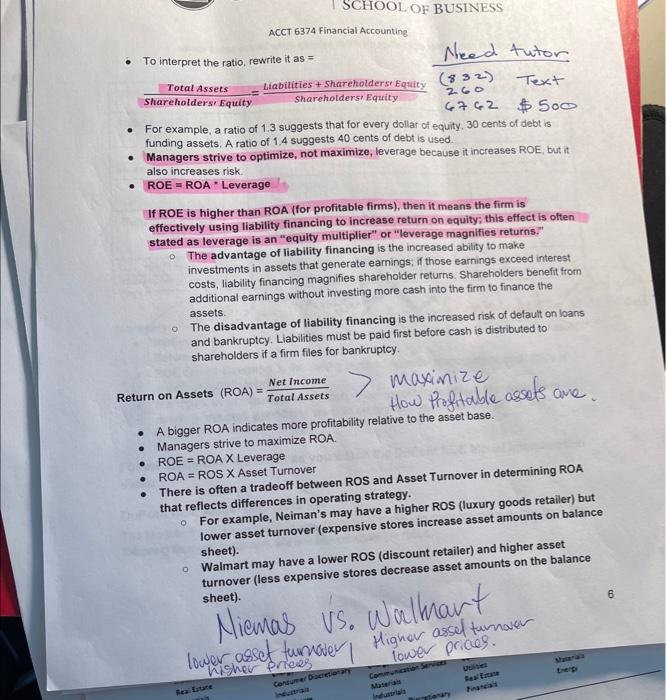

SCHOOL OF BUSINESS Total Assets 2GO ACCT 6374 Financial Accounting Need tutor To interpret the ratio, rewrite it as = Liabilities + Shareholders Equity (332) Text Shareholders Equity Shareholders' Equity 6762 $500 For example, a ratio of 1.3 suggests that for every dollar of equity, 30 cents of debt is funding assets. A ratio of 1.4 suggests 40 cents of debt is used Managers strive to optimize, not maximize, leverage because it increases ROE, but it also increases risk ROE = ROA. Leverage If ROE is higher than ROA (for profitable firms), then it means the firm is effectively using liability financing to increase return on equity; this effect is often stated as leverage is an "equity multiplier" or "leverage magnifies returns." The advantage of liability financing is the increased ability to make investments in assets that generate earnings, if those earnings exceed interest costs, liability financing magnifies shareholder returns. Shareholders benefit from additional earnings without investing more cash into the firm to finance the assets The disadvantage of liability financing is the increased risk of default on loans and bankruptcy. Liabilities must be paid first before cash is distributed to shareholders if a firm files for bankruptcy. 0 Net Income Return on Assets (ROA) = Total Assets > maximize How Profitable assets are . . . . A bigger ROA indicates more profitability relative to the asset base. Managers strive to maximize ROA ROE = ROA X Leverage ROA = ROS X Asset Turnover There is often a tradeoff between ROS and Asset Turnover in determining ROA that reflects differences in operating strategy. For example, Neiman's may have a higher ROS (luxury goods retailer) but lower asset turnover (expensive stores increase asset amounts on balance sheet). Walmart may have a lower ROS (discount retailer) and higher asset turnover (less expensive stores decrease asset amounts on the balance sheet). O o 6 Niemas us. Walmart lower asset turnover Higher assel turnover lower prices. Consumer Daereterary Commune Mater Ideal Rea se