Question

Tran Company has for its first year of operations had the following production, cost and price data: Selling price $100; Materials per unit $2;

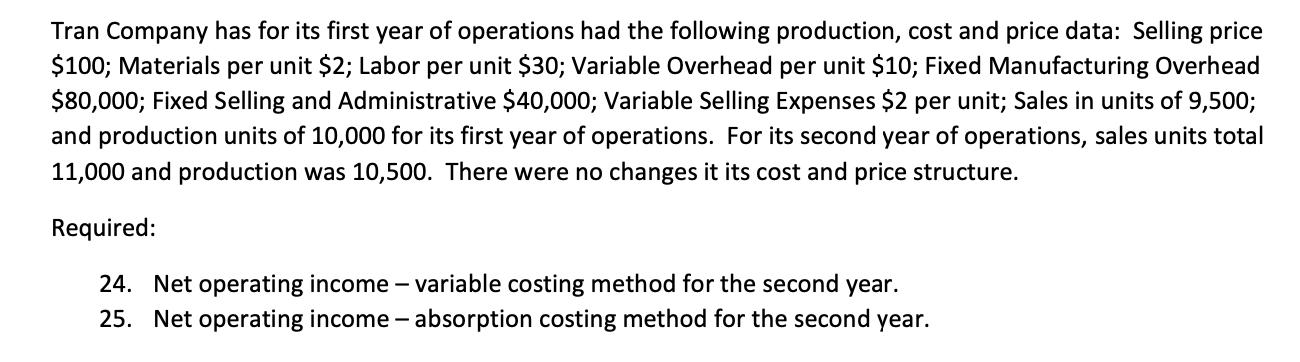

Tran Company has for its first year of operations had the following production, cost and price data: Selling price $100; Materials per unit $2; Labor per unit $30; Variable Overhead per unit $10; Fixed Manufacturing Overhead $80,000; Fixed Selling and Administrative $40,000; Variable Selling Expenses $2 per unit; Sales in units of 9,500; and production units of 10,000 for its first year of operations. For its second year of operations, sales units total 11,000 and production was 10,500. There were no changes it its cost and price structure. Required: 24. Net operating income - variable costing method for the second year. 25. Net operating income - absorption costing method for the second year.

Step by Step Solution

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

24 Net operating income variable costing method for the second ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2015

Authors: William H. Hoffman, William A. Raabe, David M. Maloney, James C. Young

38th Edition

978-1305310810, 1305310810, 978-1285439631

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App