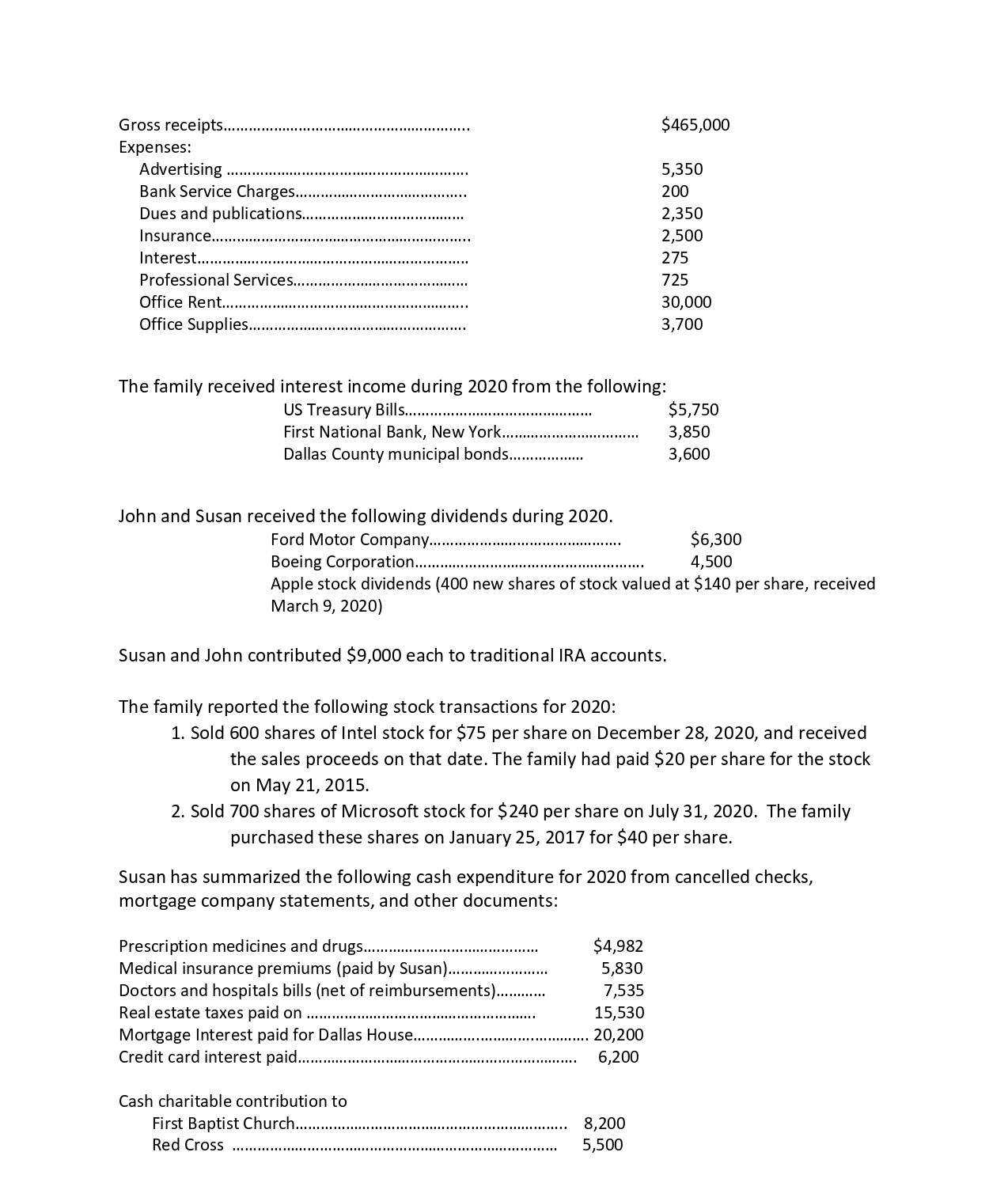

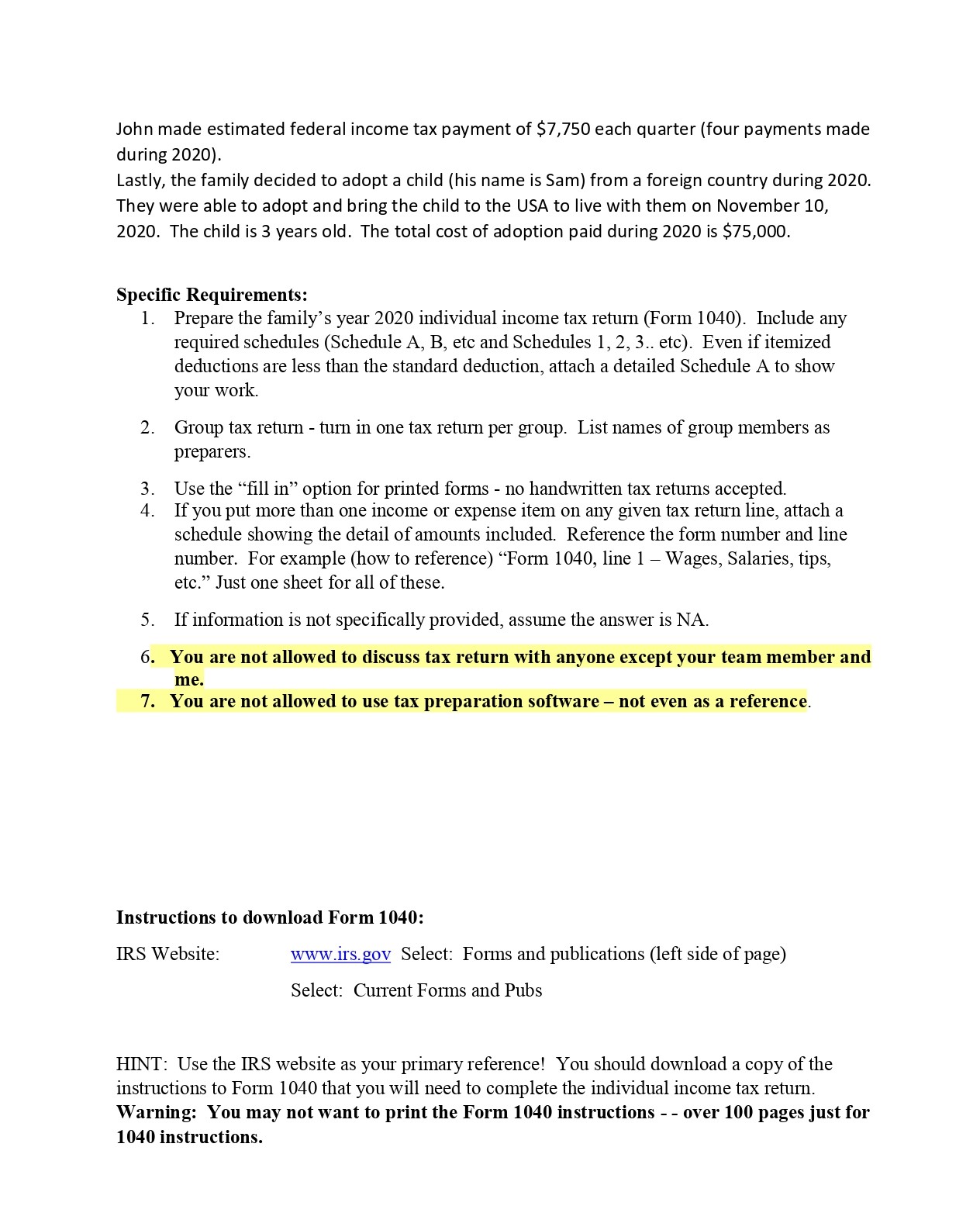

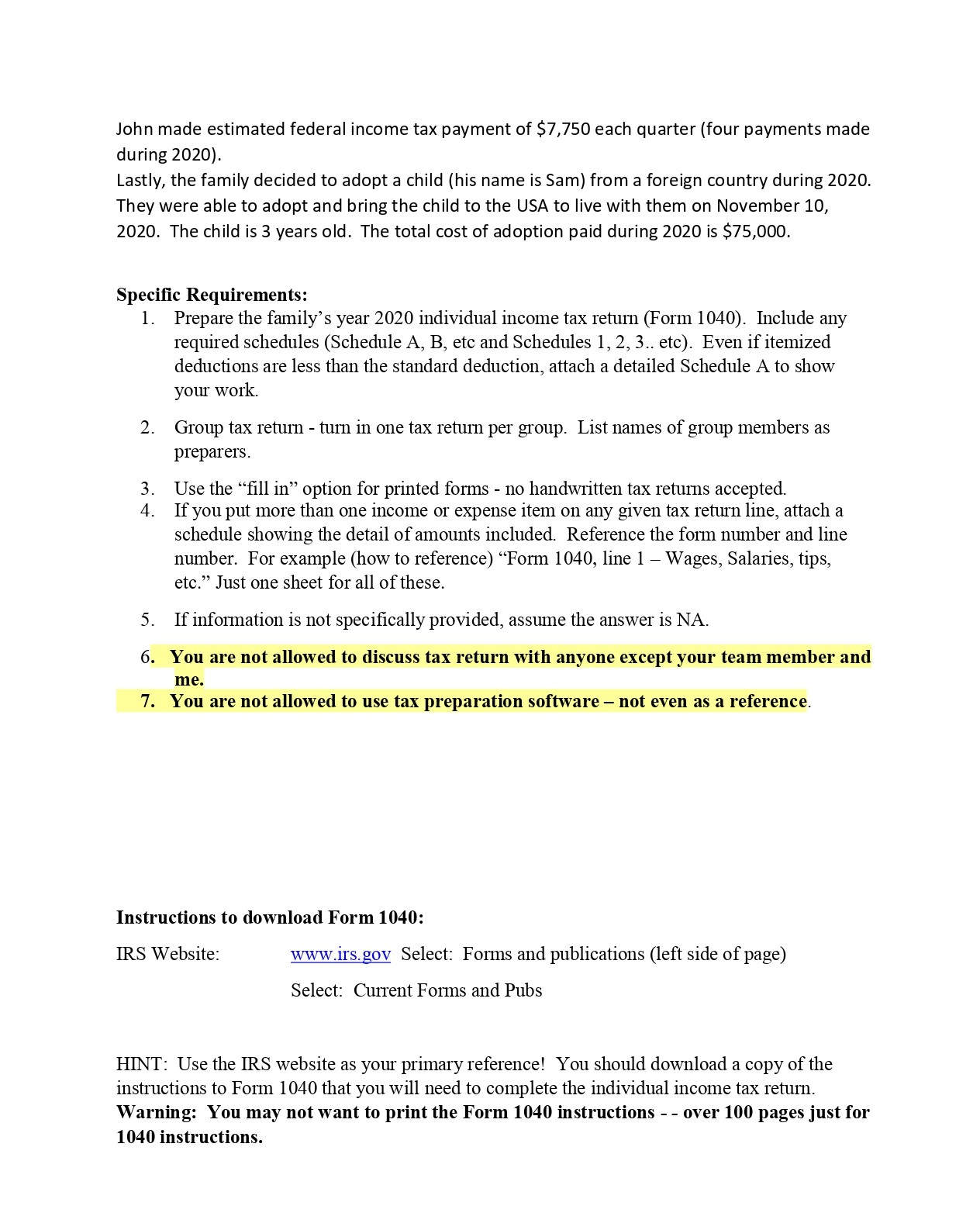

Schedule 5 (Form 8849) (Rev. January 2006) Department of the Treasury Internal Revenue Service Name as shown on Form 8849 Claimant's registration number Part I Section 4081(e) Claims Attach to Form 8849. Do not file with any other schedule. 1 Gasoline 2 Aviation gasoline 3 Diesel fuel EIN Claim for Refund of Second Tax. Caution. Claims are made on Schedule 5 by the person that has filed Form 720 reporting and paying the tax claimed. Type of fuel (c) Type of fuel (d) Enter line number from Date second tax liability incurred Part I. Use MMDDYYYY format. $ Gallons of fuel claimed OMB No. 1545-1420 4 Kerosene 5 Diesel-water fuel emulsion 6 Dyed diesel fuel, dyed kerosene, and other exempt removals 7 Kerosene for use in aviation 8 Kerosene for use in commercial aviation (other than foreign trade) Part II Supporting Information Required. See instructions. If more space is needed, attach separate sheets. Total refund (see instructions) $ $ For Privacy Act and Paperwork Reduction Act Notice, see Form 8849 instructions. Cat. No. 27453B (a) Amount of refund Claimant certifies that the amount of the second tax has not been included in the price of the fuel, and has not been collected from the purchaser. Claimant has attached a copy of the First Taxpayer's Report, and if applicable, a copy of the Statement of Subsequent Seller. (b) CRN (1) Amount of second tax paid 362 324 360 346 309 303 369 355 Schedule 5 (Form 8849) (Rev. 1-2006) Schedule 5 (Form 8849) (Rev. 1-2006) Instructions Section references are to the Internal Revenue Code. What's New Line 5 is used for section 4081 (e) claims for a diesel-water fuel emulsion, effective after December 31, 2005. Line 6 is used for section 4081 (e) claims for dyed diesel fuel, dyed kerosene, and other exempt removals, effective after September 30, 2005. See Line 6 below for the fuels applicable on line 6. Claims relating to kerosene for use in aviation are completely revised, effective after September 30, 2005. Aviation-grade kerosene has been deleted from line 5. Lines 7 and 8 have been added for kerosene for use in aviation. For section 4081(e) claims related to aviation-grade kerosene before October 1, 2005, use the February 2005 revision of Schedule 5 (Form 8849). Purpose of Schedule A person who has paid and reported a section 4081 tax to the government on taxable fuel uses Schedule 5 to claim a refund of that tax if a prior section 4081 tax on that fuel has also been paid and reported to the government. Section 4081(e) Claims Section 4081(e) applies to the fuels listed in Part I. If two taxes were paid on the fuel for which the claim is filed, then a claim for refund of the second tax may be made. Example. Janet is a taxable fuel registrant that owns 10,000 gallons of gasoline that is being transported on a vessel in the United States. On June 1, 2006, Janet sells the gasoline to Hazel, a person that is not a taxable fuel registrant. Janet is liable for tax on this sale. Janet prepares a First Taxpayer's Report related to this sale and gives a copy of the report to Hazel. On June 4, 2006, Hazel sells the same gallons of gasoline to Caroline, a taxable fuel registrant. Hazel also gives Caroline a copy of Janet's First Taxpayer's Report and a Statement of Subsequent Seller. On June 9, 2006, the gasoline is removed from a terminal at the rack. Caroline is the position holder of the gasoline at the time of the removal and thus is liable for tax on the removal. Caroline pays this tax to the government. After Caroline has filed a return of this second tax, Caroline files Form 8849 and Schedule 5 for a refund for the second tax and includes a copy of the First Taxpayer's Report and Statement of Subsequent Seller. In Part I of Schedule 5, Caroline enters "1,840.00" in column 1(a). In Part II, Caroline enters "1" in column (c); "06092006" in column (d); "10,000.00" in column (e); and "1,840.00" in column (f). Claimant The person who reported on Form 720 and paid the second tax to the government on the same fuel is the only person eligible to make this claim. Page 2 Claim Requirement Generally, the claim must be filed within 3 years from the time the return for the second tax was filed or 2 years from the time the second tax was paid to the government, whichever is later. Total Refund Add all amounts in column (a) and enter the result in the total refund box at the top of the Schedule. Part I For each type of fuel, enter the total of all amounts from column (f), Part II. Line 6. Section 4081(e) claims can be made on line 6 for the tax on the following fuels: dyed diesel fuel, dyed kerosene, and other exempt removals (gasoline blendstocks, kerosene used for a feedstock, and diesel fuel or kerosene used in Alaska). The person that has reported a section 4081 tax on Form 720 and paid that tax to the government, if a prior section 4081 tax on the fuel has also been paid and reported to the government, makes the claim. Line 7. Section 4081(e) claims can be made for kerosene for use in aviation by a person that has reported a section 4081 tax on Form 720 (IRS No. 69) and paid that tax to the government if a prior section 4081 tax on the kerosene has also been paid and reported to the government. Line 8. Section 4081(e) claims can be made for kerosene for use in commercial aviation (other than foreign trade) by a person that has reported a section 4081 tax on Form 720 (IRS No. 77) and paid that tax to the government if a prior section 4081 tax on the kerosene has also been paid and reported to the government. Part II For each payment of a second tax, complete all the information required. Information to be Attached 1. A copy of the First Taxpayer's Report that relates to the fuel covered by each claim and 2. If the fuel covered by the claim was bought from someone other than the first taxpayer, a copy of the Statement of Subsequent Seller that the claimant received with respect to that fuel. The First Taxpayer's Report and Statement of Subsequent Seller must contain all the information as shown in Model Certificates A and B in Appendix B of Pub. 510. How To File Attach Schedule 5 to Form 8849. On the envelope write "Section 4081(e) Claim" and mail to the IRS at the address under Where To File in the Form 8849 instructions. Tax Return - John and Susan Smith John and Susan are married and file a joint return. John is 37 years of age and Susan is 42. John is a self-employed certified public accountant (CPA) and Susan is employed by HSBC Bank as a vice president for Home-Loans. They have 3 children: Mary, age 17, Maya, age 13, and Kara, age 10. The family lives at 6814 W. Harry, Dallas, Texas, 75225. They purchased their home on October 1, 2019. Until September 1, 2019, the family lived in New York City, NY, where John was employed by T-Mobil Company and Susan was a loan officer for Capital One Bank. They sold their home in New York and moved to Texas so that Susan could assume her new job as a vice-president for marketing at GM. John started his own business in Texas. Susan started her new job on January 1, 2020 and John started his own business on March 1, 2020. The family purchased their new home on December 1, 2019 for $435,000. It's a 30-year, 4% conventional mortgage loan from Bank of Texas. Susan received her W-2 (Note: This form was completed by the employer and sent a copy to Susan and another copy to the IRS. Hence, you do not need to complete W-2 form), reporting her salaries and withholds for 2020: Susan, Social Security No. 247-32-5629: Gross Salary.. Federal Income Taxes withheld................ F. I. C. A taxes withheld: Social Security...... Medicare....... $375,000 38,250 ??? ?? On January 1, 2020, John rented office space at 3995 W. Michigan Drive, Dallas, TX. The terms of the one-year lease agreement called for a monthly rent of $2,500. John decided to operate his business in the name of "Optimistic John, Certified Public Accountant," and he elected to use the cash method of accounting for his revenues and expenses. The following items relate to his business for 2020. Tax Return - John and Susan Smith John and Susan are married and file a joint return. John is 37 years of age and Susan is 42. John is a self-employed certified public accountant (CPA) and Susan is employed by HSBC Bank as a vice president for Home-Loans. They have 3 children: Mary, age 17, Maya, age 13, and Kara, age 10. The family lives at 6814 W. Harry, Dallas, Texas, 75225. They purchased their home on October 1, 2019. Until September 1, 2019, the family lived in New York City, NY, where John was employed by T-Mobil Company and Susan was a loan officer for Capital One Bank. They sold their home in New York and moved to Texas so that Susan could assume her new job as a vice-president for marketing at GM. John started his own business in Texas. Susan started her new job on January 1, 2020 and John started his own business on March 1, 2020. The family purchased their new home on December 1, 2019 for $435,000. It's a 30-year, 4% conventional mortgage loan from Bank of Texas. Susan received her W-2 (Note: This form was completed by the employer and sent a copy to Susan and another copy to the IRS. Hence, you do not need to complete W-2 form), reporting her salaries and withholds for 2020: Susan, Social Security No. 247-32-5629: Gross Salary.. Federal Income Taxes withheld................ F. I. C. A taxes withheld: Social Security...... Medicare....... $375,000 38,250 ??? ?? On January 1, 2020, John rented office space at 3995 W. Michigan Drive, Dallas, TX. The terms of the one-year lease agreement called for a monthly rent of $2,500. John decided to operate his business in the name of "Optimistic John, Certified Public Accountant," and he elected to use the cash method of accounting for his revenues and expenses. The following items relate to his business for 2020. Gross receipts.. Expenses: Advertising Bank Service Charges... Dues and publications... Insurance........... Interest....... Professional Services.. Office Rent....... Office Supplies..... John and Susan received the following dividends during 2020. Ford Motor Company... The family received interest income during 2020 from the following: US Treasury Bills........ First National Bank, New York.... Dallas County municipal bonds.. $465,000 $6,300 Boeing Corporation...... 4,500 Apple stock dividends (400 new shares of stock valued at $140 per share, received March 9, 2020) Prescription medicines and drugs..... Medical insurance premiums (paid by Susan).. Doctors and hospitals bills (net of reimbursements).. 5,350 200 2,350 2,500 275 725 Susan and John contributed $9,000 each to traditional IRA accounts. Real estate taxes paid on Mortgage Interest paid for Dallas House.... Credit card interest paid....... 30,000 3,700 The family reported the following stock transactions for 2020: 1. Sold 600 shares of Intel stock for $75 per share on December 28, 2020, and received the sales proceeds on that date. The family had paid $20 per share for the stock on May 21, 2015. 2. Sold 700 shares of Microsoft stock for $240 per share on July 31, 2020. The family purchased these shares on January 25, 2017 for $40 per share. Cash charitable contribution to First Baptist Church... Red Cross Susan has summarized the following cash expenditure for 2020 from cancelled checks, mortgage company statements, and other documents: $4,982 5,830 7,535 15,530 20,200 6,200 $5,750 3,850 3,600 8,200 5,500 Gross receipts.. Expenses: Advertising Bank Service Charges... Dues and publications... Insurance........... Interest....... Professional Services.. Office Rent....... Office Supplies..... John and Susan received the following dividends during 2020. Ford Motor Company... The family received interest income during 2020 from the following: US Treasury Bills........ First National Bank, New York.... Dallas County municipal bonds.. $465,000 $6,300 Boeing Corporation...... 4,500 Apple stock dividends (400 new shares of stock valued at $140 per share, received March 9, 2020) Prescription medicines and drugs..... Medical insurance premiums (paid by Susan).. Doctors and hospitals bills (net of reimbursements).. 5,350 200 2,350 2,500 275 725 Susan and John contributed $9,000 each to traditional IRA accounts. Real estate taxes paid on Mortgage Interest paid for Dallas House.... Credit card interest paid....... 30,000 3,700 The family reported the following stock transactions for 2020: 1. Sold 600 shares of Intel stock for $75 per share on December 28, 2020, and received the sales proceeds on that date. The family had paid $20 per share for the stock on May 21, 2015. 2. Sold 700 shares of Microsoft stock for $240 per share on July 31, 2020. The family purchased these shares on January 25, 2017 for $40 per share. Cash charitable contribution to First Baptist Church... Red Cross Susan has summarized the following cash expenditure for 2020 from cancelled checks, mortgage company statements, and other documents: $4,982 5,830 7,535 15,530 20,200 6,200 $5,750 3,850 3,600 8,200 5,500 John made estimated federal income tax payment of $7,750 each quarter (four payments made during 2020). Lastly, the family decided to adopt a child (his name is Sam) from a foreign country during 2020. They were able to adopt and bring the child to the USA to live with them on November 10, 2020. The child is 3 years old. The total cost of adoption paid during 2020 is $75,000. Specific Requirements: 1. Prepare the family's year 2020 individual income tax return (Form 1040). Include any required schedules (Schedule A, B, etc and Schedules 1, 2, 3.. etc). Even if itemized deductions are less than the standard deduction, attach a detailed Schedule A to show your work. 2. Group tax return - turn in one tax return per group. List names of group members as preparers. 4. 3. Use the "fill in" option for printed forms - no handwritten tax returns accepted. If you put more than one income or expense item on any given tax return line, attach a schedule showing the detail of amounts included. Reference the form number and line number. For example (how to reference) "Form 1040, line 1 - Wages, Salaries, tips, etc." Just one sheet for all of these. 5. If information is not specifically provided, assume the answer is NA. 6. You are not allowed to discuss tax return with anyone except your team member and me. 7. You are not allowed to use tax preparation software - not even as a reference. Instructions to download Form 1040: IRS Website: www.irs.gov Select: Forms and publications (left side of page) Select: Current Forms and Pubs HINT: Use the IRS website as your primary reference! You should download a copy of the instructions to Form 1040 that you will need to complete the individual income tax return. Warning: You may not want to print the Form 1040 instructions - - over 100 pages just for 1040 instructions. John made estimated federal income tax payment of $7,750 each quarter (four payments made during 2020). Lastly, the family decided to adopt a child (his name is Sam) from a foreign country during 2020. They were able to adopt and bring the child to the USA to live with them on November 10, 2020. The child is 3 years old. The total cost of adoption paid during 2020 is $75,000. Specific Requirements: 1. Prepare the family's year 2020 individual income tax return (Form 1040). Include any required schedules (Schedule A, B, etc and Schedules 1, 2, 3.. etc). Even if itemized deductions are less than the standard deduction, attach a detailed Schedule A to show your work. 2. Group tax return - turn in one tax return per group. List names of group members as preparers. 4. 3. Use the "fill in" option for printed forms - no handwritten tax returns accepted. If you put more than one income or expense item on any given tax return line, attach a schedule showing the detail of amounts included. Reference the form number and line number. For example (how to reference) "Form 1040, line 1 - Wages, Salaries, tips, etc." Just one sheet for all of these. 5. If information is not specifically provided, assume the answer is NA. 6. You are not allowed to discuss tax return with anyone except your team member and me. 7. You are not allowed to use tax preparation software - not even as a reference. Instructions to download Form 1040: IRS Website: www.irs.gov Select: Forms and publications (left side of page) Select: Current Forms and Pubs HINT: Use the IRS website as your primary reference! You should download a copy of the instructions to Form 1040 that you will need to complete the individual income tax return. Warning: You may not want to print the Form 1040 instructions - - over 100 pages just for 1040 instructions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations for the Schedule 5 claim Part 1 Claim for Refund of Second Tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started