Question

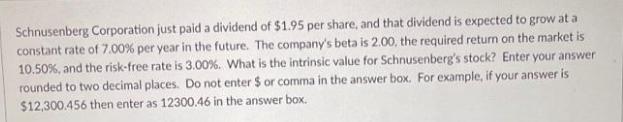

Schnusenberg Corporation just paid a dividend of $1.95 per share, and that dividend is expected to grow at a constant rate of 7.00% per

Schnusenberg Corporation just paid a dividend of $1.95 per share, and that dividend is expected to grow at a constant rate of 7.00% per year in the future. The company's beta is 2.00, the required return on the market is 10.50%, and the risk-free rate is 3.00%. What is the intrinsic value for Schnusenberg's stock? Enter your answer rounded to two decimal places. Do not enter $ or comma in the answer box. For example, if your answer is $12,300.456 then enter as 12300.46 in the answer box.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The intrinsic value of Schnusenbergs stock can be calculated using the Gordon Growth Model ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial management theory and practice

Authors: Eugene F. Brigham and Michael C. Ehrhardt

13th edition

1439078106, 111197375X, 9781439078105, 9781111973759, 978-1439078099

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App