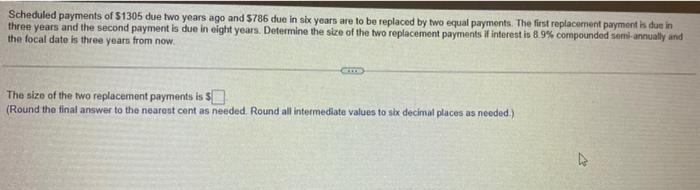

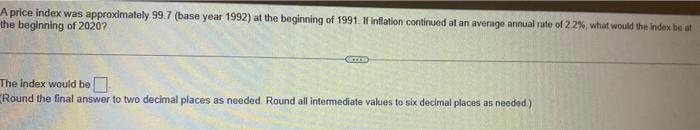

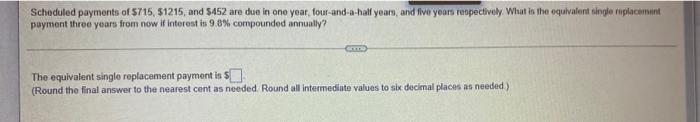

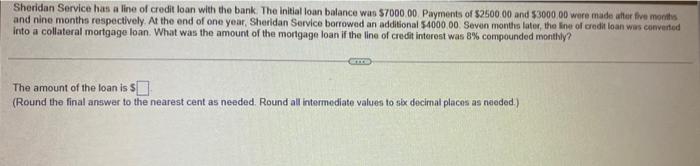

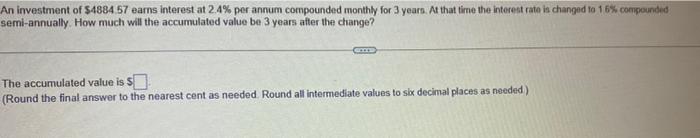

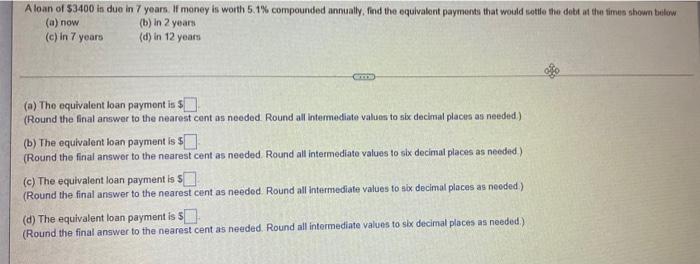

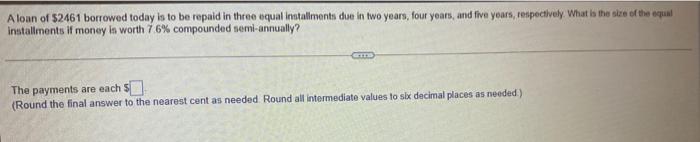

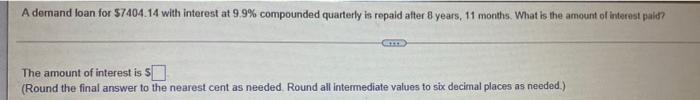

Scheduled payments of $1305 due two years ago and 5786 due in six years are to be replaced by two equal payments. The first replacement payment is due in three years and the second payment is due in eight years. Determine the size of the two replacement payments interest is 8.9% compounded semi-annually and the focal date is three years from now. The size of the two replacement payments is 50 (Round the final answer to the nearest cont as needed. Round all intermediate values to six decimal places as needed) A price index was approximately 99.7 (base year 1992) at the beginning of 1991. If Inflation continued at an average annual rate of 22%, what would the index best the beginning of 20207 The index would be Round the final answer to two decimal places as needed. Round all intermediate values to six decimal places as needed.) Scheduled payments of S715, 51215, and $452 are due in one year, four-and-a-half years, and five years respectively. What is the equivalent singerplacement payment three years from now if interest is 98% compounded annually? The equivalent single replacement payment in $ (Round the final answer to the nearest cent as needed Round all intermediate values to six decimal places as needed) Sheridan Service has a line of credit loan with the bank. The initial loan balance was 57000 00. Payments of $250000 and $3000.00 were made after five months and nine months respectively. At the end of one year Sheridan Service borrowed an additional 5400000 Seven months later, the line of credit loan was converted into a collateral mortgage loan. What was the amount of the mortgage loan if the line of credit interest was 8% compounded monthly? The amount of the loan is (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) An investment of $4884 57 earns interest at 2.4% per annum compounded monthly for 3 years. At that time the interest rate is changed to 16% compounded semi-annually How much will the accumulated value be 3 years after the change? GO The accumulated value is $ (Round the final answer to the nearest cent as needed Round all intermediate values to six decimal places as needed) A loan of $3400 in due in 7 years. If money is worth 5.1% compounded annually find the equivalent payments that would settle the debt at the times shown below (a) now (b) in 2 years (c) in 7 years (d) in 12 years Se CD (a) The equivalent loan payment is $ (Round the final answer to the nearest cont as needed Round all intermediate values to six decimal places as needed) (b) The equivalent loan payment is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed) (c) The equivalent loan payment is $ (Round the final answer to the nearest cent as needed Round all intermediate values to six decimal places as needed) (d) The equivalent loan payment is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed) Aloan of $2461 borrowed today is to be repaid in three equal installments due in two years, four years, and five years, respectively. What is the size of the equal installments if money is worth 7 6% compounded semi-annually? The payments are each 5 (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed) A demand loan for $7404.14 with interest at 9.9% compounded quarterly in repaid after 8 years, 11 months. What is the amount of interest paid? The amount of interest is $ (Round the final answer to the nearest cent as needed Round all intermediate values to six decimal places as needed.)