Answered step by step

Verified Expert Solution

Question

1 Approved Answer

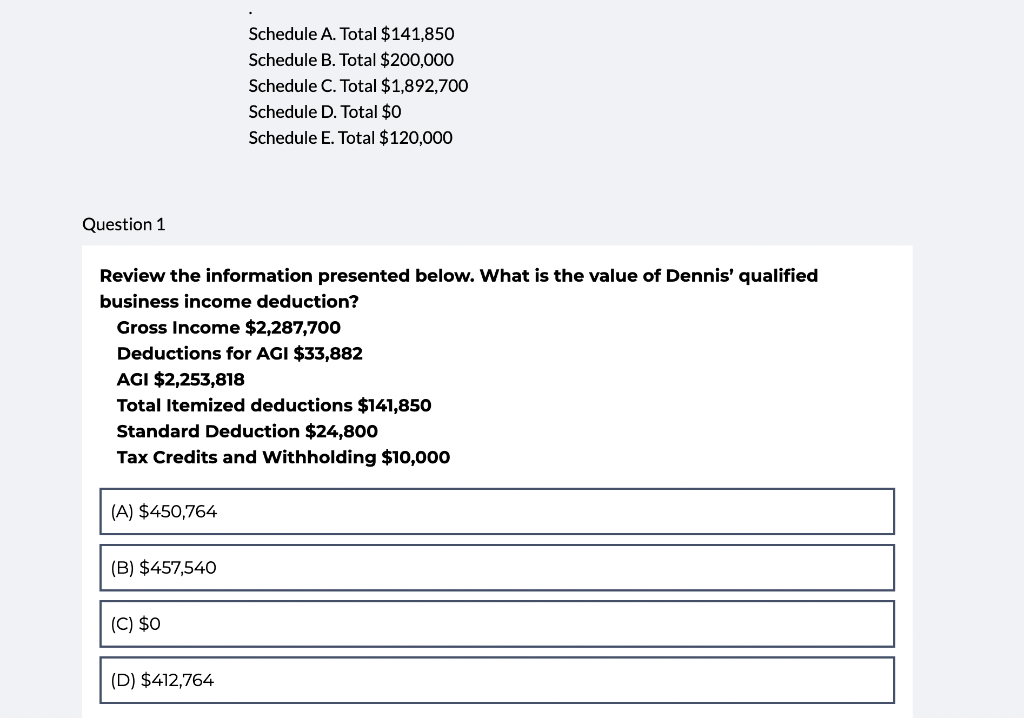

Schedule A. Total $141,850 Schedule B. Total $200,000 Schedule C. Total $1,892,700 Schedule D. Total $0 Schedule E. Total $120,000 Question 1 Review the information

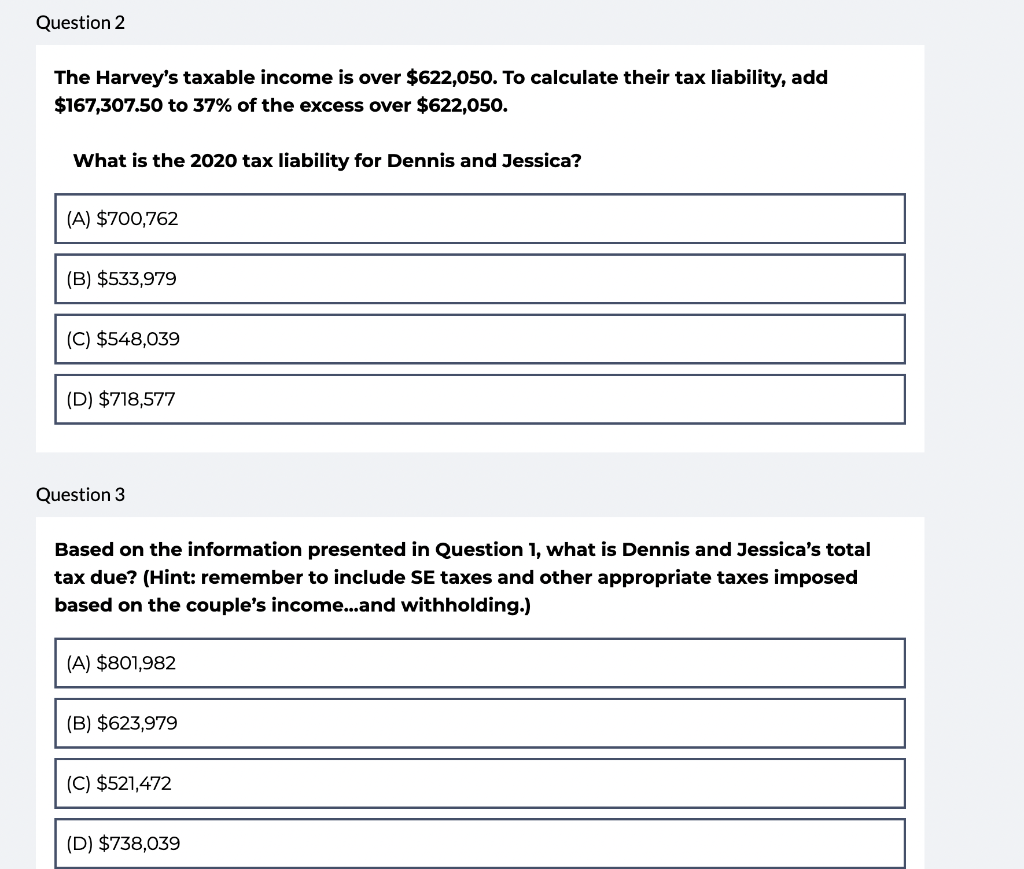

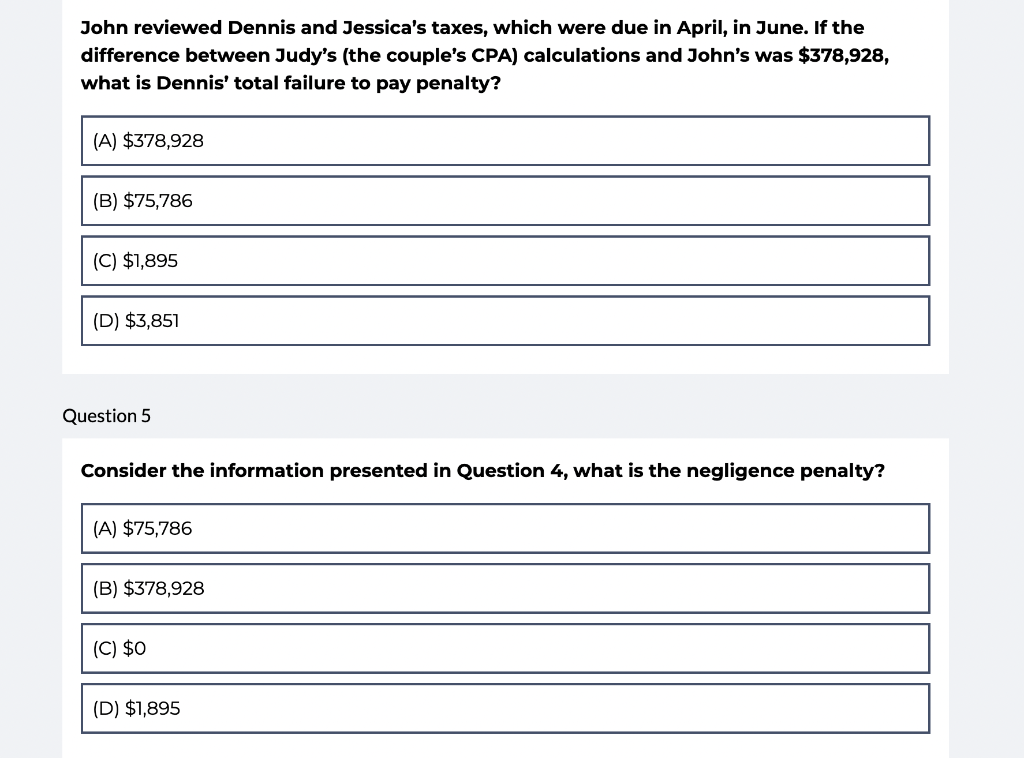

Schedule A. Total $141,850 Schedule B. Total $200,000 Schedule C. Total $1,892,700 Schedule D. Total $0 Schedule E. Total $120,000 Question 1 Review the information presented below. What is the value of Dennis' qualified business income deduction? Gross Income $2,287,700 Deductions for AGI $33,882 AGI $2,253,818 Total Itemized deductions $141,850 Standard Deduction $24,800 Tax Credits and Withholding $10,000 (A) $450,764 (B) $457,540 (C) $0 (D) $412,764 Question 2 The Harvey's taxable income is over $622,050. To calculate their tax liability, add $167,307.50 to 37% of the excess over $622,050. What is the 2020 tax liability for Dennis and Jessica? (A) $700,762 (B) $533,979 (C) $548,039 (D) $718,577 Question 3 Based on the information presented in Question 1, what is Dennis and Jessica's total tax due? (Hint: remember to include SE taxes and other appropriate taxes imposed based on the couple's income...and withholding.) (A) $801,982 (B) $623,979 (C) $521,472 (D) $738,039 John reviewed Dennis and Jessica's taxes, which were due in April, in June. If the difference between Judy's (the couple's CPA) calculations and John's was $378,928, what is Dennis' total failure to pay penalty? (A) $378,928 (B) $75,786 (C) $1,895 (D) $3,851 Question 5 Consider the information presented in Question 4, what is the negligence penalty? (A) $75,786 (B) $378,928 (C) $0 (D) $1,895 Schedule A. Total $141,850 Schedule B. Total $200,000 Schedule C. Total $1,892,700 Schedule D. Total $0 Schedule E. Total $120,000 Question 1 Review the information presented below. What is the value of Dennis' qualified business income deduction? Gross Income $2,287,700 Deductions for AGI $33,882 AGI $2,253,818 Total Itemized deductions $141,850 Standard Deduction $24,800 Tax Credits and Withholding $10,000 (A) $450,764 (B) $457,540 (C) $0 (D) $412,764 Question 2 The Harvey's taxable income is over $622,050. To calculate their tax liability, add $167,307.50 to 37% of the excess over $622,050. What is the 2020 tax liability for Dennis and Jessica? (A) $700,762 (B) $533,979 (C) $548,039 (D) $718,577 Question 3 Based on the information presented in Question 1, what is Dennis and Jessica's total tax due? (Hint: remember to include SE taxes and other appropriate taxes imposed based on the couple's income...and withholding.) (A) $801,982 (B) $623,979 (C) $521,472 (D) $738,039 John reviewed Dennis and Jessica's taxes, which were due in April, in June. If the difference between Judy's (the couple's CPA) calculations and John's was $378,928, what is Dennis' total failure to pay penalty? (A) $378,928 (B) $75,786 (C) $1,895 (D) $3,851 Question 5 Consider the information presented in Question 4, what is the negligence penalty? (A) $75,786 (B) $378,928 (C) $0 (D) $1,895

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started