Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Schenck Company is required by a bond indenture to make equal annual payments to a bond sinking fund at the end of each of

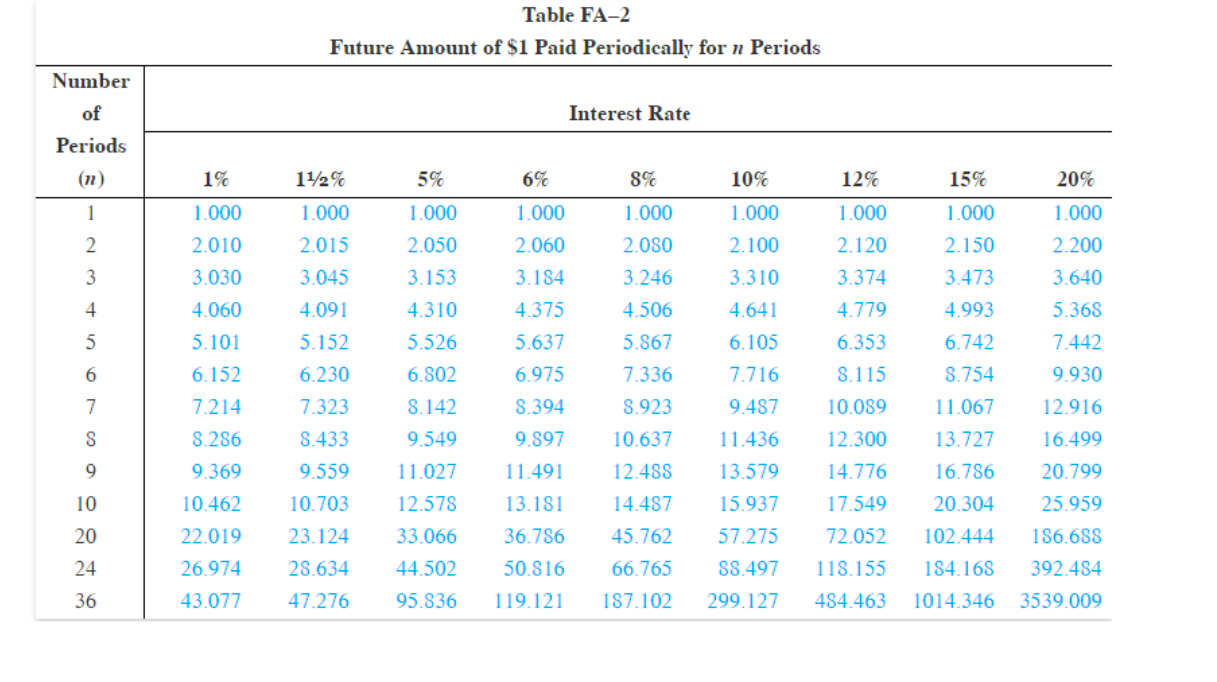

Schenck Company is required by a bond indenture to make equal annual payments to a bond sinking fund at the end of each of the next 20 years. The sinking fund will earn 8 percent interest and must accumulate to a total of $800,000 at the end of the 20-year period. Use Table FA-2. Required: a. Calculate the amount of the annual payments. b. Calculate the total amount of interest that will be earned by the fund over the 20-year period. c. Make the journal entry to record redemption of the bond issue at the end of the 20-year period, assuming that the sinking fund is recorded on Schenck's accounting records at $800,000 and bonds payable are recorded at the same amount. d. What would be the effect of an increase in the rate of return on the required annual payment? Complete this question by entering your answers in the tabs below. Required Required Required Required A B C D Calculate the total amount of interest that will be earned by the fund over the 20-year period. (Round FV factor to 3 decimal places and final answer to the nearest dollar amount.) Total interest Show less Number of Periods Table FA-2 Future Amount of $1 Paid Periodically for Periods Interest Rate (n) 1% 12% 5% 6% 8% 10% 12% 15% 20% 1 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2 2.010 2.015 2.050 2.060 2.080 2.100 2.120 2.150 2.200 3 3.030 3.045 3.153 3.184 3.246 3.310 3.374 3.473 3.640 4 4.060 4.091 4.310 4.375 4.506 4.641 4.779 4.993 5.368 5 5.101 5.152 5.526 5.637 5.867 6.105 6.353 6.742 7.442 10 24 67890228 6.152 6.230 6.802 6.975 7.336 7.716 8.115 8.754 9.930 7.214 7.323 8.142 8.394 8.923 9.487 10.089 11.067 12.916 8.286 8.433 9.549 9.897 10.637 11.436 12.300 13.727 16.499 9.369 9.559 11.027 11.491 12.488 13.579 14.776 16.786 20.799 10.462 10.703 12.578 13.181 14.487 15.937 17.549 20.304 25.959 22.019 23.124 33.066 36.786 45.762 57.275 72.052 102.444 186.688 26.974 28.634 44.502 50.816 66.765 88.497 118.155 184.168 392.484 36 43.077 47.276 95.836 119.121 187.102 299.127 484.463 1014.346 3539.009

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the amount of the annual payments we need to find the annuity factor for 20 periods a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started