Question

Schmidt Electronics offered an incentive stock plan to its employees. On January 1, Year 1, 80,000 options were granted for 80,000 $1 par common shares.

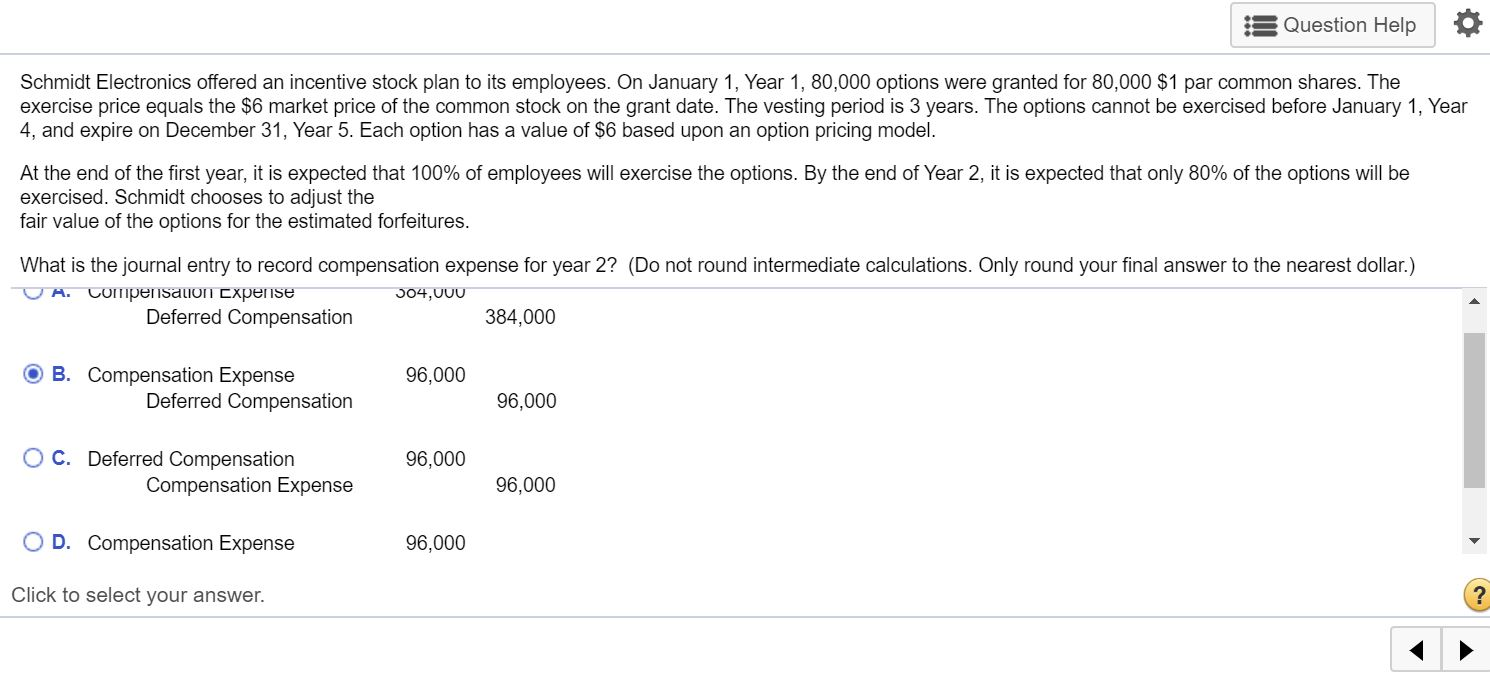

Schmidt Electronics offered an incentive stock plan to its employees. On January 1, Year 1, 80,000 options were granted for 80,000 $1 par common shares. The exercise price equals the $6 market price of the common stock on the grant date. The vesting period is 3 years. The options cannot be exercised before January 1, Year 4, and expire on December 31, Year 5. Each option has a value of $ 6 based upon an option pricing model. At the end of the first year, it is expected that 100% of employees will exercise the options. By the end of Year 2, it is expected that only 80% of the options will be exercised. Schmidt chooses to adjust the fair value of the options for the estimated forfeitures. What is the journal entry to record compensation expense for year 2? (Do not round intermediate calculations. Only round your final answer to the nearest dollar.)

Schmidt Electronics offered an incentive stock plan to its employees. On January 1, Year 1, 80,000 options were granted for 80,000 $1 par common shares. The exercise price equals the $6 market price of the common stock on the grant date. The vesting period is 3 years. The options cannot be exercised before January 1, Year 4, and expire on December 31, Year 5. Each option has a value of $ 6 based upon an option pricing model. At the end of the first year, it is expected that 100% of employees will exercise the options. By the end of Year 2, it is expected that only 80% of the options will be exercised. Schmidt chooses to adjust the fair value of the options for the estimated forfeitures. What is the journal entry to record compensation expense for year 2? (Do not round intermediate calculations. Only round your final answer to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started