Answered step by step

Verified Expert Solution

Question

1 Approved Answer

schedule C. i don't if I am right. please help me this is 2022 tax Cassi (SSN 412-34-5670) has a home cleaning business she runs

schedule C. i don't if I am right. please help me this is 2022 tax

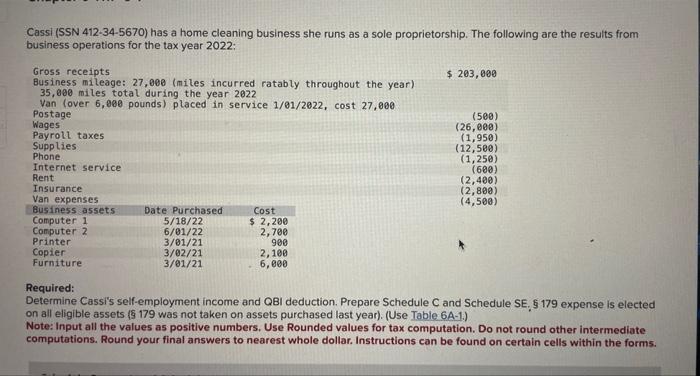

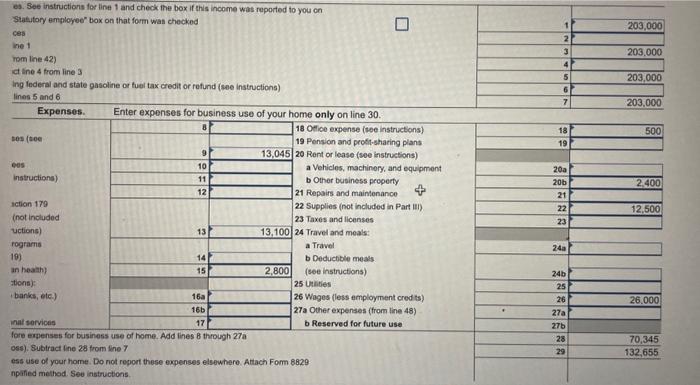

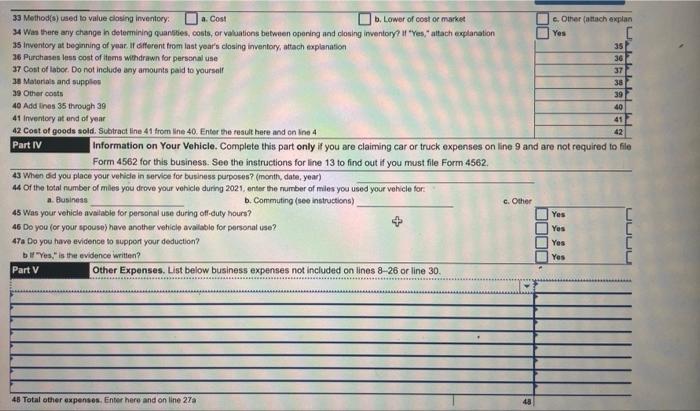

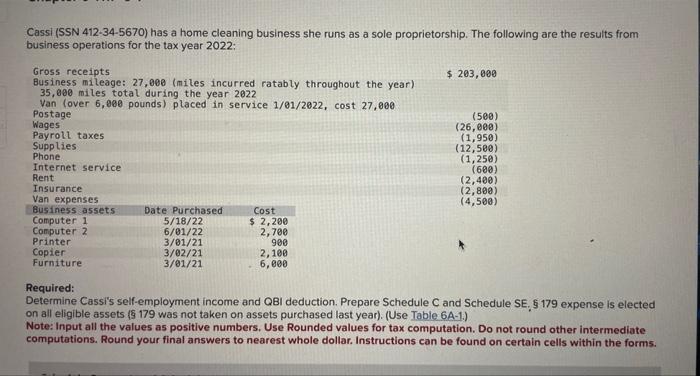

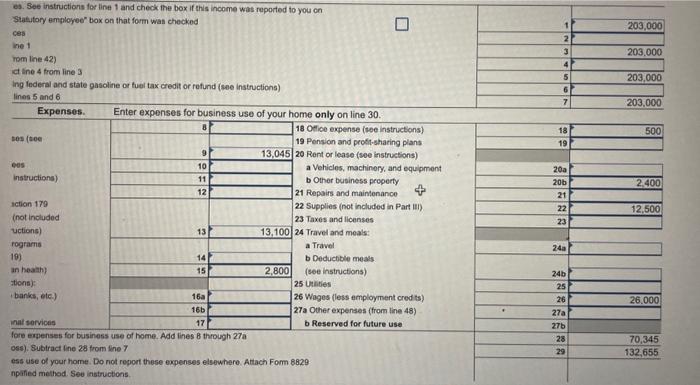

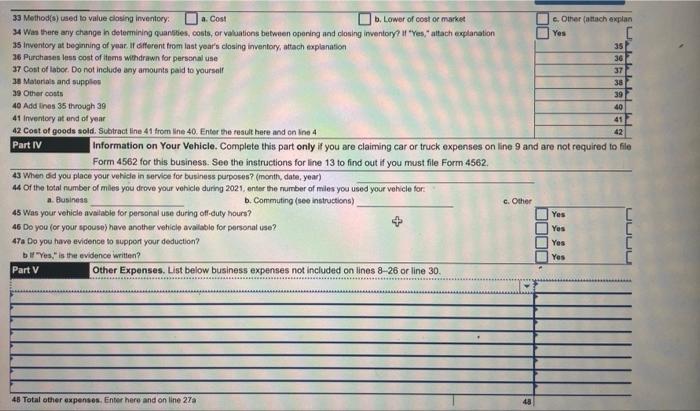

Cassi (SSN 412-34-5670) has a home cleaning business she runs as a sole proprietorship. The following are the results from business operations for the tax year 2022 ; Required: Determine Cassi's self-employment income and QBI deduction. Prepare Schedule C and Schedule SE, $179 expense is elected on all eligible assets (\$ 179 was not taken on assets purchased last year). (Use Table 6A-1.) Note: Input all the values as positive numbers. Use Rounded values for tax computation. Do not round other intermediate computations. Round your final answers to nearest whole dollar. Instructions can be found on certain cells within the forms. es. See instructions for line 1 and check the box if this income wat reported to you cn Statutory empleyeo" box on that form was checked ces ine 1 rom line 42) it ine 4 from line 3 ing lederal and state gasoline or fuel tax credit or refund (see instructions) lines 5 and 6 \begin{tabular}{|l|l|} \hline & \\ \hline 1 & 203,000 \\ \hline 2 & \\ \hline 3 & 203,000 \\ \hline 4 & \\ \hline 5 & 203,000 \\ \hline 6 & \\ \hline 7 & 203.000 \\ \hline \end{tabular} Expenses. Enter expenses for business use of your home only on line 30 . ses (toe ess instructions) 18 Ollice expense (see instructions) 19 Pension and profirsharing plans Iction 179 (not included uctions) rograms 19) an hoalh) thons): banks, ete. inat servicas fore erpenses for business use of home. Add lines 8 through 27 a oss). Subtract ine 28 trom line 7 ess use of your home. Do not report these expenses elsowhere. Attach Fom 8829 npafied method. See instructions. 33 Method(s) ased to value closing inventory: a. Cost b. Lower of cost or market 34 Was there any change in determiring quansies, costs, or valuations between onering and closing inventory? If "Yes," altach erplanation 15 inventory at beginning of year. If dfferent trom last year's ciosing inventory, attach explanation 16 Purchases less cost of items withdrawn for personal use 37 Cost of labor. Do not include any amounts paid to yoursaif 18 Matorials and supplios 29 Cther costs 40 Add lines 35 through 39 41 inventory at and of year 42. Cost of goods sold. Subtract line 41 from line 40 . Enter the fesilt here and en ine 4 Cassi (SSN 412-34-5670) has a home cleaning business she runs as a sole proprietorship. The following are the results from business operations for the tax year 2022 ; Required: Determine Cassi's self-employment income and QBI deduction. Prepare Schedule C and Schedule SE, $179 expense is elected on all eligible assets (\$ 179 was not taken on assets purchased last year). (Use Table 6A-1.) Note: Input all the values as positive numbers. Use Rounded values for tax computation. Do not round other intermediate computations. Round your final answers to nearest whole dollar. Instructions can be found on certain cells within the forms. es. See instructions for line 1 and check the box if this income wat reported to you cn Statutory empleyeo" box on that form was checked ces ine 1 rom line 42) it ine 4 from line 3 ing lederal and state gasoline or fuel tax credit or refund (see instructions) lines 5 and 6 \begin{tabular}{|l|l|} \hline & \\ \hline 1 & 203,000 \\ \hline 2 & \\ \hline 3 & 203,000 \\ \hline 4 & \\ \hline 5 & 203,000 \\ \hline 6 & \\ \hline 7 & 203.000 \\ \hline \end{tabular} Expenses. Enter expenses for business use of your home only on line 30 . ses (toe ess instructions) 18 Ollice expense (see instructions) 19 Pension and profirsharing plans Iction 179 (not included uctions) rograms 19) an hoalh) thons): banks, ete. inat servicas fore erpenses for business use of home. Add lines 8 through 27 a oss). Subtract ine 28 trom line 7 ess use of your home. Do not report these expenses elsowhere. Attach Fom 8829 npafied method. See instructions. 33 Method(s) ased to value closing inventory: a. Cost b. Lower of cost or market 34 Was there any change in determiring quansies, costs, or valuations between onering and closing inventory? If "Yes," altach erplanation 15 inventory at beginning of year. If dfferent trom last year's ciosing inventory, attach explanation 16 Purchases less cost of items withdrawn for personal use 37 Cost of labor. Do not include any amounts paid to yoursaif 18 Matorials and supplios 29 Cther costs 40 Add lines 35 through 39 41 inventory at and of year 42. Cost of goods sold. Subtract line 41 from line 40 . Enter the fesilt here and en ine 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To help Cassi determine her selfemployment income and Qualified Business Income QBI deduction we nee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started