Answered step by step

Verified Expert Solution

Question

1 Approved Answer

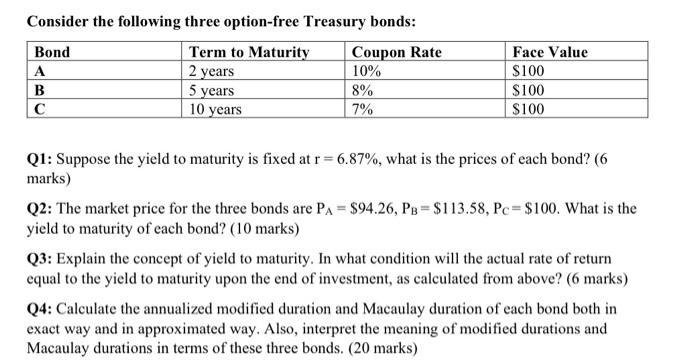

Consider the following three option-free Treasury bonds: Bond Term to Maturity A 2 years B 5 years C 10 years Coupon Rate 10% 8%

Consider the following three option-free Treasury bonds: Bond Term to Maturity A 2 years B 5 years C 10 years Coupon Rate 10% 8% 7% Face Value $100 $100 $100 Q1: Suppose the yield to maturity is fixed at r= 6.87%, what is the prices of each bond? (6 marks) Q2: The market price for the three bonds are PA = $94.26, PB = $113.58, Pc=$100. What is the yield to maturity of each bond? (10 marks) Q3: Explain the concept of yield to maturity. In what condition will the actual rate of return equal to the yield to maturity upon the end of investment, as calculated from above? (6 marks) Q4: Calculate the annualized modified duration and Macaulay duration of each bond both in exact way and in approximated way. Also, interpret the meaning of modified durations and Macaulay durations in terms of these three bonds. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 The prices of the three bonds are PA 9426 PB 11358 and Pc 100 2 The yield to matur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started