Question

Schedule B Keisha Patel (age 41) is an employee in ABC Consulting Group. She is requesting you, as one of the company's tax accountants, to

Schedule B

Keisha Patel (age 41) is an employee in ABC Consulting Group. She is requesting you, as one of the company's tax accountants, to handle her tax material for the current year. To assist you, the following information for the current tax year that is pertinent to her is provided in the following table. Below is the income that Keisha realized during the year.

| Keisha Patel Income | |

| Income Sources | Amounts |

| W-2 income | $122,000 |

| Form 1099-INT (1) | 5,500 |

| Qualified cash dividend (2) | 4,800 |

| Distribution from IRA (3) | 10,000 |

| Jury duty compensation | 105 |

| State income tax refund for prior year (4) | 1,200 |

Note (1): Keisha purchased Alley Corporation bonds between interest periods and paid $1,200 in accrued interest.

Note (2): Keisha received a qualified dividend payment from ABC Corporation of $4,800.

Note (3): Keisha withdrew the money for the tuition payment of her daughter, who is attending the university. All of Keisha's contributions to her IRA were deductible. Keisha also participates in her employer-sponsored 401(k) plan.

Note (4): Keisha itemized in the prior year.

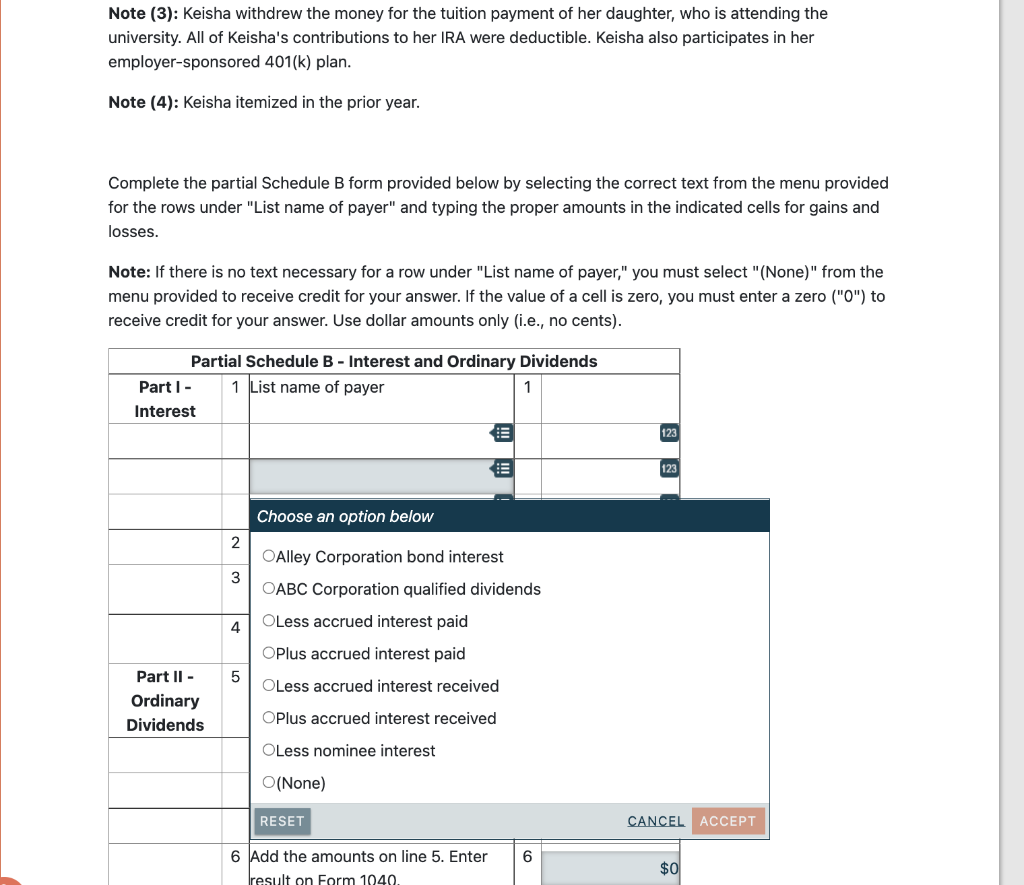

Complete the partial Schedule B form provided below by selecting the correct text from the menu provided for the rows under "List name of payer" and typing the proper amounts in the indicated cells for gains and losses.

Note: If there is no text necessary for a row under "List name of payer," you must select "(None)" from the menu provided to receive credit for your answer. If the value of a cell is zero, you must enter a zero ("0") to receive credit for your answer. Use dollar amounts only (i.e., no cents).

| Partial Schedule B - Interest and Ordinary Dividends | ||||

| Part I - Interest | 1 | List name of payer | 1 | |

| answer | answer | |||

| answer | answer | |||

| answer | answer | |||

| 2 | Add the amounts on line 1. | 2 | $0 | |

| 3 | Excludable interest on Series EE and I U.S. savings bonds | 3 | answer | |

| 4 | Subtract line 3 from line 2. Enter result on Form 1040. | 4 | $0 | |

| Part II - Ordinary Dividends | 5 | List name of payer | 5 | |

| answer | answer | |||

| answer | answer | |||

| answer | answer | |||

| 6 | Add the amounts on line 5. Enter result on Form 1040. | 6 | $0 | |

Possible Answer for Middle Section

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started