Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Schoology - (no subject)-kaushalsaima110 x G Which one of the following stage x hanson.schoology.com/common-assessment-delivery/start/33258225677action TEST2: Topics 1) Pricing and 2) Incremental Analyis onresume&submissionid=281961503 Kryotek

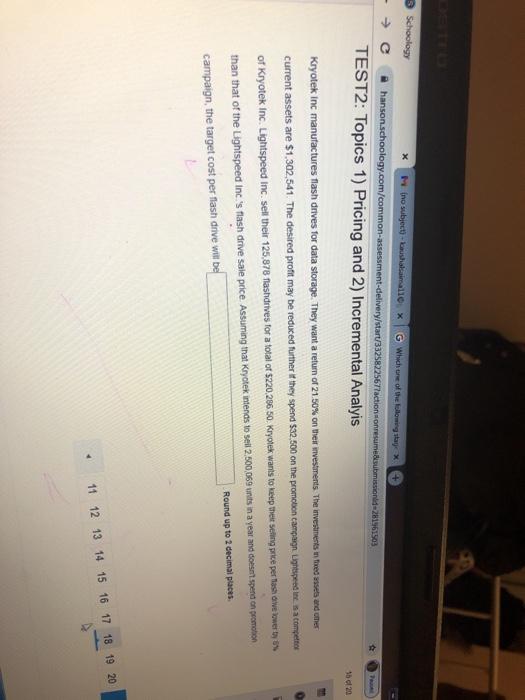

Schoology - (no subject)-kaushalsaima110 x G Which one of the following stage x hanson.schoology.com/common-assessment-delivery/start/33258225677action TEST2: Topics 1) Pricing and 2) Incremental Analyis onresume&submissionid=281961503 Kryotek inc manufactures flash drives for data storage. They want a return of 21.50% on their investments. The investments in fixed assets and other current assets are $1,302,541. The desired profit may be reduced further if they spend $32.500 on the promotion campaign Lightspeed inc. is a compettor of Kryotek Inc. Lightspeed Inc. sell their 125,878 flashdrives for a total of $220,286 50. Kryotek wants to keep their selling price per flash dive lower by 0% than that of the Lightspeed Inc.'s flash drive sale price. Assuming that Kryotek intends to sell 2.500,069 units in a year and doesn't spend on promotion campaign, the target cost per flash drive will be Round up to 2 decimal places. Pan 15 of 20 11 12 13 14 15 16 17 18 19 20

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Selling Price per unit sold by Lightspeed22028650125878 17...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started