Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Scooby Industries just received a patent on a new cancer treatment. Over the past several years, the firm spent $1,500,000 developing this drug. Because

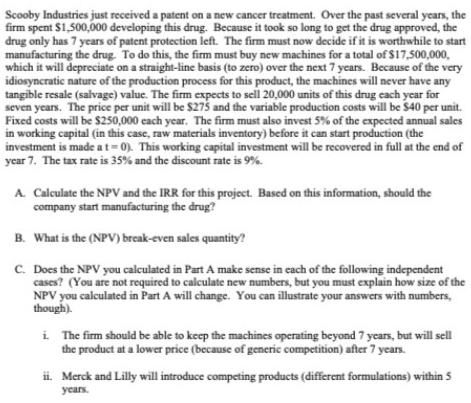

Scooby Industries just received a patent on a new cancer treatment. Over the past several years, the firm spent $1,500,000 developing this drug. Because it took so long to get the drug approved, the drug only has 7 years of patent protection left. The firm must now decide if it is worthwhile to start manufacturing the drug. To do this, the firm must buy new machines for a total of $17,500,000, which it will depreciate on a straight-line basis (to zero) over the next 7 years. Because of the very idiosyncratic nature of the production process for this product, the machines will never have any tangible resale (salvage) value. The firm expects to sell 20,000 units of this drug each year for seven years. The price per unit will be $275 and the variable production costs will be $40 per unit. Fixed costs will be $250,000 each year. The firm must also invest 5% of the expected annual sales in working capital (in this case, raw materials inventory) before it can start production (the investment is made a t= 0). This working capital investment will be recovered in full at the end of year 7. The tax rate is 35% and the discount rate is 9%. A. Calculate the NPV and the IRR for this project. Based on this information, should the company start manufacturing the drug? B. What is the (NPV) break-even sales quantity? C. Does the NPV you calculated in Part A make sense in each of the following independent cases? (You are not required to calculate new numbers, but you must explain how size of the NPV you calculated in Part A will change. You can illustrate your answers with numbers, though). i. The firm should be able to keep the machines operating beyond 7 years, but will sell the product at a lower price (because of generic competition) after 7 years. ii. Merck and Lilly will introduce competing products (different formulations) within 5 years.

Step by Step Solution

★★★★★

3.55 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate the NPV and IRR we need to determine the cash flows associated with the project Year 0 Initial investment in machines 17500000 Working ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started