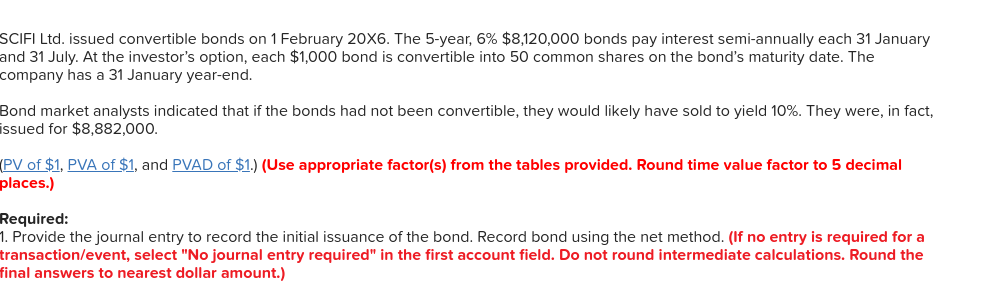

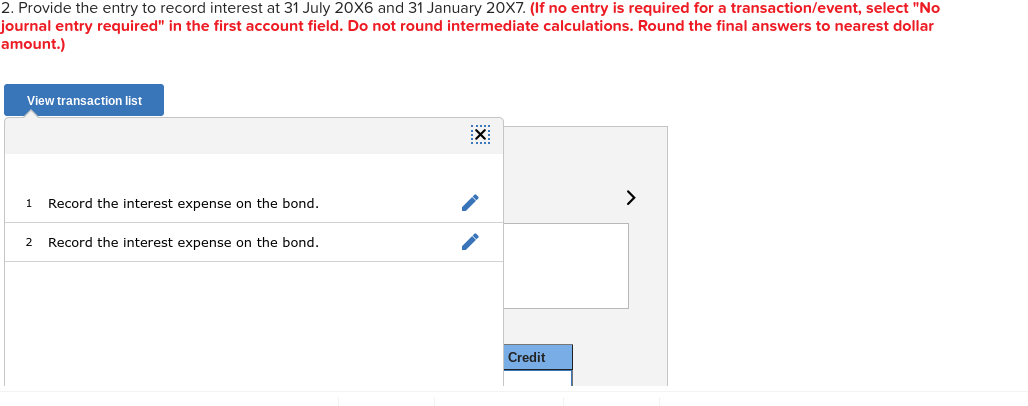

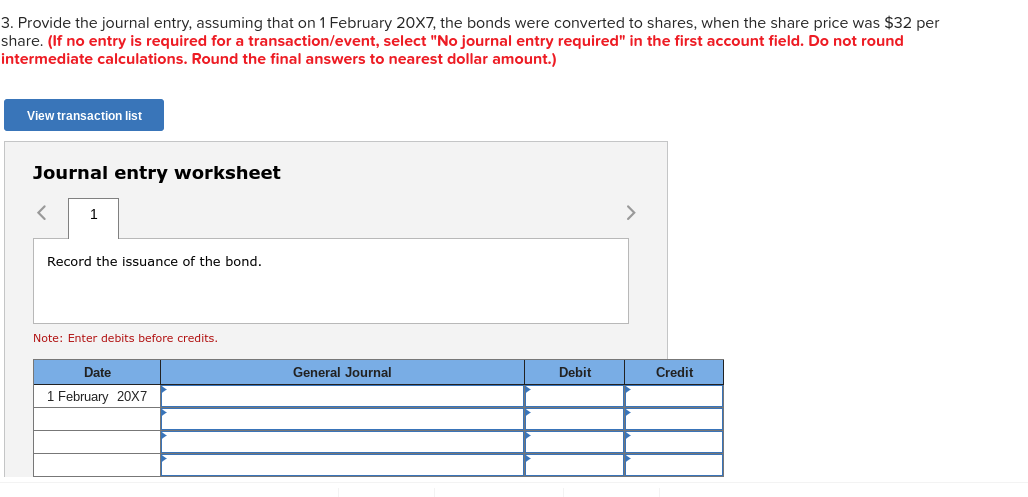

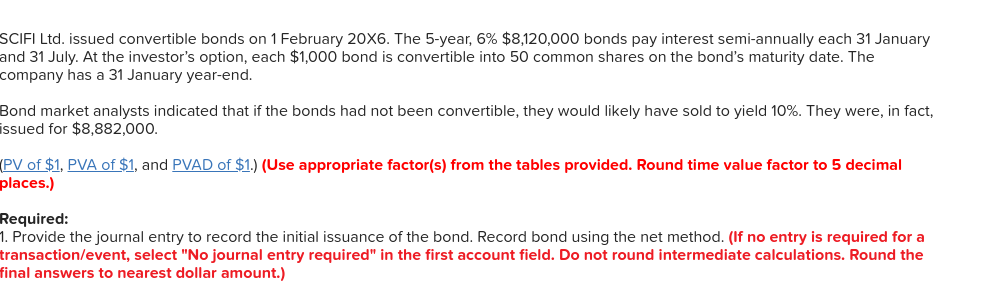

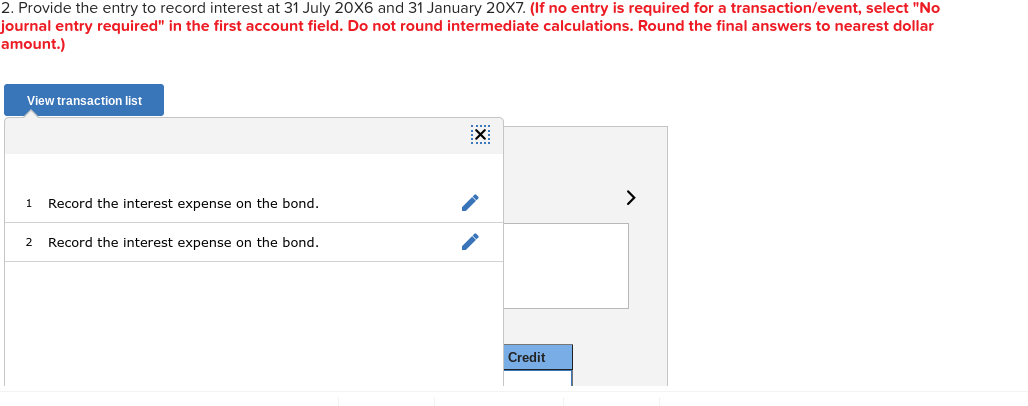

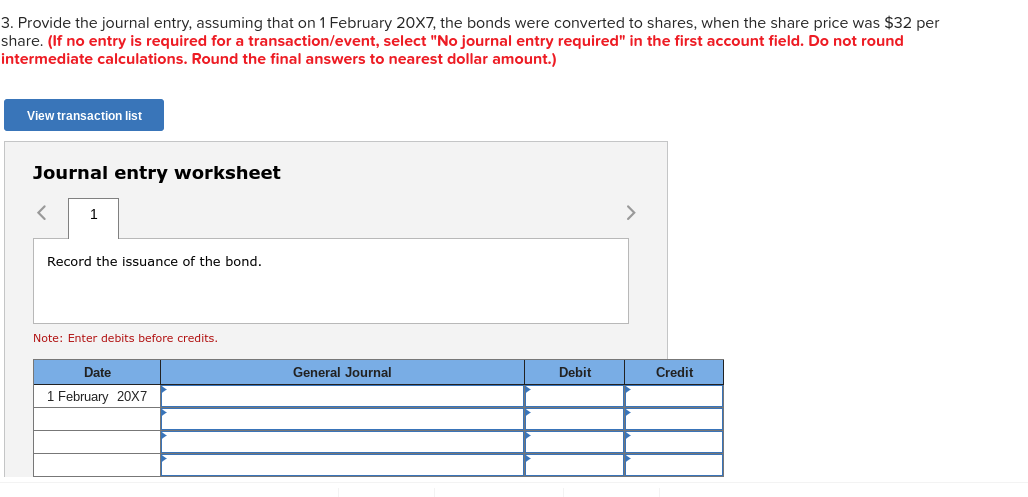

SCIFI Ltd. issued convertible bonds on 1 February 20X6. The 5-year, 6% $8,120,000 bonds pay interest semi-annually each 31 January and 31 July. At the investor's option, each $1,000 bond is convertible into 50 common shares on the bond's maturity date. The company has a 31 January year-end. Bond market analysts indicated that if the bonds had not been convertible, they would likely have sold to yield 10%. They were, in fact, issued for $8,882,000. (PV of $1, PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided. Round time value factor to 5 decimal places.) Required: 1. Provide the journal entry to record the initial issuance of the bond. Record bond using the net method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round the final answers to nearest dollar amount.) 2. Provide the entry to record interest at 31 July 20X6 and 31 January 20X7. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round the final answers to nearest dollar amount.) View transaction list X 1 > Record the interest expense on the bond. 2 Record the interest expense on the bond. Credit 3. Provide the journal entry, assuming that on 1 February 20X7, the bonds were converted to shares, when the share price was $32 per share. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round the final answers to nearest dollar amount.) View transaction list Journal entry worksheet Record the issuance of the bond. Note: Enter debits before credits. Date General Journal Debit Credit 1 February 20X7 SCIFI Ltd. issued convertible bonds on 1 February 20X6. The 5-year, 6% $8,120,000 bonds pay interest semi-annually each 31 January and 31 July. At the investor's option, each $1,000 bond is convertible into 50 common shares on the bond's maturity date. The company has a 31 January year-end. Bond market analysts indicated that if the bonds had not been convertible, they would likely have sold to yield 10%. They were, in fact, issued for $8,882,000. (PV of $1, PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided. Round time value factor to 5 decimal places.) Required: 1. Provide the journal entry to record the initial issuance of the bond. Record bond using the net method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round the final answers to nearest dollar amount.) 2. Provide the entry to record interest at 31 July 20X6 and 31 January 20X7. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round the final answers to nearest dollar amount.) View transaction list X 1 > Record the interest expense on the bond. 2 Record the interest expense on the bond. Credit 3. Provide the journal entry, assuming that on 1 February 20X7, the bonds were converted to shares, when the share price was $32 per share. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round the final answers to nearest dollar amount.) View transaction list Journal entry worksheet Record the issuance of the bond. Note: Enter debits before credits. Date General Journal Debit Credit 1 February 20X7