Question

Schrand Aerobics, Inc., rents studio space ( including a sound system ) and specializes in offering aerobics classes. On January 1 , its beginning account

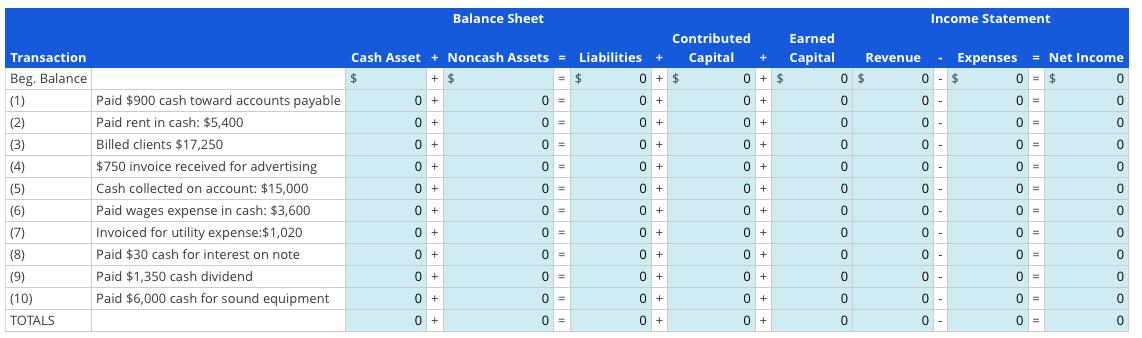

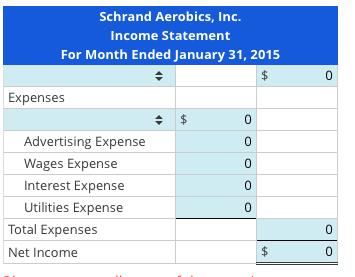

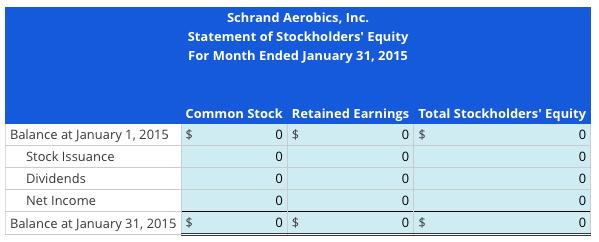

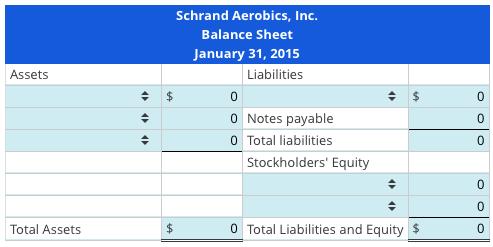

Schrand Aerobics, Inc., rents studio space including a sound system and specializes in offering aerobics classes. On January its beginning account balances are as follows: Cash, $; Accounts Receivable, $; Equipment, $; Notes Payable, $; Accounts Payable, $; Common Stock, $; Retained Earnings, $; Services Revenue, $; Rent Expense, $; Advertising Expense, $; Wages Expense, $; Utilities Expense, $; Interest Expense, $

The following transactions occurred during January.

Required:

Required:

a. Prepare journal entries for each of the transactions 1 through 10.

b. Set up accounts, including beginning balances, for cash of the accounts used in part a. Post the journal entries to those T-accounts.

Balance Sheet Contributed Earned Income Statement Transaction Cash Asset + Noncash Assets = Liabilities + Capital + Capital Revenue Expenses = Net Income Beg. Balance + $ 0+ $ 0+ $ 0 $ 0 - $ 0 = $ 0 (1) Paid $900 cash toward accounts payable 0+ 0 0+ 0+ 0 0 = (2) Paid rent in cash: $5,400 0 + 0 = 0 + 0 + 0 0 - 0 = 0 (3) Billed clients $17,250 0 + 0 = 0 + 0 + 0 - 0 = 0 (4) $750 invoice received for advertising 0 + 0 = 0+ 0 + 0 0 0 = 0 (5) Cash collected on account: $15,000 0+ 0 = 0 + 0 + 0 0 = (6) Paid wages expense in cash: $3,600 0 + 0 = 0 + 0 + 0 0 - 0 = 0 (7) Invoiced for utility expense:$1,020 0 + 0 = 0 + 0 + 0 - 0 = 0 (8) Paid $30 cash for interest on note 0 + 0 = 0 + 0 + 0 0 0 = 0 (9) Paid $1,350 cash dividend 0+ 0 = 0 + 0 + 0 0 = (10) Paid $6,000 cash for sound equipment 0 + 0 = 0 + 0 + 0 0 - 0 = 0 TOTALS 0 + 0 0+ 0 + 0 0 = 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Here are the journal entries for transactions 1 through 10 1 Issued common stock for cash Cash 550...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started